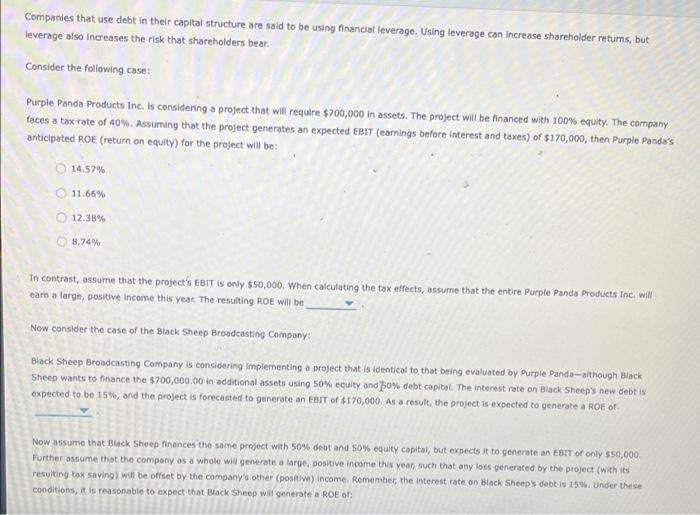

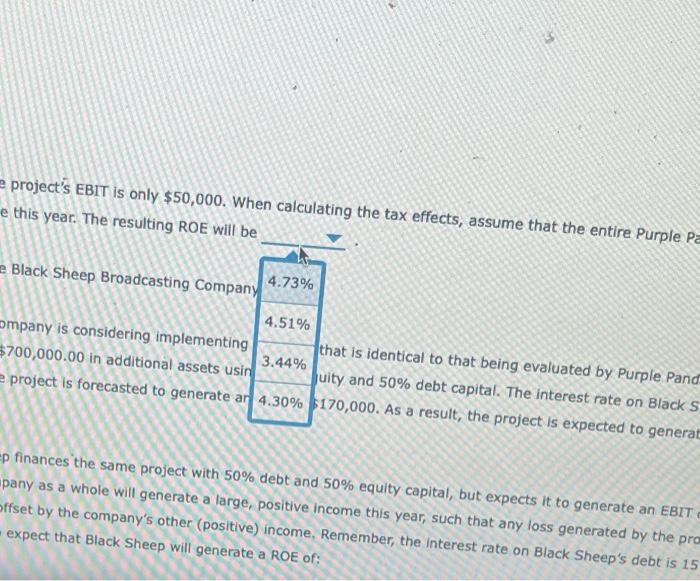

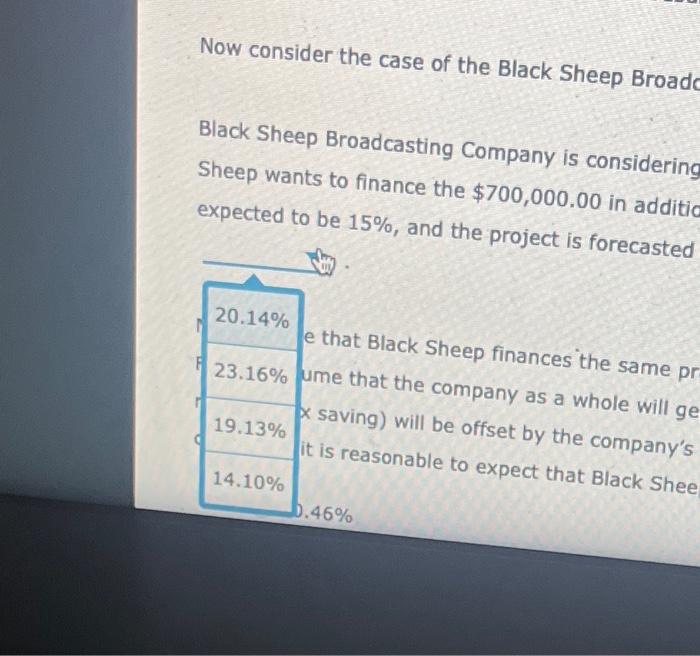

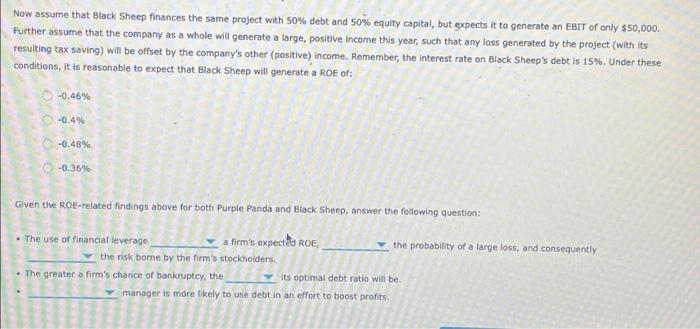

Companies that use debt in their capital structure are said to be using financial leverage. Using leverage can increase shareholder retums, but leverage also increases the risk that shareholders bear. Consider the following case: Purple Panda Products Inc. is considering a project that will require $700,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 40%. Assuming that the project generates an expected EBIT (earnings before interest and taxes) of $170,000, then Purple Panda's anticipated ROE (return on equity) for the project will be: 14.57% 11.66% 12.38% 8.74% In contrast, assume that the project's EBIT is only $50,000. When calculating the tax effects, assume that the entire Purple Panda Products Inc. will carn a large, positive Income this year. The resulting ROE will be Now consider the case of the Black Sheep Broadcasting Company: Black Sheep Broadcasting Company is considering implementing a project that is identical to that being evaluated by Purple Panda-although Black Sheep wants to finance the $700,000.00 in additional assets using 50% equity and $0% debt capitol. The interest rate on Black Sheep's new debt is expected to be 15%, and the project is forecasted to generate an EBIT of $170,000. As a result, the project is expected to generate a ROE OF Now assume that Black Sheep finances the same project with 50% debt and 50% equity capital, but expects it to generate an EBIT of only $50,000 Further assume that the company as a whole will generate a large positive income this year, such that any loss generated by the project (with its resulting tax saving) will be offset by the company's other (positive) income. Remember the interest rate on Black Sheep's debt is 15%. Under these conditions, it is reasonable to expect that Black Sheep will generate a ROE of: project's EBIT is only $50,000. When calculating the tax effects, assume that the entire Purple Pa e this year. The resulting ROE will be Black Sheep Broadcasting Company 4.73% 4.51% mpany is considering implementing that is identical to that being evaluated by Purple Pand $700,000.00 in additional assets usin 3.44% uity and 50% debt capital. The interest rate on Black S e project is forecasted to generate ar 4.30% $170,000. As a result, the project is expected to generat Ep finances the same project with 50% debt and 50% equity capital, but expects it to generate an EBIT pany as a whole will generate a large, positive income this year, such that any loss generated by the pro offset by the company's other (positive) income, Remember, the interest rate on Black Sheep's debt is 15 -expect that Black Sheep will generate a ROE of: Now consider the case of the Black Sheep Broadc Black Sheep Broadcasting Company is considering Sheep wants to finance the $700,000.00 in additia expected to be 15%, and the project is forecasted 20.14% e that Black Sheep finances the same pr 123.16% ume that the company as a whole will ge saving) will be offset by the company's 19.13% it is reasonable to expect that Black Shee 14.10% 0.46% Now assume that Black Sheep finances the same project with 50% debt and 50% equity capital, but expects it to generate an EBIT of only $50,000. Further assume that the company as a whole will generate a large, positive Income this year, such that any loss generated by the project (with resulting tax saving) will be offset by the company's other (positive) income. Remember, the interest rate on Black Sheep's debt is 15%. Under these conditions, it is reasonable to expect that Black Sheep will generate a ROE of: -0.46% -0.49 -0.48% -0.36% Given the ROE-related findings above for both Purple Panda and Black Sheep, answer the following question: The use of financal leverage a firm's expected ROE the probability of a large loss, and consequently the risk borne by the firm's stockholders The greater a firm's chance of bankruptcy, the its optimal debt ratio will be manager is more likely to use debt in an effort to boost profits