Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Companies WMM and KLL have been offered the following rates per annum on a $50 million 5-year investment, shown in Exhibit 3. KLL requires a

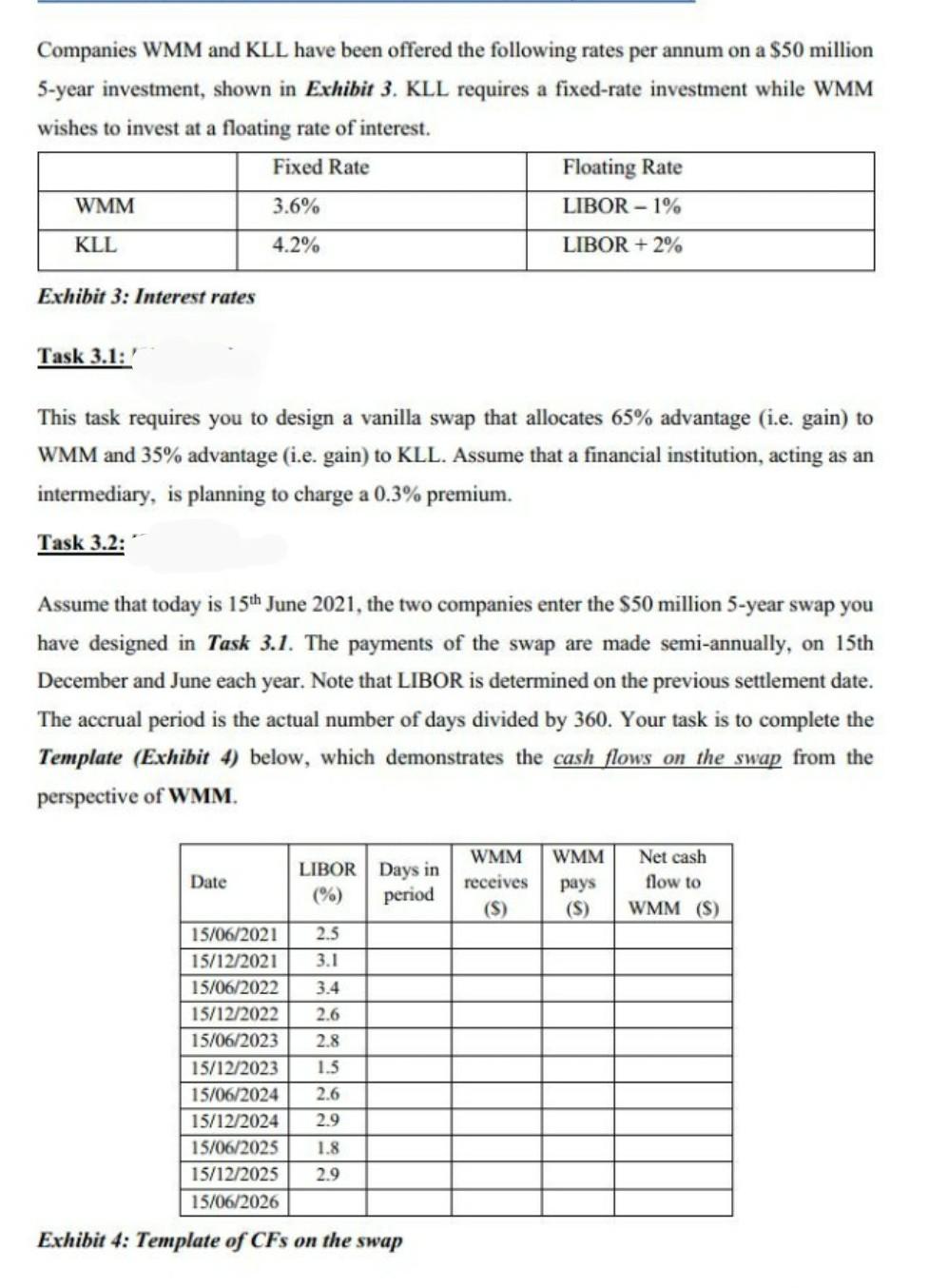

Companies WMM and KLL have been offered the following rates per annum on a $50 million 5-year investment, shown in Exhibit 3. KLL requires a fixed-rate investment while WMM wishes to invest at a floating rate of interest. Exhibit 3: Interest rates Task 3.1: ' This task requires you to design a vanilla swap that allocates 65% advantage (i.e. gain) to WMM and 35\% advantage (i.e. gain) to KLL. Assume that a financial institution, acting as an intermediary, is planning to charge a 0.3% premium. Task 3.2: Assume that today is 15th June 2021, the two companies enter the \$50 million 5-year swap you have designed in Task 3.1. The payments of the swap are made semi-annually, on 15 th December and June each year. Note that LIBOR is determined on the previous settlement date. The accrual period is the actual number of days divided by 360 . Your task is to complete the Template (Exhibit 4) below, which demonstrates the cash flows on the swap from the perspective of WMM. Exhibit 4: Template of CFs on the swap Companies WMM and KLL have been offered the following rates per annum on a $50 million 5-year investment, shown in Exhibit 3. KLL requires a fixed-rate investment while WMM wishes to invest at a floating rate of interest. Exhibit 3: Interest rates Task 3.1: ' This task requires you to design a vanilla swap that allocates 65% advantage (i.e. gain) to WMM and 35\% advantage (i.e. gain) to KLL. Assume that a financial institution, acting as an intermediary, is planning to charge a 0.3% premium. Task 3.2: Assume that today is 15th June 2021, the two companies enter the \$50 million 5-year swap you have designed in Task 3.1. The payments of the swap are made semi-annually, on 15 th December and June each year. Note that LIBOR is determined on the previous settlement date. The accrual period is the actual number of days divided by 360 . Your task is to complete the Template (Exhibit 4) below, which demonstrates the cash flows on the swap from the perspective of WMM. Exhibit 4: Template of CFs on the swap

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started