Answered step by step

Verified Expert Solution

Question

1 Approved Answer

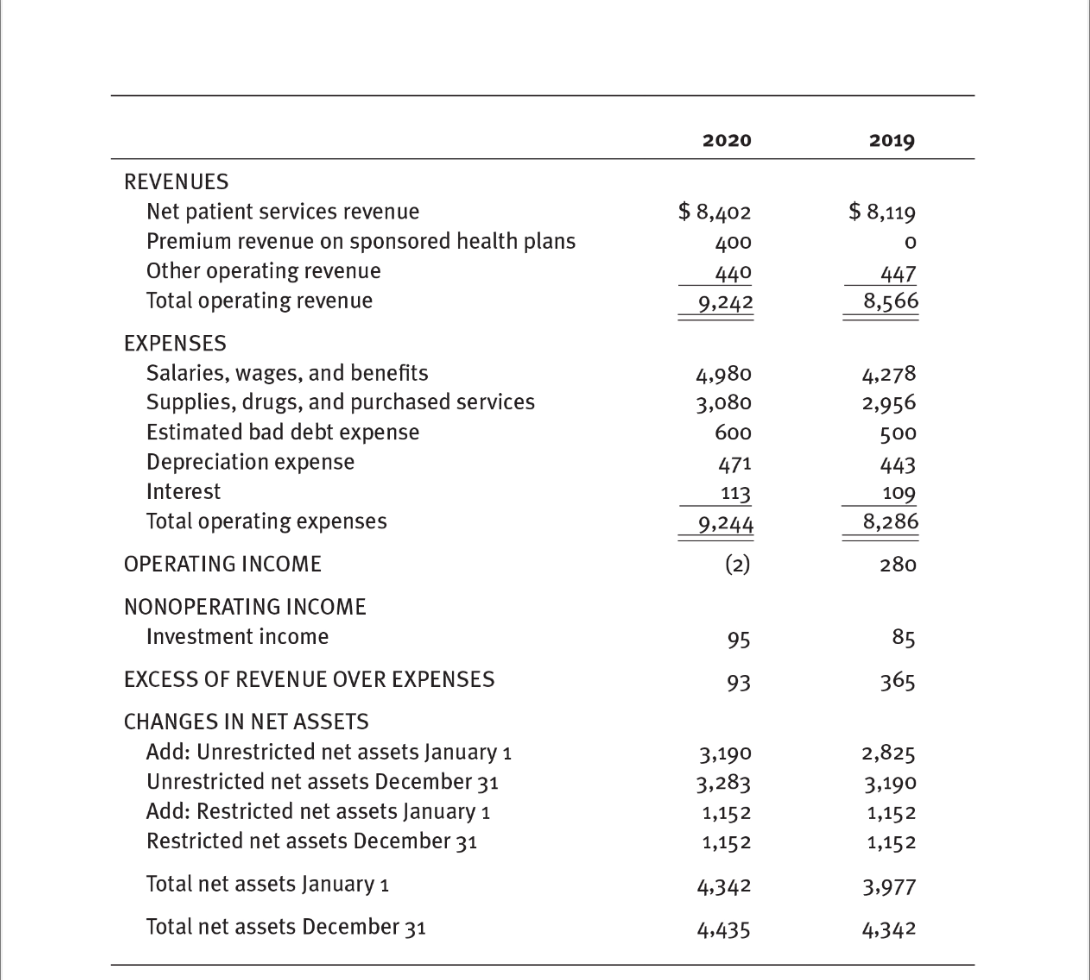

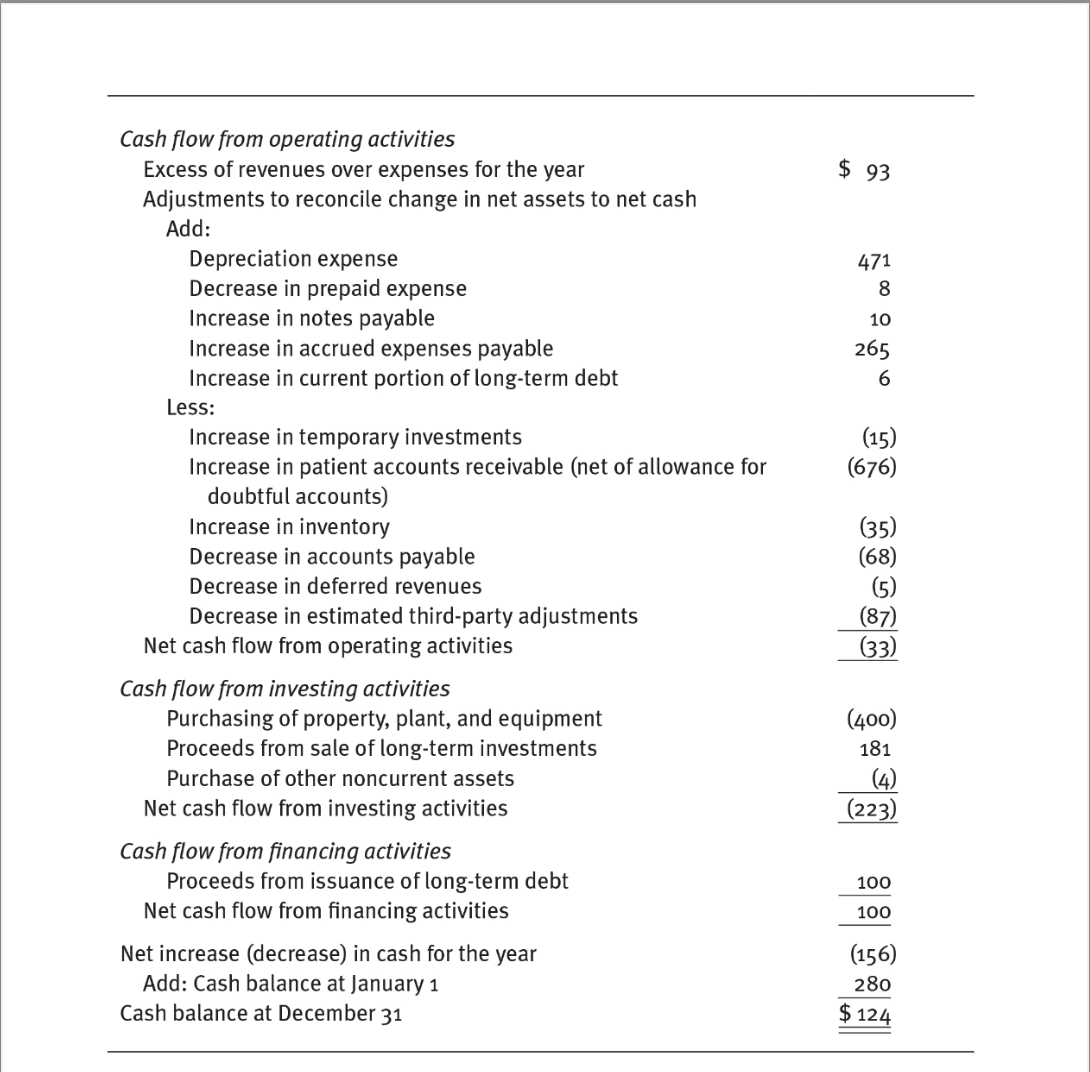

calculate the following ratios for 2020: Current ratio Collection period ratio Days cash on hand, all sources, ratio Days cash on hand, short-term sources, ratio

- calculate the following ratios for 2020:

- Current ratio

- Collection period ratio

- Days cash on hand, all sources, ratio

- Days cash on hand, short-term sources, ratio

- Average payment period ratio

- Operating margin ratio

- Total margin ratio

- Return on net assets ratio

- Total asset turnover ratio

- Average age of plant ratio

- Fixed asset turnover ratio

- Current asset turnover ratio

- Inventory turnover ratio

- Net asset financing ratio

- Long-term debt to capitalization ratio

- Debt service coverage ratio

- Cash flow to debt ratio

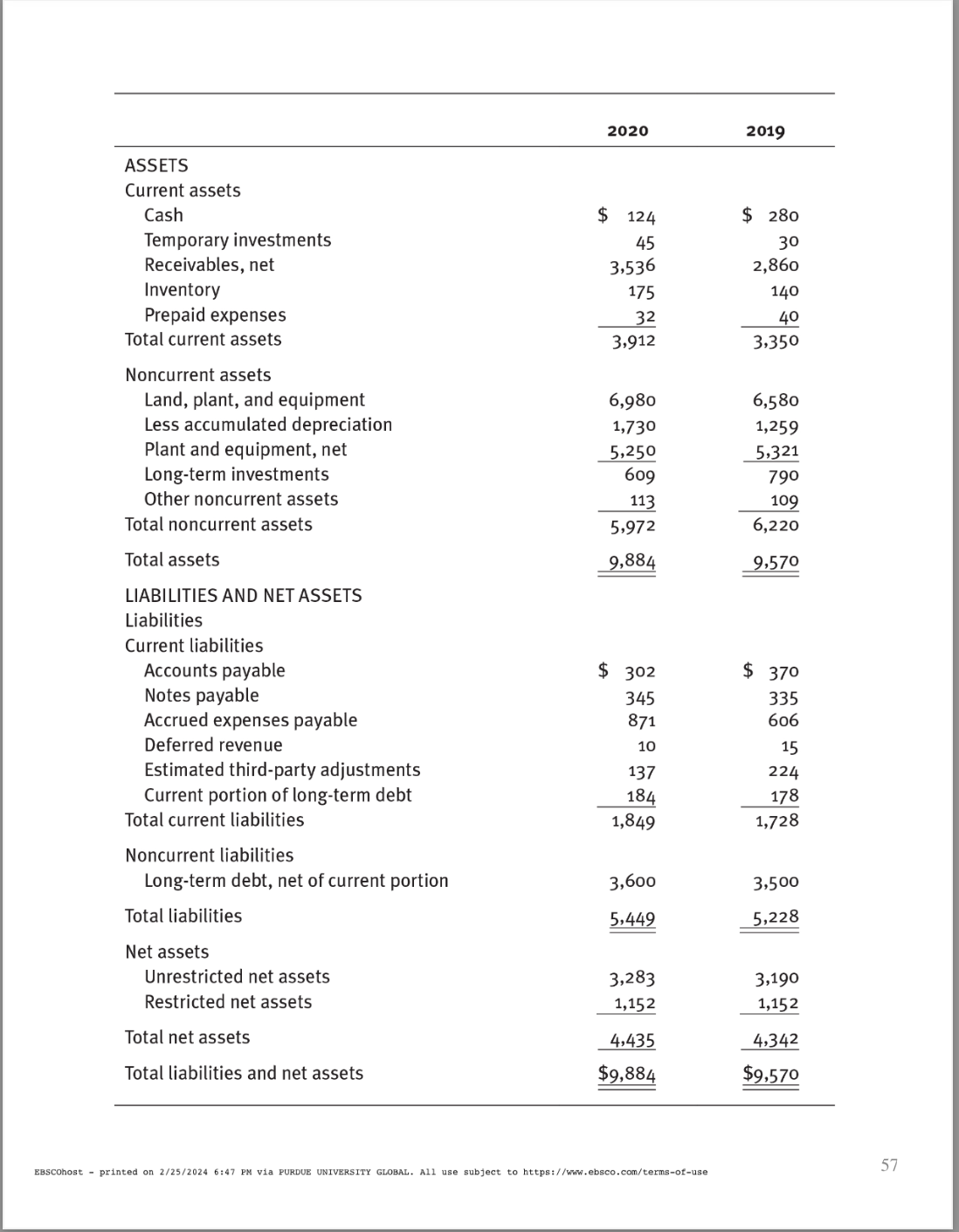

ASSETS Current assets Cash Temporary investments Receivables, net Inventory Prepaid expenses 2020 2019 $ 124 $ 280 45 30 3,536 2,860 175 140 32 40 3,912 3,350 Total current assets Noncurrent assets Land, plant, and equipment 6,980 6,580 Less accumulated depreciation 1,730 1,259 Plant and equipment, net 5,250 5,321 Long-term investments 609 790 Other noncurrent assets 113 109 Total noncurrent assets 5,972 6,220 Total assets 9,884 9,570 LIABILITIES AND NET ASSETS Liabilities Current liabilities Accounts payable Notes payable Accrued expenses payable Deferred revenue Estimated third-party adjustments Current portion of long-term debt Total current liabilities $ 302 $ 370 345 335 871 606 10 15 137 224 184 178 1,849 1,728 Noncurrent liabilities Long-term debt, net of current portion 3,600 3,500 Total liabilities 5,449 5,228 Net assets Unrestricted net assets Restricted net assets Total net assets Total liabilities and net assets 3,283 3,190 1,152 1,152 4,435 4,342 $9,884 $9,570 EBSCOhost printed on 2/25/2024 6:47 PM via PURDUE UNIVERSITY GLOBAL. All use subject to https://www.ebsco.com/terms-of-use 57

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started