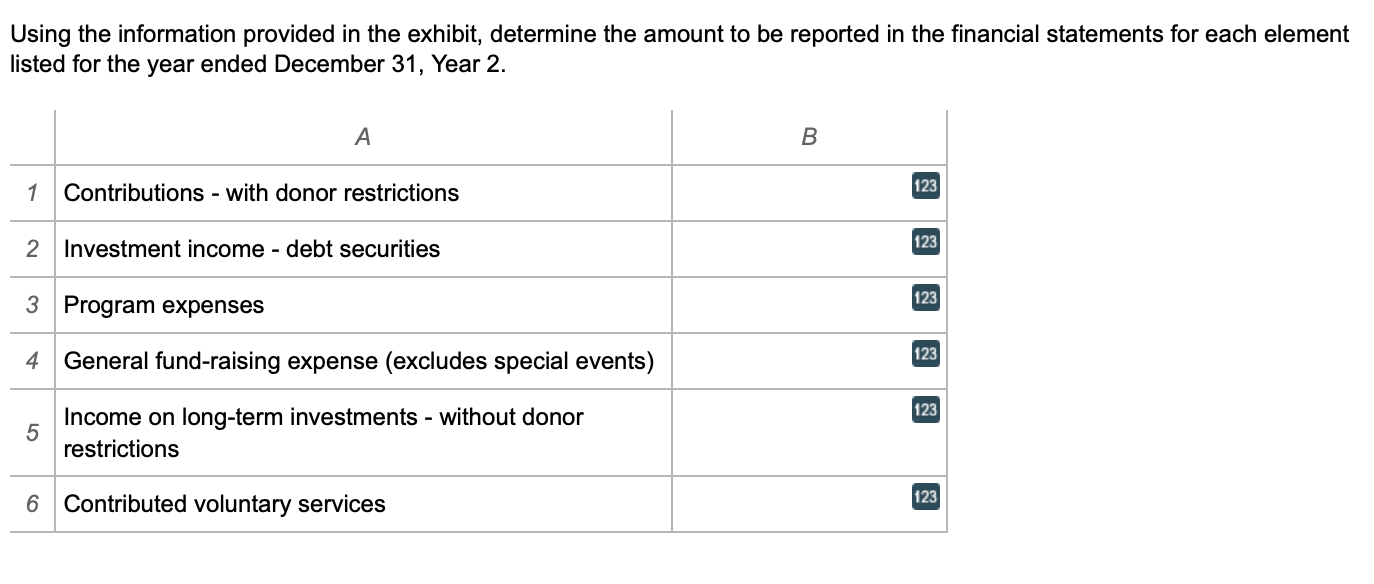

Question

Community Service, Inc. is a nongovernmental not-for-profit voluntary health and welfare calendar-year organization that began operations on January 1, Year 1. It performs voluntary services

Community Service, Inc. is a nongovernmental not-for-profit voluntary health and welfare calendar-year organization that began operations on January 1, Year 1. It performs voluntary services and derives its revenue primarily from voluntary contributions from the general public. Community imposes a time restriction on all promises to contribute cash in future periods. However, no such policy exists with respect to gifts of long-lived assets. Selected transactions that occurred during Community's Year 2 calendar year:

| Debt security endowment received in Year 2; income to be used for community services: | ||

| Face value | $95,000 | |

| Fair value at time of receipt | 89,000 | |

| Fair value at 12/31/Year 2 | 86,000 | |

| Interest earned in Year 2 | 9,500 | |

| Interest received in Year 2 | 4,750 | |

| 10 concerned citizens volunteered to serve meals to the homeless (400 hours free; fair market value of services $5 per hour): | 2,000 | |

| Short-term investment in equity securities in Year 2: | ||

| Cost | 10,000 | |

| Fair Value 12/31/Year 2 | 12,000 | |

| Dividend income | 1,250 | |

| Reading materials donated to Community and distributed to the children in Year 2: | ||

| Fair market value | 7,500 | |

| Federal youth training fee for services grant | ||

| Cash received during Year 2 | 30,000 | |

| Instructor salaries paid | 25,000 | |

| Other cash operating expenses: | ||

| Business manager salary | 55,000 | |

| General bookkeeper salary | 37,800 | |

| Director of community activities salary | 60,000 | |

| Space rental (75% for community activities 25% for office activities) | 30,000 | |

| Printing and mailing costs for pledge cards | 2,750 | |

| Interest payment on short-term bank loan in Year 2 | 1,250 | |

| Principal payment on short-term bank loan in Year 2 | 750 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started