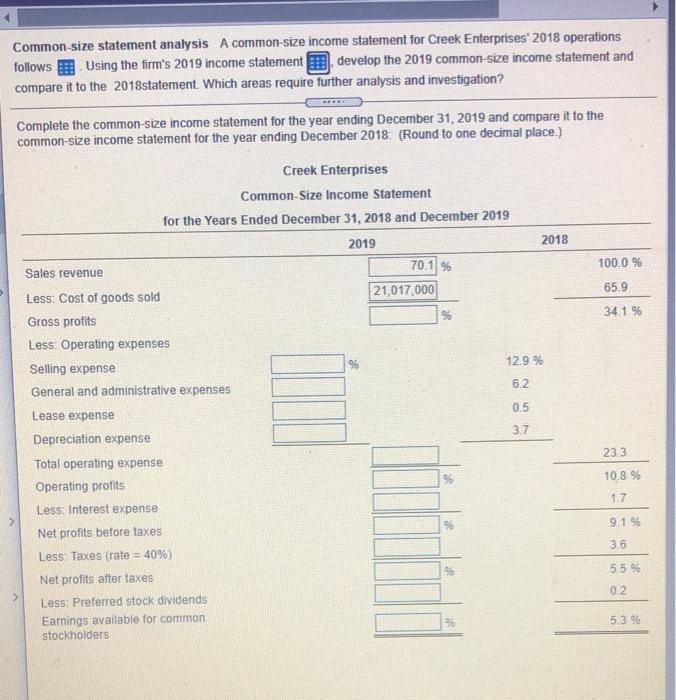

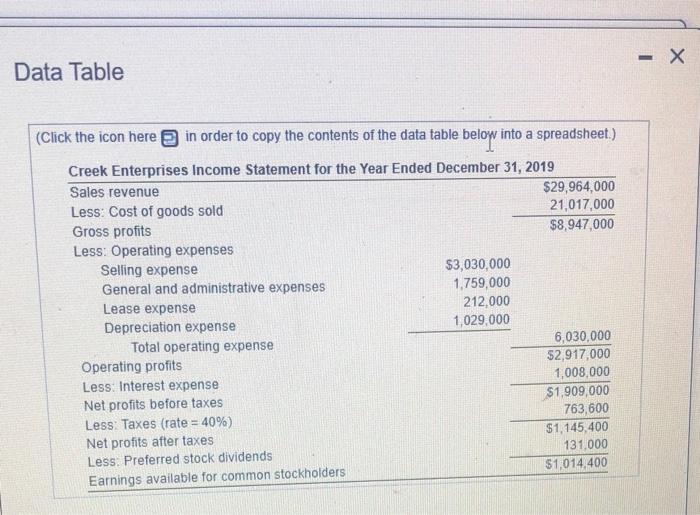

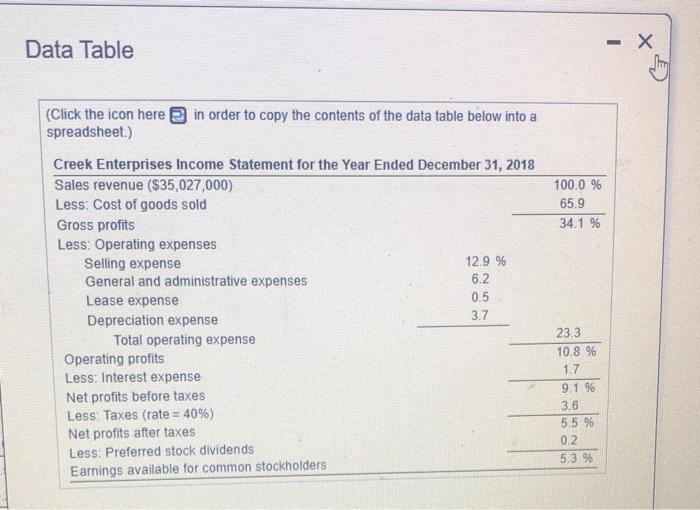

Common-size statement analysis A common-size income statement for Creek Enterprises' 2018 operations follows Using the firm's 2019 income statement develop the 2019 common-size income statement and compare it to the 2018statement. Which areas require further analysis and investigation? Complete the common-size income statement for the year ending December 31, 2019 and compare it to the common-size income statement for the year ending December 2018 (Round to one decimal place.) Creek Enterprises Common-Size Income Statement for the Years Ended December 31, 2018 and December 2019 2019 2018 70.1% 100.0 % Sales revenue 21,017,000 65.9 95 34 1 % Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses 96 12.9% 6.2 0.5 Lease expense 3.7 23.3 96 10.8 % 1.7 > 96 9.1% Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less Taxes (rate = 40%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders 3.6 96 5.5 % 02 9 5.3 % - X Data Table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) Creek Enterprises Income Statement for the Year Ended December 31, 2019 Sales revenue $29,964,000 Less: Cost of goods sold 21,017,000 Gross profits $8,947,000 Less: Operating expenses Selling expense $3,030,000 General and administrative expenses 1,759,000 Lease expense 212,000 Depreciation expense 1,029,000 Total operating expense 6,030,000 Operating profits $2,917,000 Less: Interest expense 1,008,000 Net profits before taxes $1,909,000 763,600 Less: Taxes (rate = 40%) $1,145,400 Net profits after taxes 131,000 Less: Preferred stock dividends $1,014,400 Earnings available for common stockholders - Data Table 100.0 % 65.9 34.1 % (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) Creek Enterprises Income Statement for the Year Ended December 31, 2018 Sales revenue ($35,027,000) Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense 12.9 % General and administrative expenses 6.2 Lease expense 0.5 Depreciation expense 3.7 Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 40%) Net profits after taxes Less. Preferred stock dividends Earnings available for common stockholders 23.3 10.8 % 1.7 9.1 % 3.6 5.5 % 0.2 5.3 %