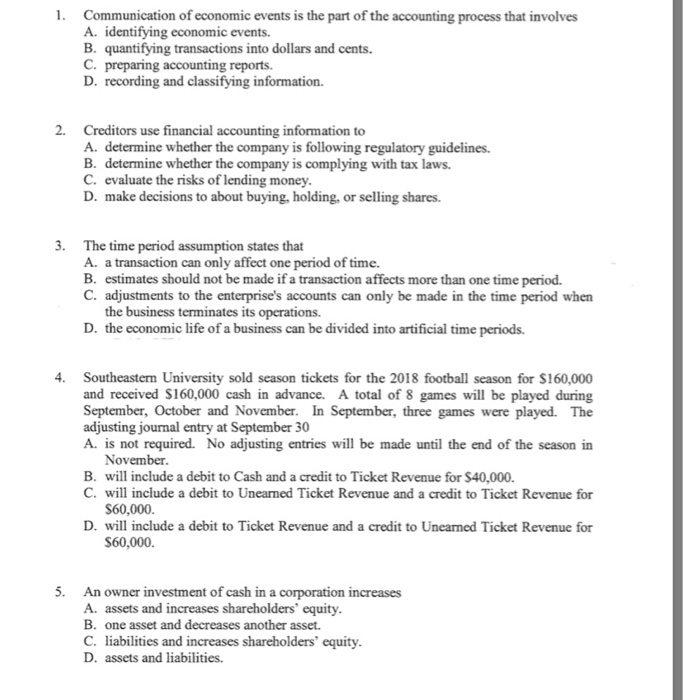

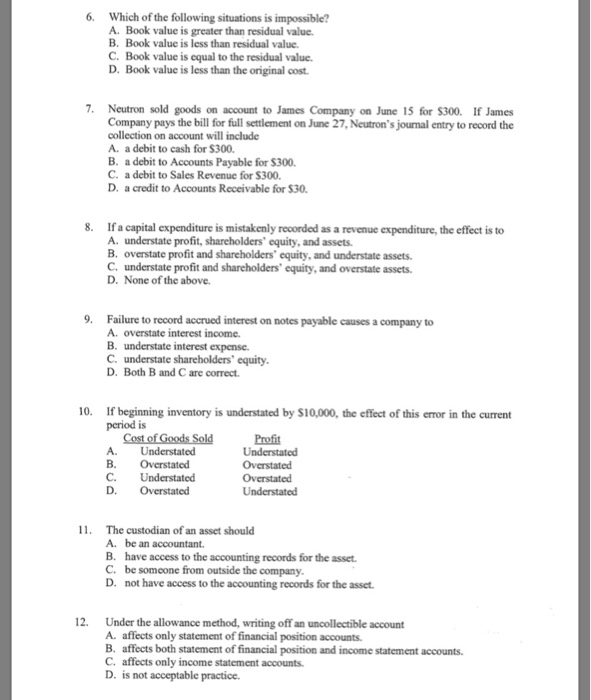

Communication of economic events is the part of the accounting process that involves A. identifying economic events. B. quantifying transactions into dollars and cents. C. preparing accounting reports. D. recording and classifying information. 2. Creditors use financial accounting information to A. determine whether the company is following regulatory guidelines. B. determine whether the company is complying with tax laws. C. evaluate the risks of lending money. D. make decisions to about buying, holding, or selling shares. 3. The time period assumption states that A. a transaction can only affect one period of time. B. estimates should not be made if a transaction affects more than one time period. C. adjustments to the enterprise's accounts can only be made in the time period when the business terminates its operations. D. the economic life of a business can be divided into artificial time periods. Southeastern University sold season tickets for the 2018 football season for $160,000 and received $160,000 cash in advance. A total of 8 games will be played during September, October and November. In September, three games were played. The adjusting journal entry at September 30 A. is not required. No adjusting entries will be made until the end of the season in November. B. will include a debit to Cash and a credit to Ticket Revenue for $40,000. C. will include a debit to Unearned Ticket Revenue and a credit to Ticket Revenue for S60,000. D. will include a debit to Ticket Revenue and a credit to Unearned Ticket Revenue for S60,000. 5. An owner investment of cash in a corporation increases A. assets and increases shareholders' equity. B. one asset and decreases another asset. C. liabilities and increases shareholders' equity. D. assets and liabilities. 6. Which of the following situations is impossible? A. Book value is greater than residual value. B. Book value is less than residual value. C. Book value is equal to the residual value. D. Book value is less than the original cost. 7. Neutron sold goods on account to James Company on June 15 for $300. If James Company pays the bill for full settlement on June 27, Neutron's journal entry to record the collection on account will include A. a debit to cash for $300. B. a debit to Accounts Payable for $300. C. a debit to Sales Revenue for $300. D. a credit to Accounts Receivable for $30. If a capital expenditure is mistakenly recorded as a revenue expenditure, the effect is to A. understate profit, shareholders' equity, and assets. B. overstate profit and shareholders' equity, and understate assets. C. understate profit and shareholders' equity, and overstate assets. D. None of the above. 8. Failure to record accrued interest on notes payable causes a company to A. overstate interest income. B. understate interest expense. C. understate shareholders' equity. D. Both B and C are correct. 9. If beginning inventory is understated by $10,000, the effect of this error in the current period is 10. Cost of Goods Sold Understated Overstated Understated Overstated Profit Understated Overstated A. B. C. Overstated Understated D. 11. The custodian of an asset should A. be an accountant. B. have access to the accounting records for the asset. C. be someone from outside the company. D. not have access to the accounting records for the asset. 12. Under the allowance method, writing off an uncollectible account A. affects only statement of financial position accounts. B. affects both statement of financial position and income statement accounts. C. affects only income statement accounts. D. is not acceptable practice