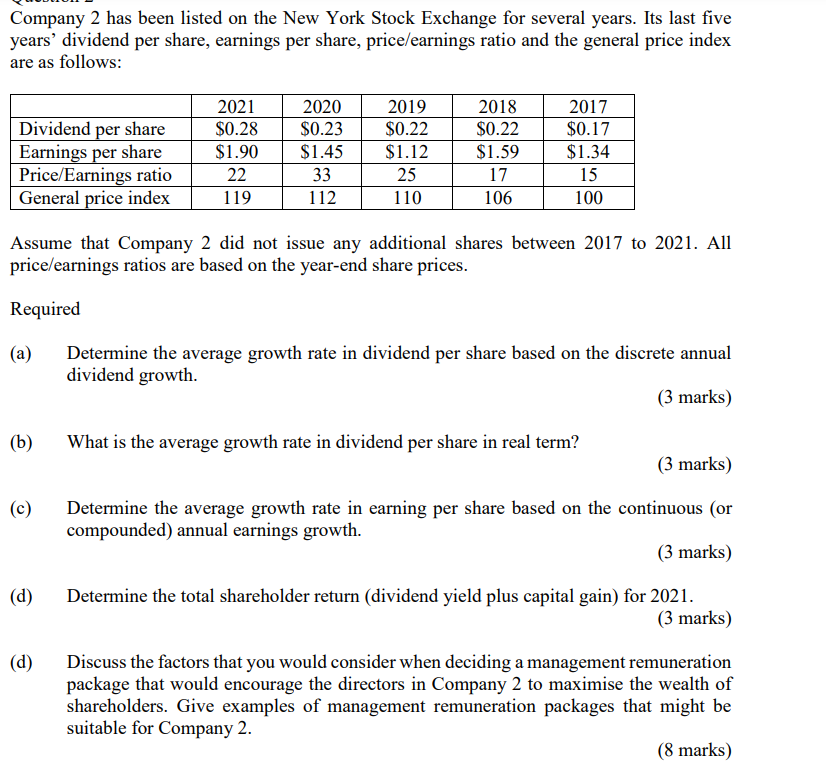

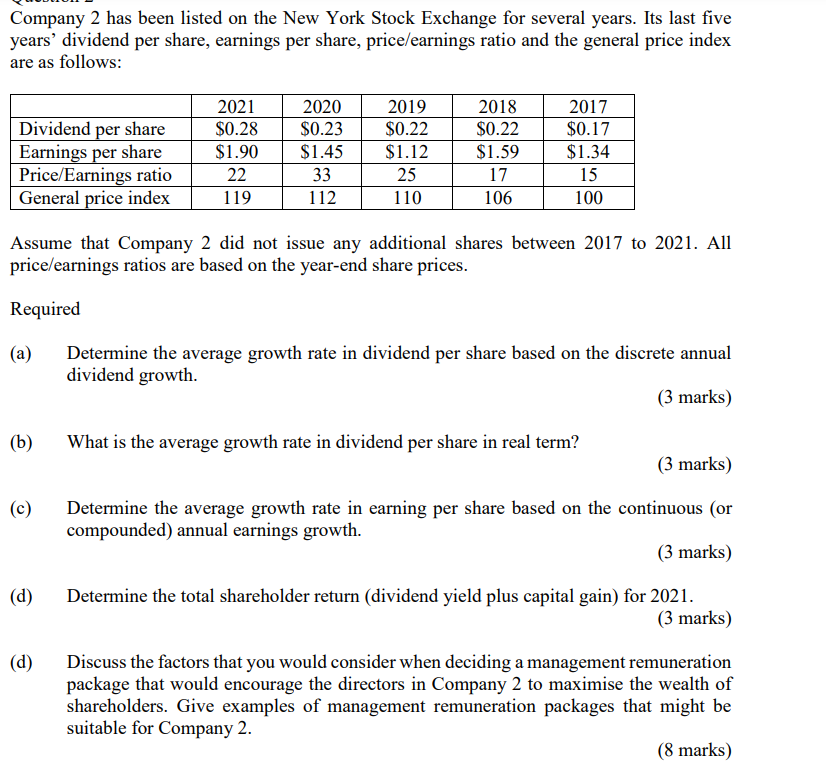

Company 2 has been listed on the New York Stock Exchange for several years. Its last five years' dividend per share, earnings per share, price/earnings ratio and the general price index are as follows: Dividend per share Earnings per share Price/Earnings ratio General price index 2021 $0.28 $1.90 22 119 2020 $0.23 $1.45 33 112 2019 $0.22 $1.12 25 110 2018 $0.22 $1.59 17 106 2017 $0.17 $1.34 15 100 Assume that Company 2 did not issue any additional shares between 2017 to 2021. All price/earnings ratios are based on the year-end share prices. Required (a) Determine the average growth rate in dividend per share based on the discrete annual dividend growth. (3 marks) (b) What is the average growth rate in dividend per share in real term? (3 marks) (c) Determine the average growth rate in earning per share based on the continuous (or compounded) annual earnings growth. (3 marks) (d) Determine the total shareholder return (dividend yield plus capital gain) for 2021. (3 marks) (d) Discuss the factors that you would consider when deciding a management remuneration package that would encourage the directors in Company 2 to maximise the wealth of shareholders. Give examples of management remuneration packages that might be suitable for Company 2. (8 marks) Company 2 has been listed on the New York Stock Exchange for several years. Its last five years' dividend per share, earnings per share, price/earnings ratio and the general price index are as follows: Dividend per share Earnings per share Price/Earnings ratio General price index 2021 $0.28 $1.90 22 119 2020 $0.23 $1.45 33 112 2019 $0.22 $1.12 25 110 2018 $0.22 $1.59 17 106 2017 $0.17 $1.34 15 100 Assume that Company 2 did not issue any additional shares between 2017 to 2021. All price/earnings ratios are based on the year-end share prices. Required (a) Determine the average growth rate in dividend per share based on the discrete annual dividend growth. (3 marks) (b) What is the average growth rate in dividend per share in real term? (3 marks) (c) Determine the average growth rate in earning per share based on the continuous (or compounded) annual earnings growth. (3 marks) (d) Determine the total shareholder return (dividend yield plus capital gain) for 2021. (3 marks) (d) Discuss the factors that you would consider when deciding a management remuneration package that would encourage the directors in Company 2 to maximise the wealth of shareholders. Give examples of management remuneration packages that might be suitable for Company 2. (8 marks)