Answered step by step

Verified Expert Solution

Question

1 Approved Answer

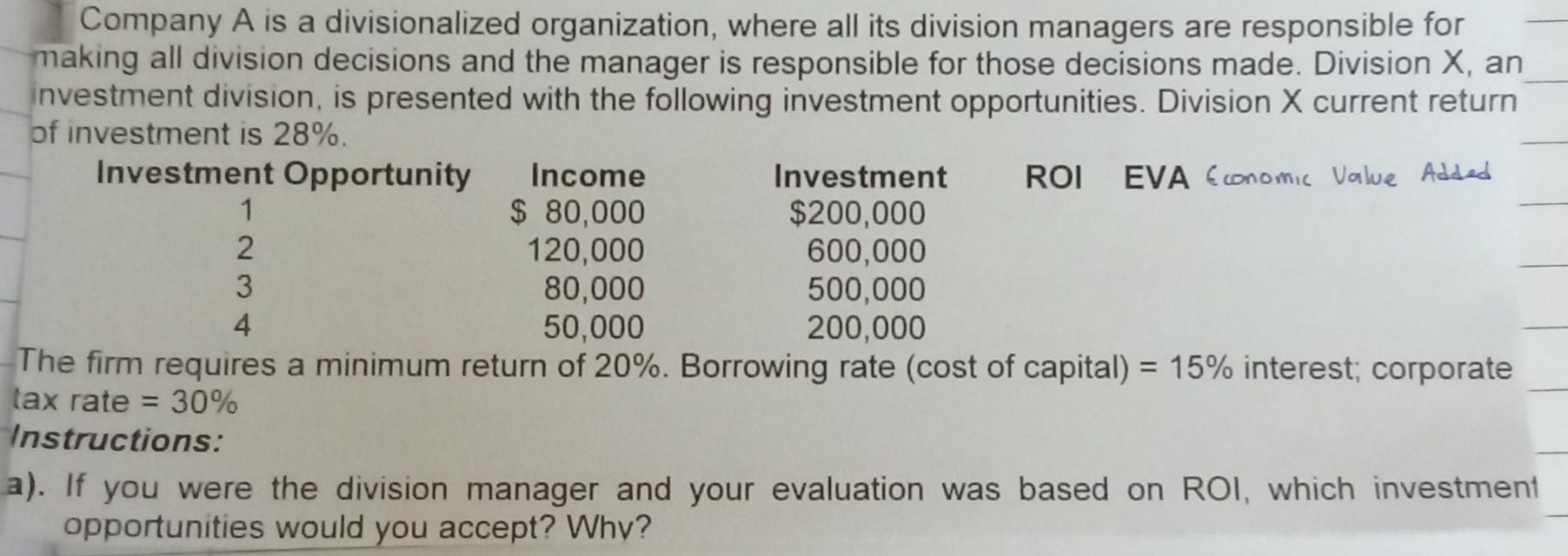

Company A is a divisionalized organization, where all its division managers are responsible for making all division decisions and the manager is responsible for those

Company A is a divisionalized organization, where all its division managers are responsible for making all division decisions and the manager is responsible for those decisions made. Division X, an investment division, is presented with the following investment opportunities. Division X current return of investment is 28% The firm requires a minimum return of 20%. Borrowing rate (cost of capital) =15% interest; corporate tax rate =30% Instructions: a). If you were the division manager and your evaluation was based on ROI, which investment opportunities would you accept? Whv

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started