Question

Companies A and B have been offered the following rates per annum on a $20 million five-year loan: Fixed rate Floating rate Company A 12.0%

Companies A and B have been offered the following rates per annum on a $20 million five-year loan: Fixed rate Floating rate Company A 12.0% LIBOR + 0.1% Company B 13.4% LIBOR + 0.6% Company A requires a floating-rate loan; company B requires a fixed-rate loan. Design a swap that will appear equally attractive to both companies (that is they split possible savings equally). Hint: figure out a range for the swap rate.

4. Consider the following borrowing costs faced by the following 3 companies: Fixed rate Floating rate Company A 7.0% LIBOR + 0.1% Company B 6.5% LIBOR - 0.1% Company C 7.3% LIBOR + 0.2% If company A wants to borrow floating-rate funds, what is the lowest possible cost of funds that this company could achieve? Assume that if any two companies enter into the swap transaction, they split the possible savings equally. Hint: consider all possible ways that company A could borrow floating-rate funds.

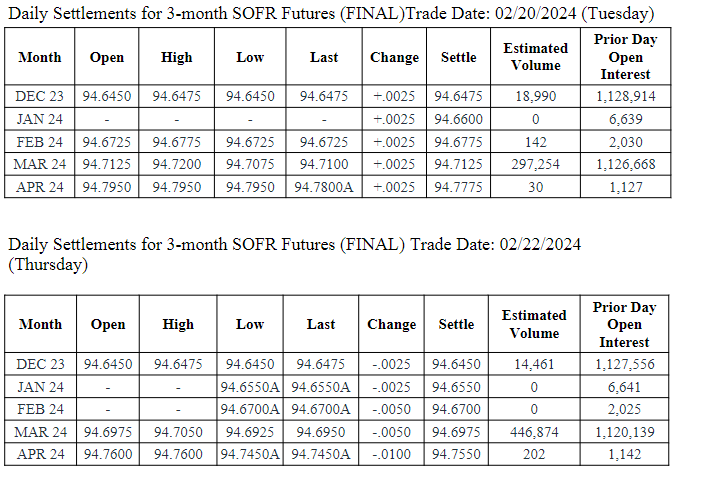

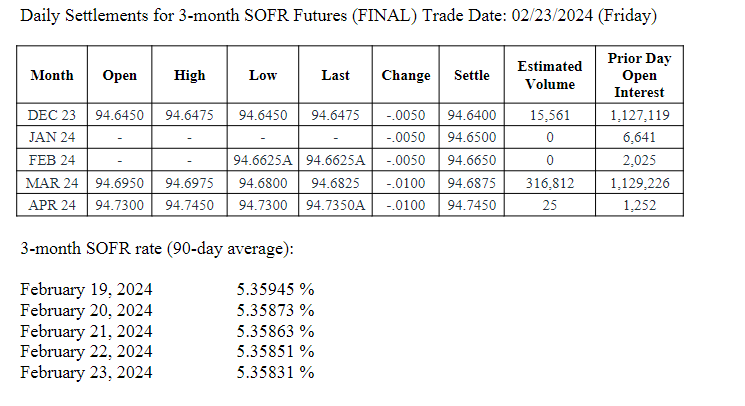

Daily Settlements for 3-month SOFR Futures (FINAL) Trade Date: 02/20/2024 (Tuesday) Prior Day Month Open High Low Last Change Settle Estimated Volume Open Interest DEC 23 94.6450 94.6475 94.6450 JAN 24 FEB 24 94.6725 94.6775 94.6725 94.7075 +.0025 94.6475 +.0025 94.6600 +.0025 94.6775 MAR 24 94.7125 94.7200 +.0025 94.7125 297,254 APR 24 94.7950 94.7950 94.7950 94.7800A +.0025 94.7775 94.6475 18,990 1,128,914 0 6,639 94.6725 142 2,030 94.7100 1,126,668 30 1,127 Daily Settlements for 3-month SOFR Futures (FINAL) Trade Date: 02/22/2024 (Thursday) Prior Day Month Open High Low Last Change Settle Estimated Volume Open Interest DEC 23 94.6450 94.6475 JAN 24 FEB 24 MAR 24 94.6975 APR 24 94.7600 94.7050 94.7600 94.6925 94.6950 -.0050 94.7450A 94.7450A -.0100 94.6450 94.6475 -.0025 94.6450 94.6550A 94.6550A -.0025 94.6550 94.6700A 94.6700A -.0050 94.6700 94.6975 14,461 1,127,556 0 6,641 0 2,025 446,874 1,120,139 94.7550 202 1,142

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started