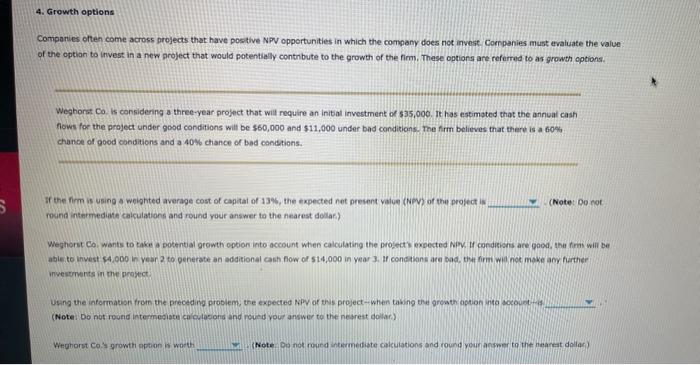

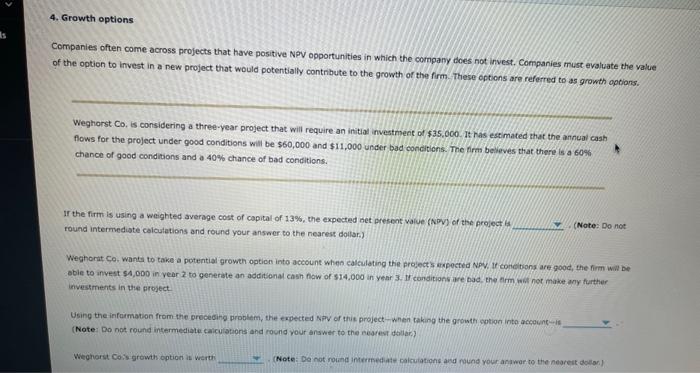

Companies often come across projects that have posive NPN opportunities in which the company does not invost. Cornpanies must evaluate the value of the optian to invest in a new project that would potentially contnbute to the growth of the fimm, These options are referrad to as growth eptions. Weghorst Co. is considering a three-year groject that will requlre an inibal investment of 535,000. fows for the project under good conditions will be $60,000 and 511,000 under bad conditions. The firm believes that there is a 60\% chance of good conditions and a 40% chance of bad constions. If the firm is using a weighted average cost of capial of 1335 , the expected het present value (NoV) of the proiect is (Note: De chot round intermediate calculations and round your answer to the nearest doilar.) Weghprst Co. wants to take a potential growth option into account when calculating the progect's expected Nifk. If condieions are good. the trat wiil be abie to lnvest \$4,000 in year 2 to generate an additional cash flow of 514,000 in vear 3. H conctiens are bad. thet firmit wil not mske amy further investrerts in the prosect. Using the information from the preceding problem, the expected Npy of this project-when taking the grosth. apteon and account ith (Note: Do not round intermigelate calcutasons and roued your answer to the neareat doliar.) Weqhorst co:s growth ppton is woth (Note Do nok rourd intermediste colculations and round younansmer to the neareat dolar) Companies often come across projects that have positive NPV opportunities in which the cornpany does not invest. Companies must evaluate the value of the option to invest in a new project that would potentially contribute to the growth of the firm. These options are reforred to as growth opoions. Weghorst Co, is considering a three-year project that will require an initial investment of $35,000. It has estimated that the annual cash flows for the project under good conditions will be $60,000 and $11,000 under bad conciticns. The firm bevieves that there is a 60%. chance of good conditions and a 40% chance of bad conditions. Ir the firm is using a weighted average cost of capital of 13%, the expected het prescot value (Nip) of the project is round intermediste colculations and round your answer to the nearest dollar.) (Note: Do not Weghorit Co. wanta to take a potential growth option into account when calculating the procect s arpected Npy, If conch tions are gooc, the firm wial be abie to anyest 54,000 in vear 2 to generate an additsonal cash fow of s14,000 in year 3 . If canditions are bad. the firm wibl not make any further investrents in the prosect. (Note: Do not round insermediate caiculatoons and round your answer to the nearev dillar.) Weghorst Cois growth option is werthi (Note: De not round intertnedate palcuiations and nound your aniwar to the neareit dollar)