Question

COMPANY A is planning to establish a subsidiary in Singapore to manufacture and sell security equipment locally. The project will end in three years and

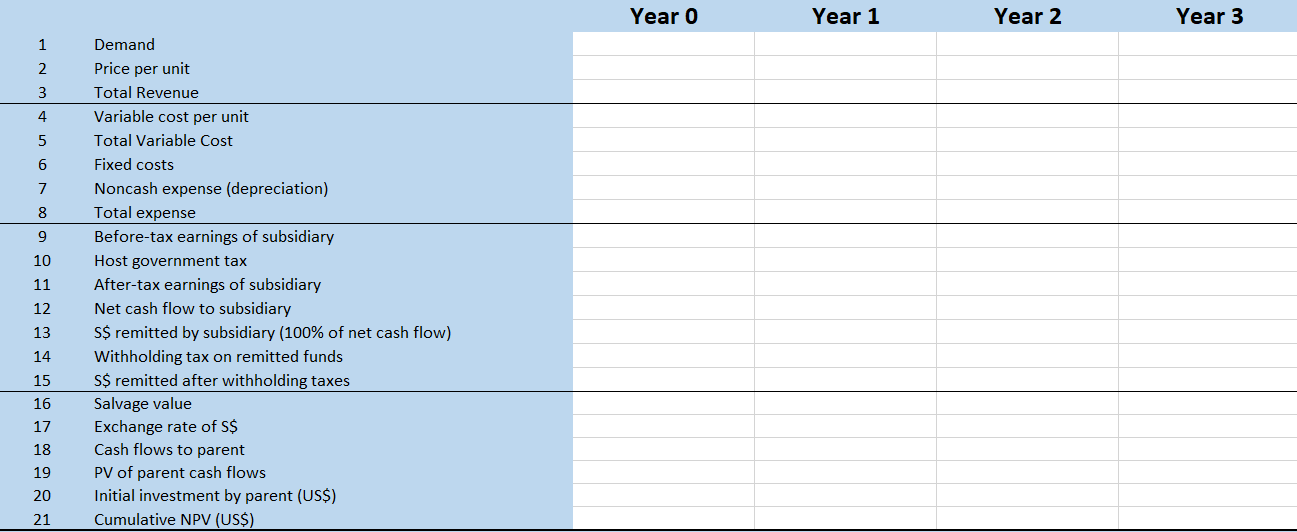

COMPANY A is planning to establish a subsidiary in Singapore to manufacture and sell security equipment locally. The project will end in three years and the subsidiary will be sold to a Singapore firm for S$8 million at the end of the project. This transaction will not be subject to withholding tax and capital gain tax. The Singapore subsidiary will require an initial investment of 11 million U.S. dollars (US$). FairyDB predicts yearly sales revenue of S$31 million, S$33 million, and S$36 million throughout the 3 years. Similarly, the variable costs are S$9 million, S$7 million, and S$10 million for the next 3 years. The fixed costs are S$5 million per year. The fixed assets have a useful life of 3 years and the depreciation is S$3 million per year. The subsidiary will remit all net cash flows to its parent at the end of each year using the forecasted exchange rates. The current spot exchange rate is US$0.1408/S$. The company forecasts the exchange rate at US$0.1073/S$ for the next three years based on strong U.S. economic outlook. The parent's required rate of return for the Singapore subsidiary is 17%. The Singapore subsidiary will be subject to a 27% corporate tax rate in Singapore and the Singapore government will impose a 20% withholding tax on the remitted funds. Due to special tax treaty, the income from Singapore is not subject to tax in the U.S. Complete the spreadsheet below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started