Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Companies that use debt in their capital structure are said to be using financial leverage. Using leverage can increase shareholder returns, but leverage also increases

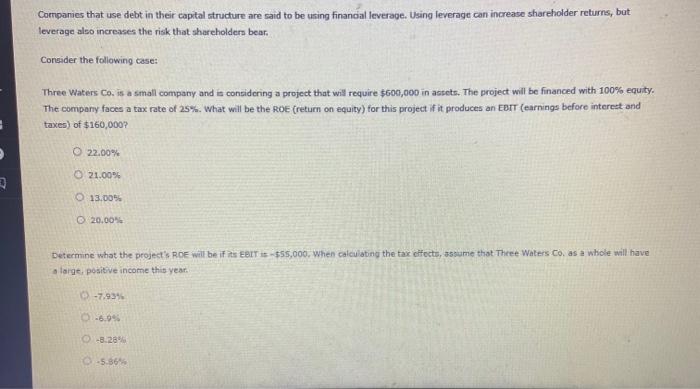

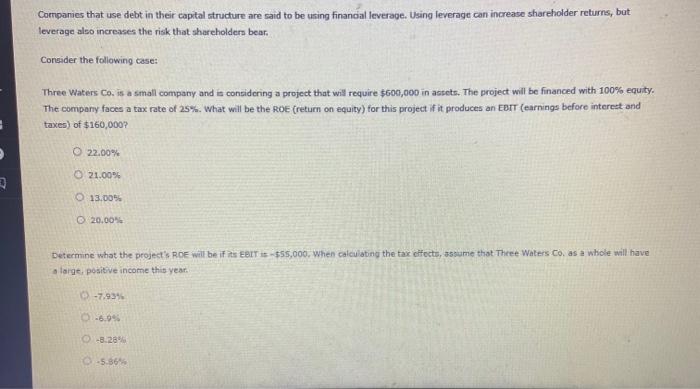

Companies that use debt in their capital structure are said to be using financial leverage. Using leverage can increase shareholder returns, but leverage also increases the risk that shareholders bear Consider the following case: Three Waters Co. is a small company and is considering a project that will require $600,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 25%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $160,000 O 22.00% 21.00% O 13.005 20.00 Determine what the project's ROE will be if its EBIT-$55,000. When calculating the tax effects, assume that Three Waters Co, as a whole will have large, positive income this year. -7.934 -6.99 -8.28 -5.86

Companies that use debt in their capital structure are said to be using financial leverage. Using leverage can increase shareholder returns, but leverage also increases the risk that shareholders bear Consider the following case: Three Waters Co. is a small company and is considering a project that will require $600,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 25%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $160,000 O 22.00% 21.00% O 13.005 20.00 Determine what the project's ROE will be if its EBIT-$55,000. When calculating the tax effects, assume that Three Waters Co, as a whole will have large, positive income this year. -7.934 -6.99 -8.28 -5.86

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started