Question

Company A and Company B are similar companies operating in thesame industry. Initially, both Company A and Company B have an enterprise valueof $400 million

Company A and Company B are similar companies operating in thesame industry.

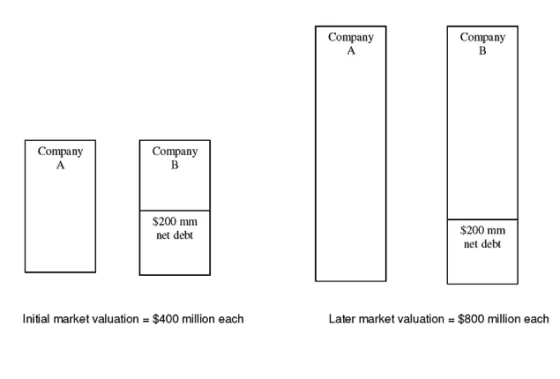

Initially, both Company A and Company B have an enterprise valueof $400 million ? that is to say, the value of the operatingbusiness is $400 million. Note that the enterprise value is thesame as the market value of equity (Share price x number of sharesoutstanding = $400 million) for Company A and different from marketvalue of equity for Company B.

Company A has no net debt and Company B has $200 million in netdebt. (Note that Company B could have $100 million in cash and $300million in debt or simply no cash and $200 million in debt. It?sthe net debt that matters in this analysis.)

Industry conditions change and the value of all businesses inthis industry sector doubles overnight. That means the enterprisevalue (the value of the operating business) for both companiesdoubles.

What is the return earned by equity investors in Company A?Company B?

Company A Company B $200 mm net debt Initial market valuation = $400 million each Company A Company B $200 mm net debt Later market valuation = $800 million each

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Introduction Enterprise value EV and net debt are crucial financial metrics in assessing a companys valuation and financial structure In this scenario ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started