Question

Company A acquired 100% of Company Bs voting stock on January 1, 2018 by issuing 10,000 shares of its $10 par value common stock. Company

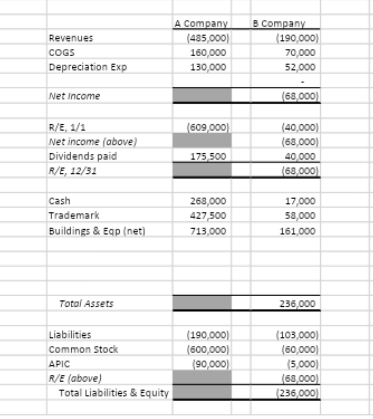

Company A acquired 100% of Company Bs voting stock on January 1, 2018 by issuing 10,000 shares of its $10 par value common stock. Company As common stock had a fair value of $14 per share at that time. Company Bs stockholders equity was $105,000 at date of acquisition. The trademark was undervalued by $10,000. It has an indefinite life. Equipment (with a 5 year life) was undervalued by $5,000. A customer list that had been created internally had an estimated useful life of 20 years was valued at $20,000. Following are the financial statements for the two companies for the year ending December 31, 2018.

Step 1. Complete the trial balance of A Company (calculate income of sub and investment in sub) by using the EQUITY Method.

Step 2. Prepare a Consolidated Worksheet for Year Ended December 31, 2018. Include the consolidated and eliminated journal entries in JOURNAL FORM.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started