Answered step by step

Verified Expert Solution

Question

1 Approved Answer

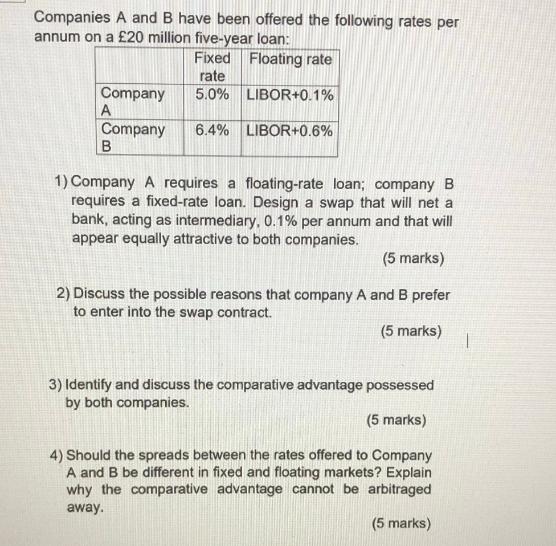

Companies A and B have been offered the following rates per annum on a 20 million five-year loan: Fixed rate Floating rate Company 5.0%

Companies A and B have been offered the following rates per annum on a 20 million five-year loan: Fixed rate Floating rate Company 5.0% LIBOR+0.1% A Company 6.4% LIBOR+0.6% B 1) Company A requires a floating-rate loan; company B requires a fixed-rate loan. Design a swap that will net a bank, acting as intermediary, 0.1% per annum and that will appear equally attractive to both companies. (5 marks) 2) Discuss the possible reasons that company A and B prefer to enter into the swap contract. (5 marks) 3) Identify and discuss the comparative advantage possessed by both companies. (5 marks) 4) Should the spreads between the rates offered to Company A and B be different in fixed and floating markets? Explain why the comparative advantage cannot be arbitraged away. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To design a swap that will be equally attractive to both companies and net the bank 01 per annum we can create a fixedforfloating interest rate swap Heres how the swap can be structured Company A Fl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d5d151613d_967674.pdf

180 KBs PDF File

663d5d151613d_967674.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started