Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company A sold merchandise for $171,000 cash during July. Returns that month to rate is 40%, the company $171,000 and $102,600. $171,000 and $100,440. $167,400

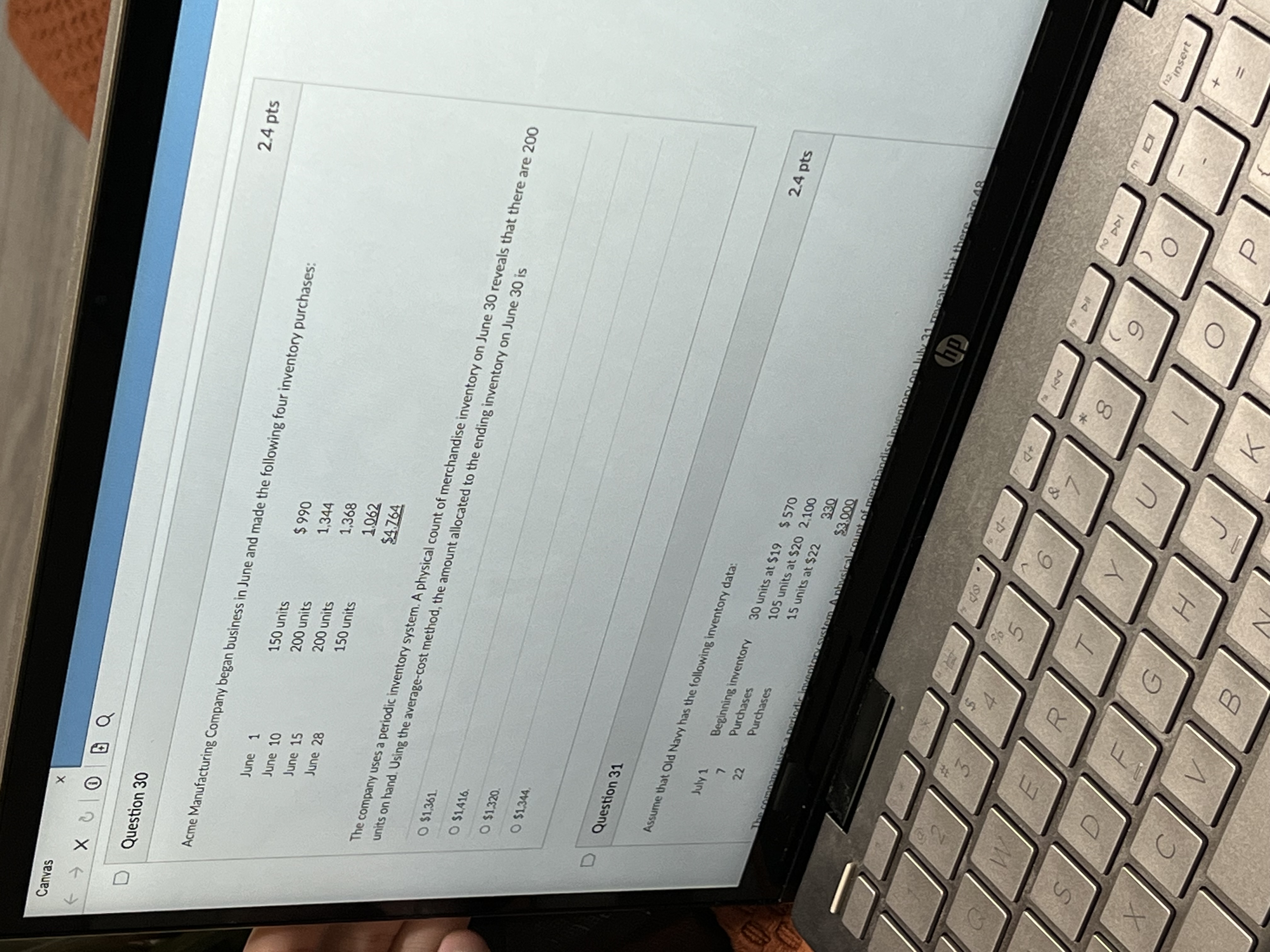

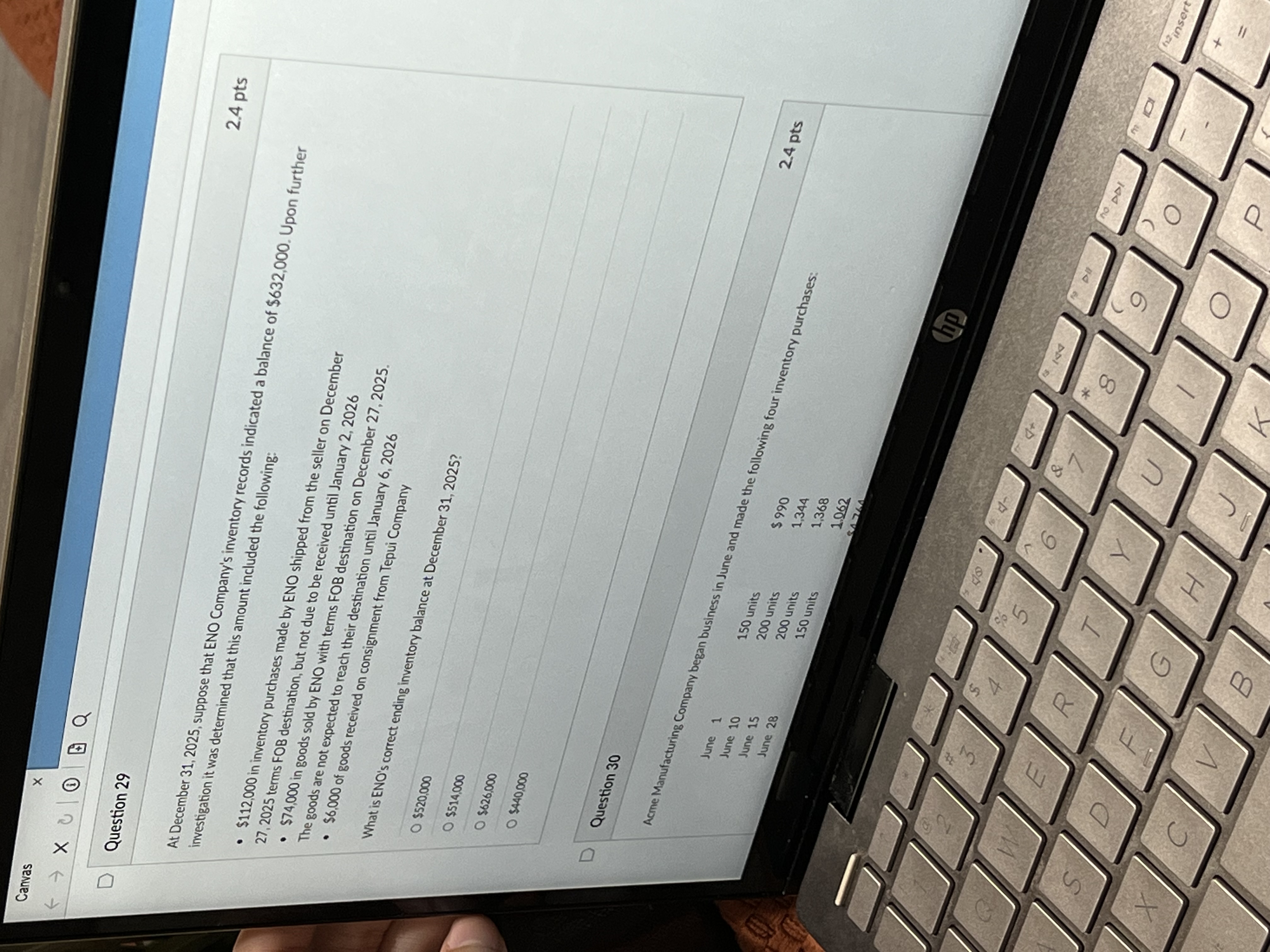

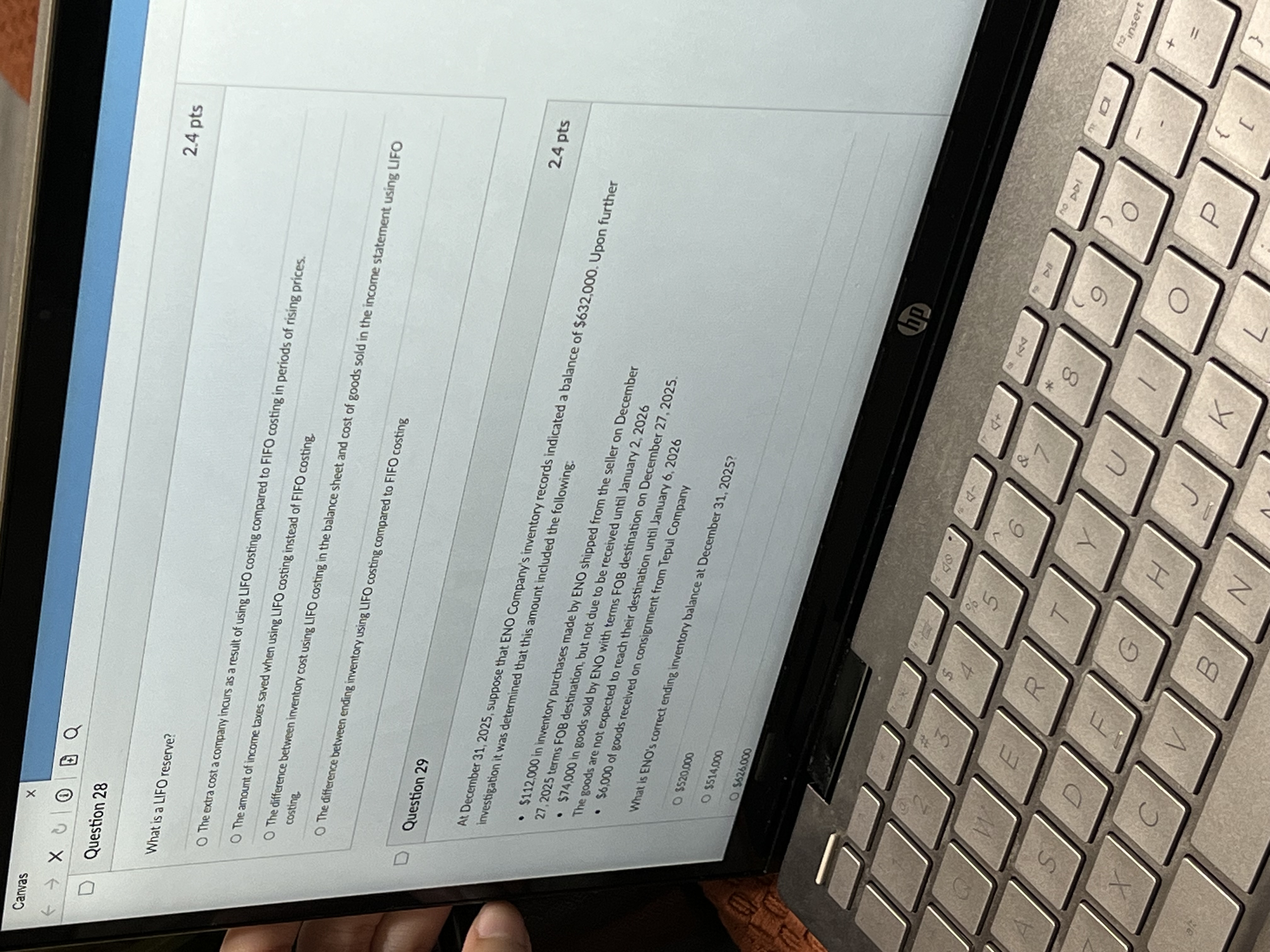

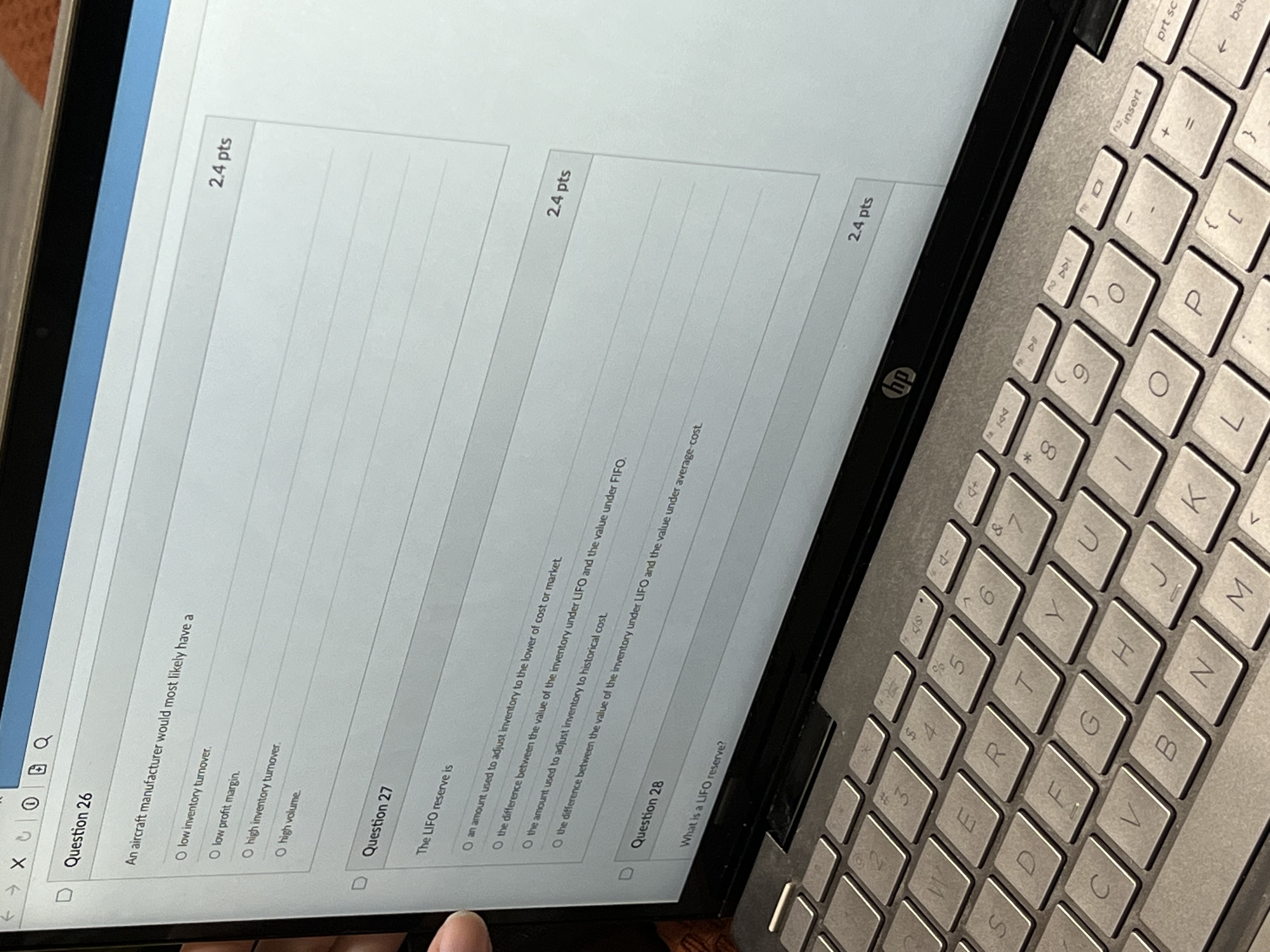

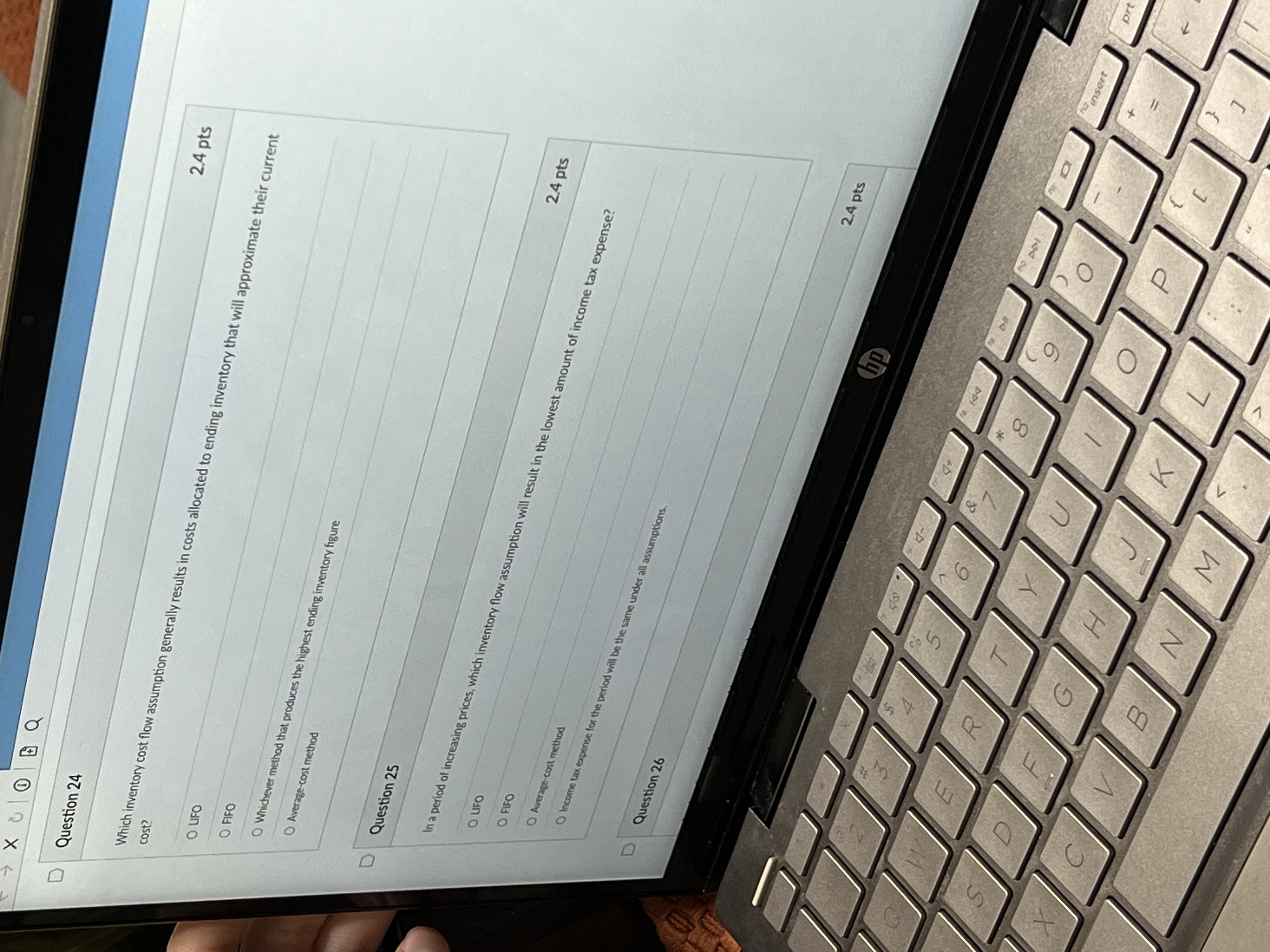

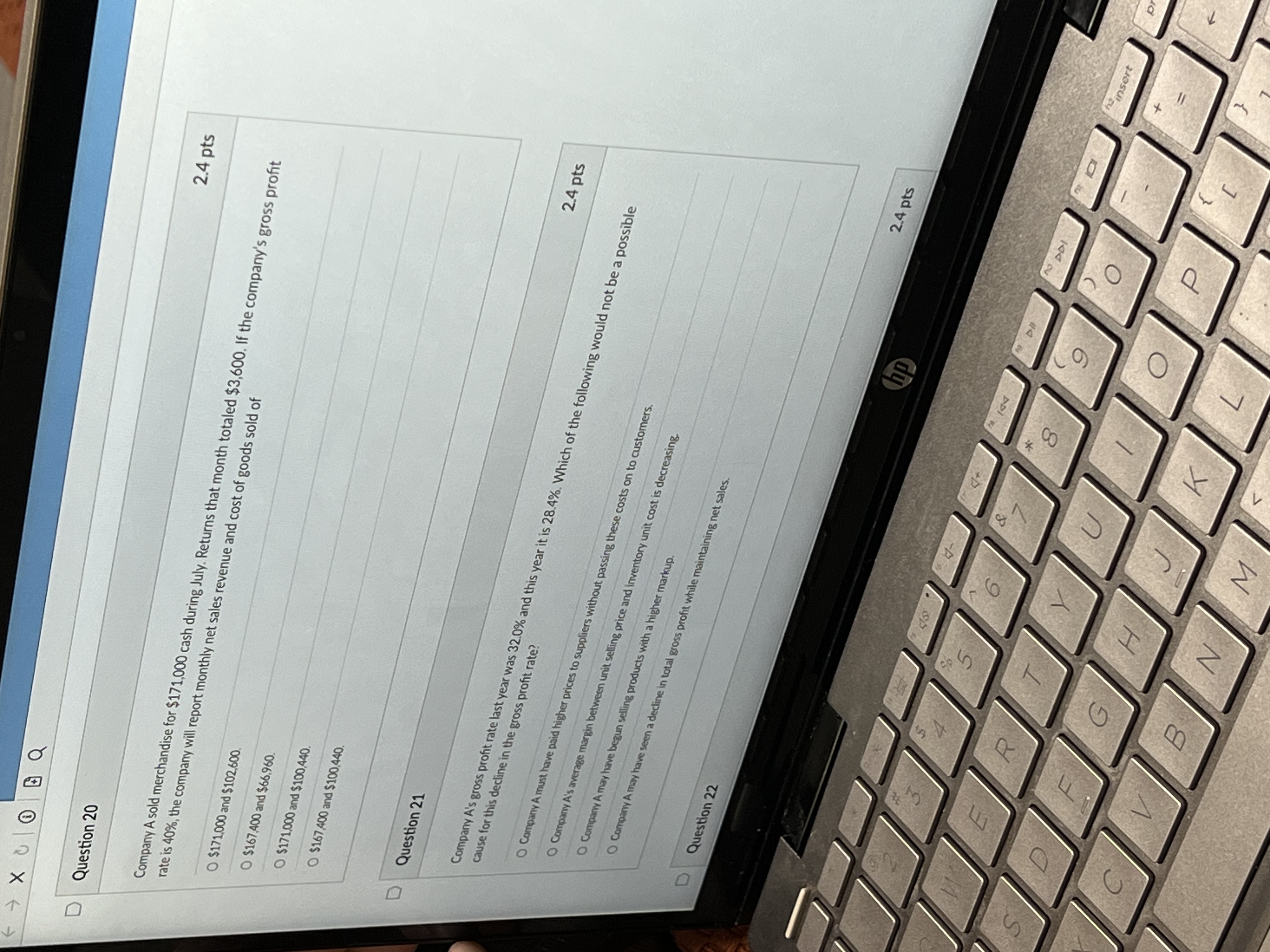

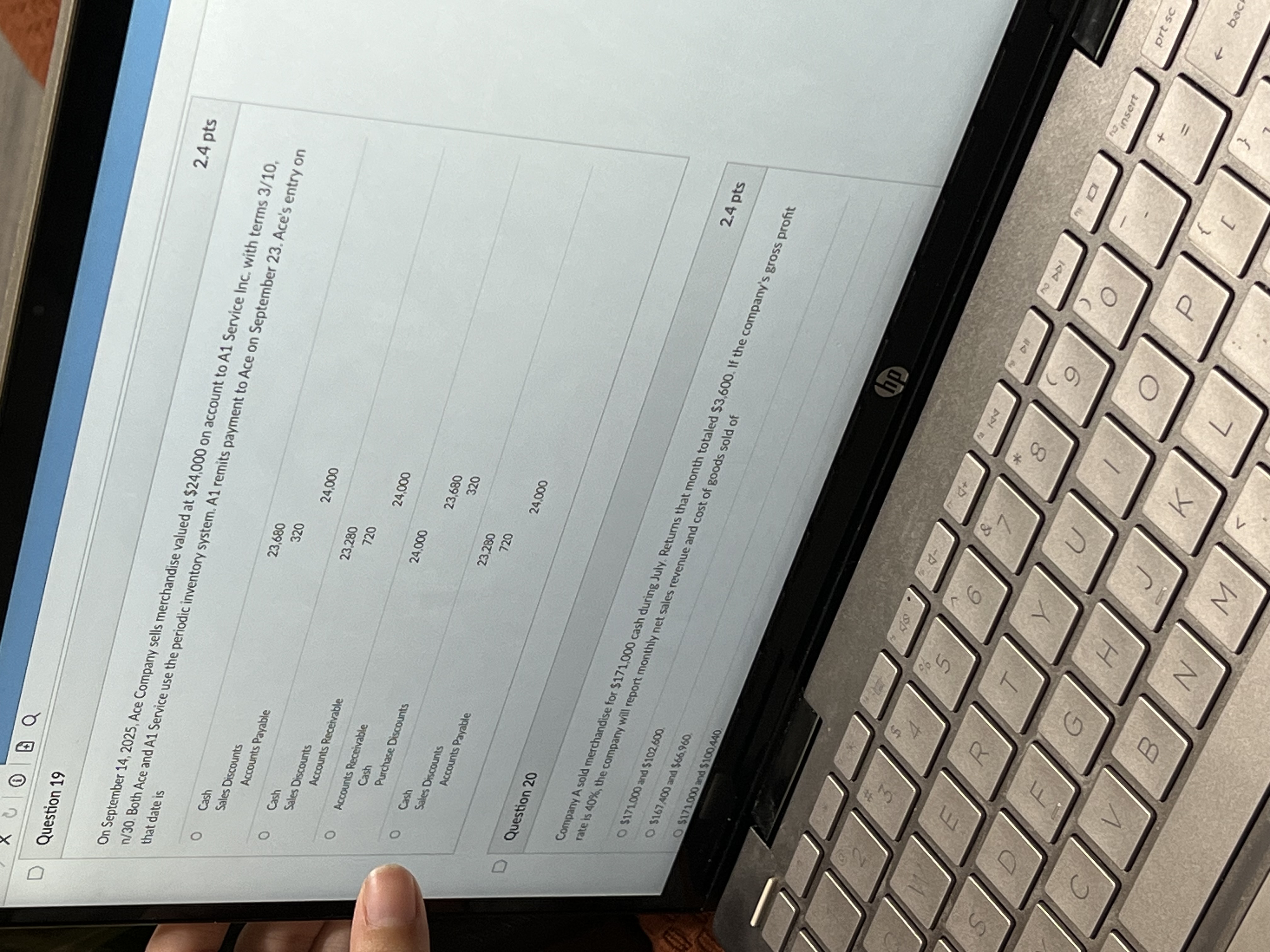

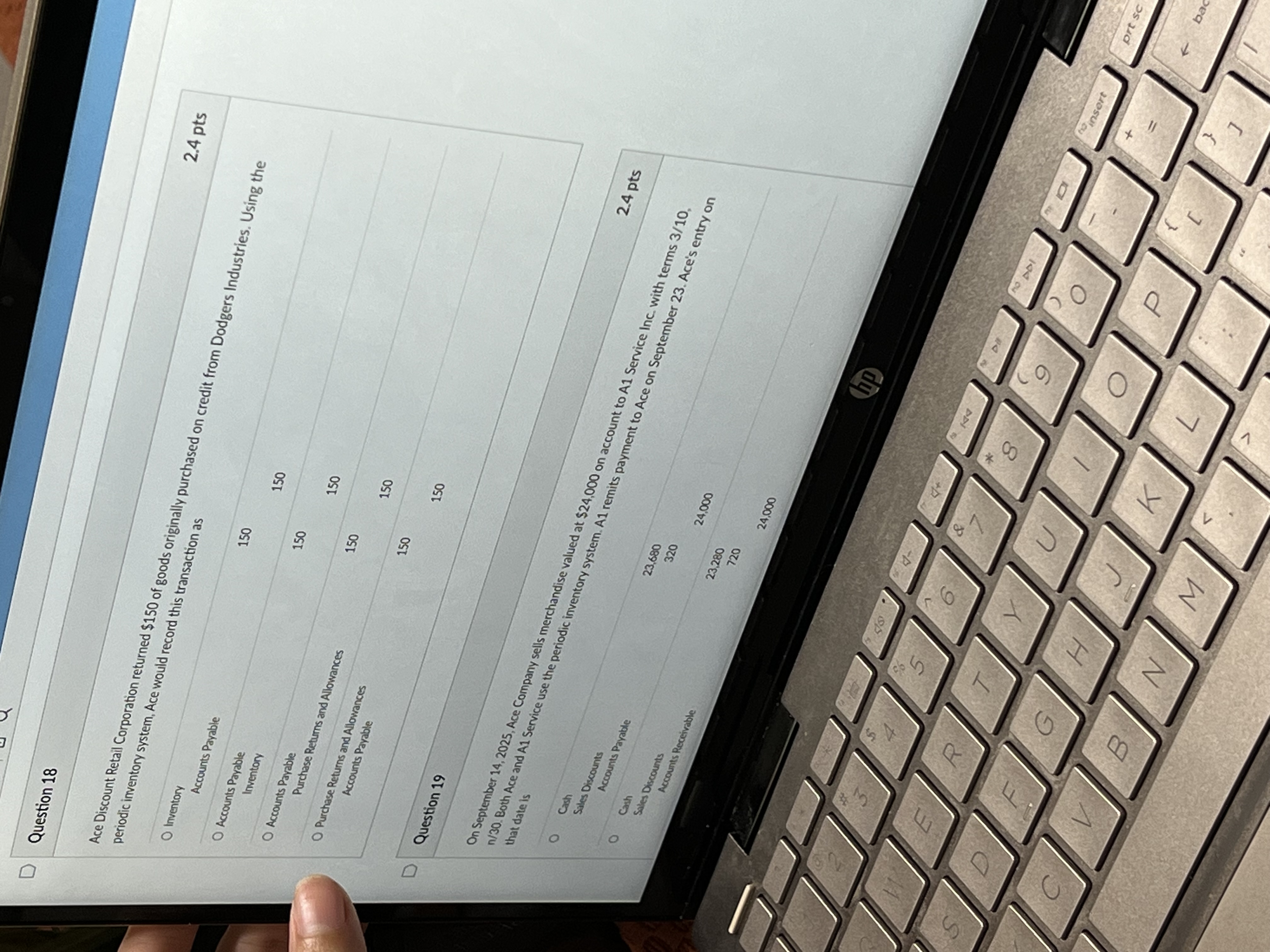

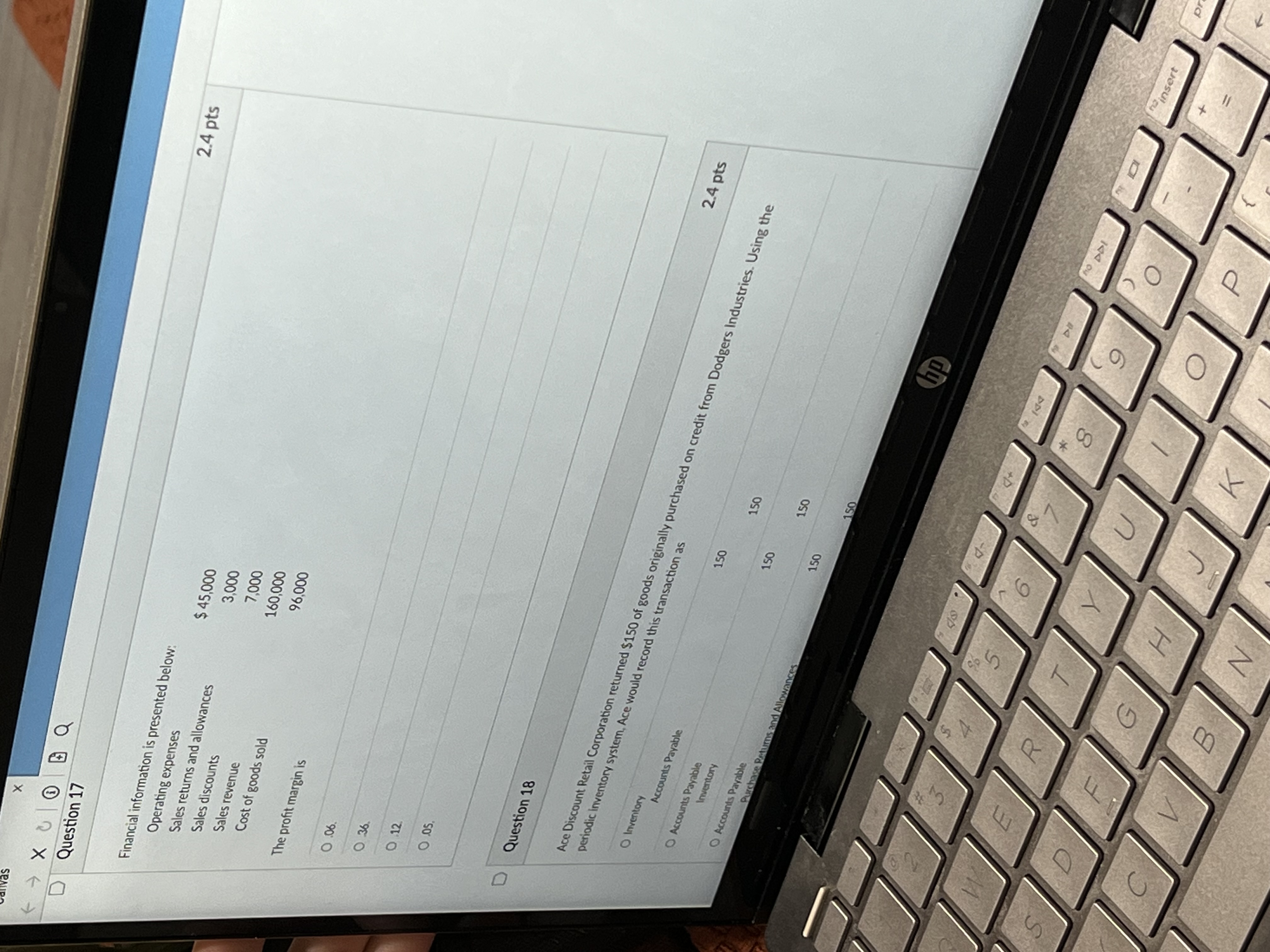

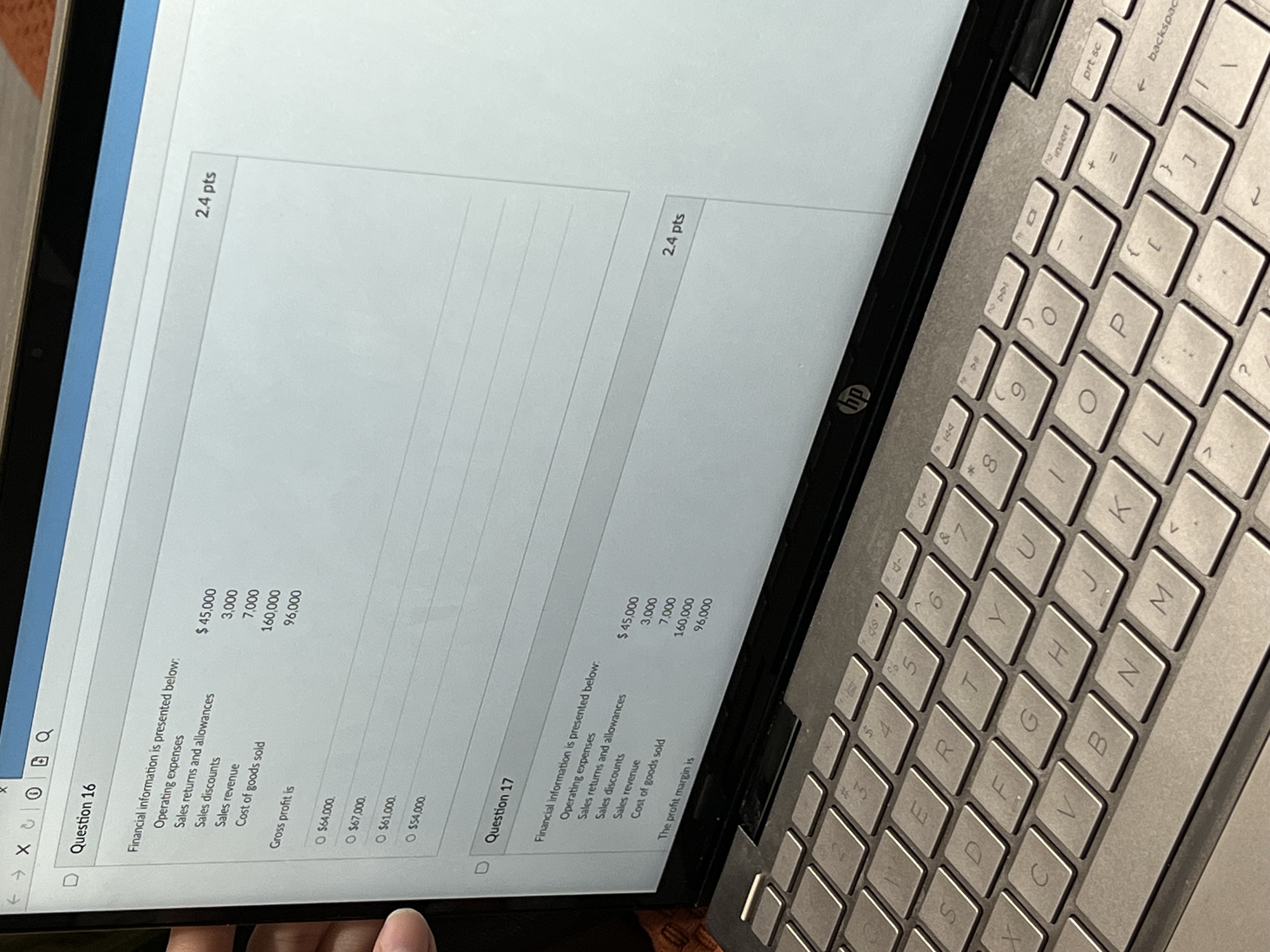

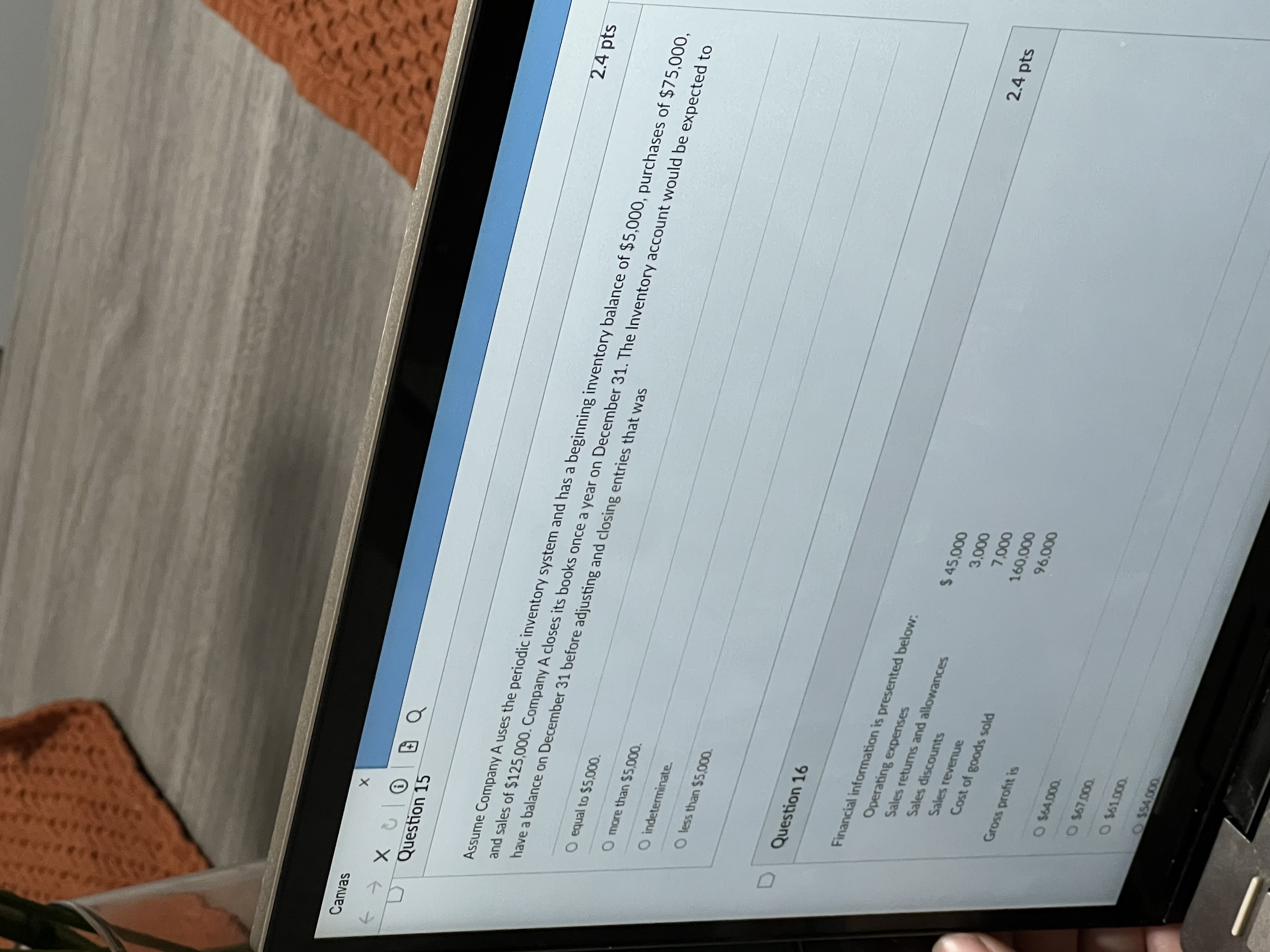

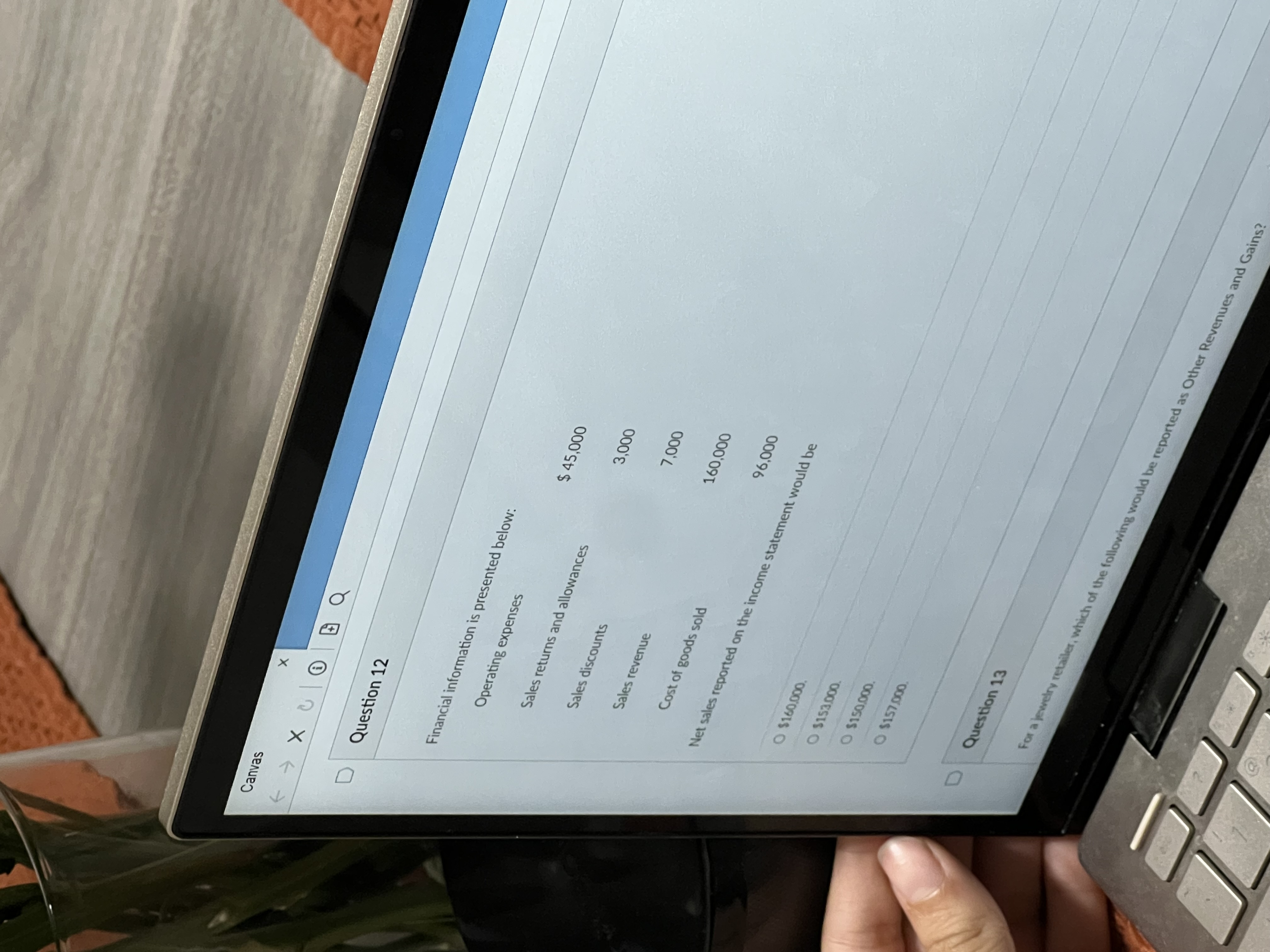

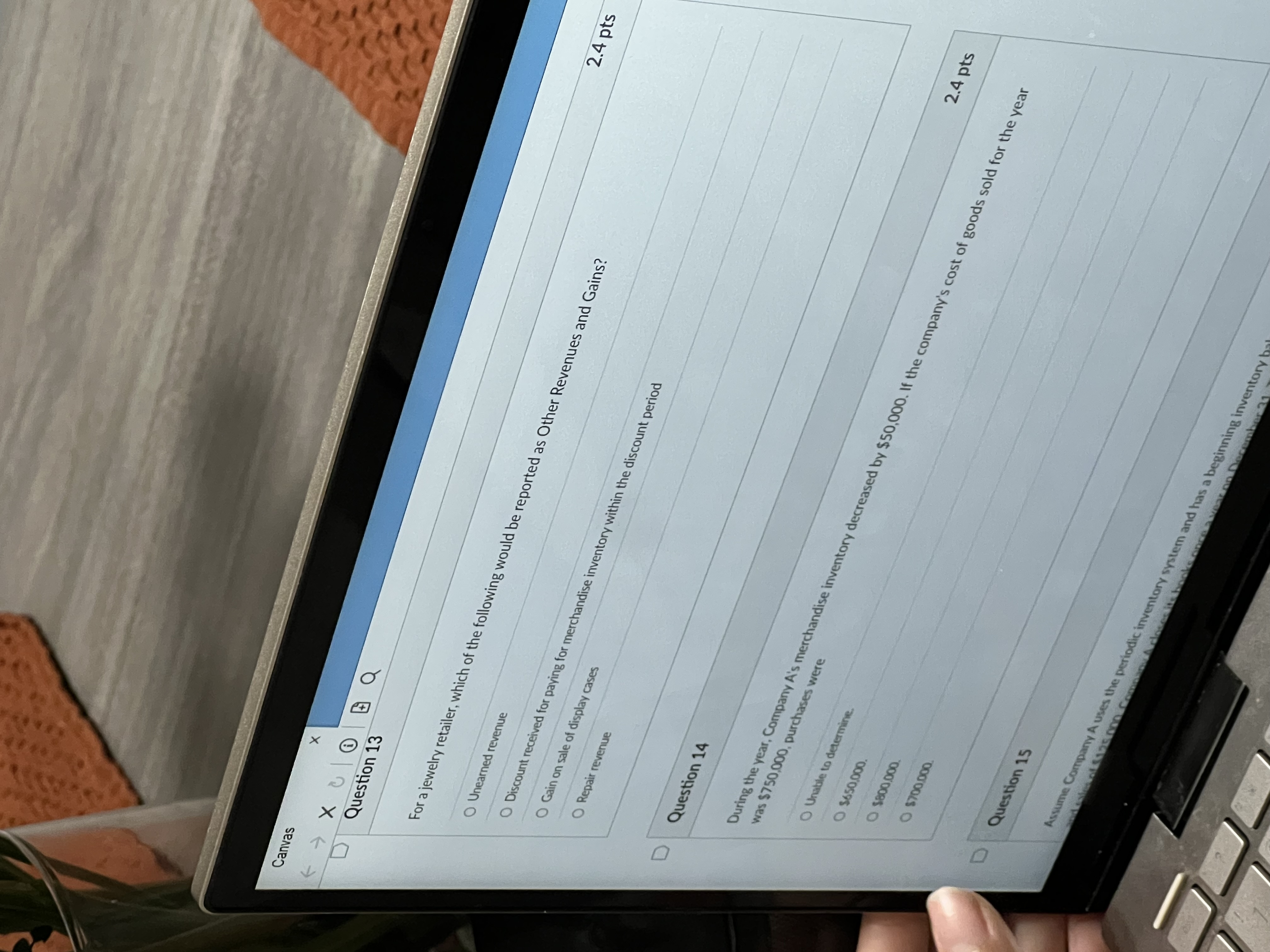

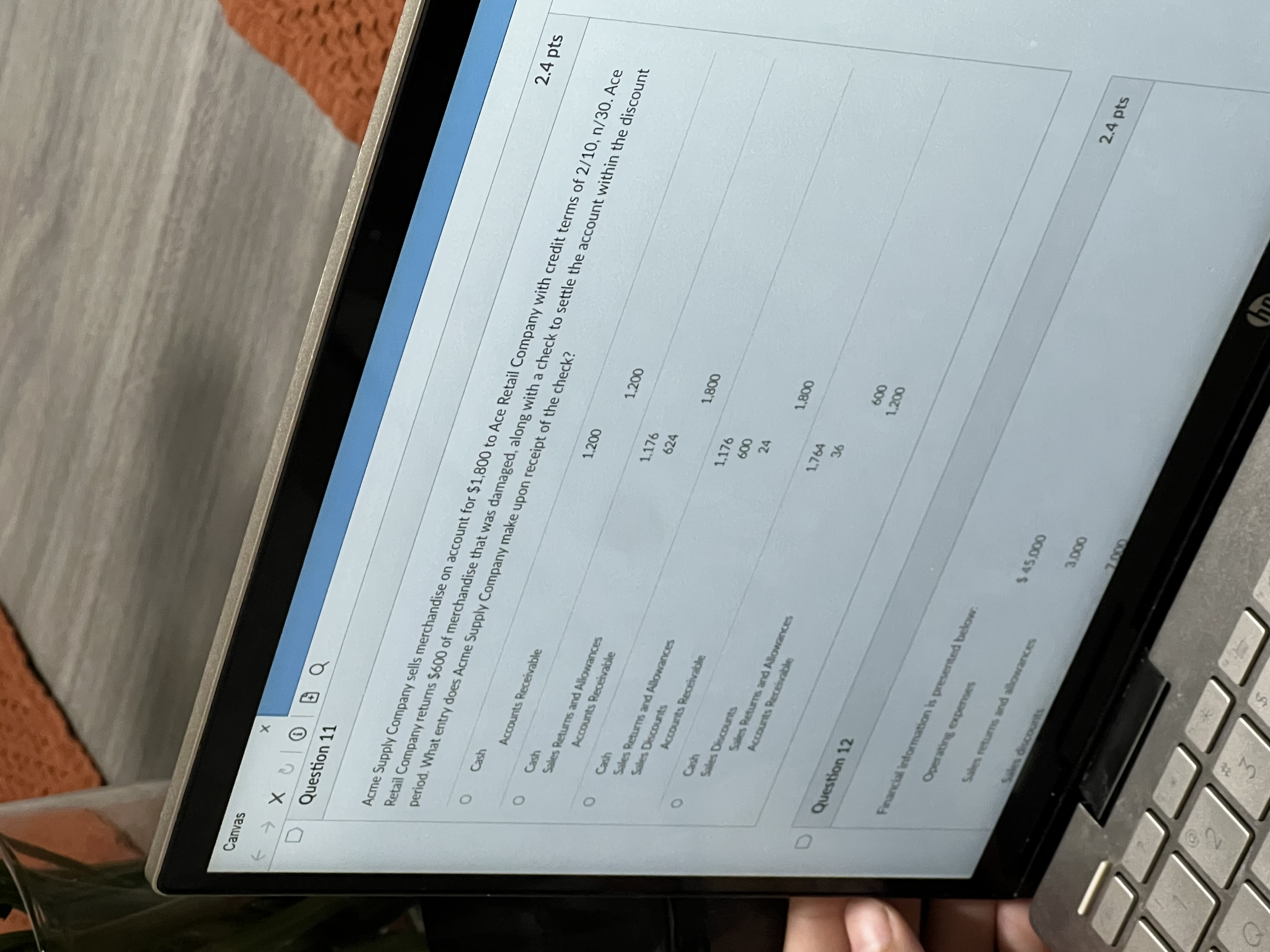

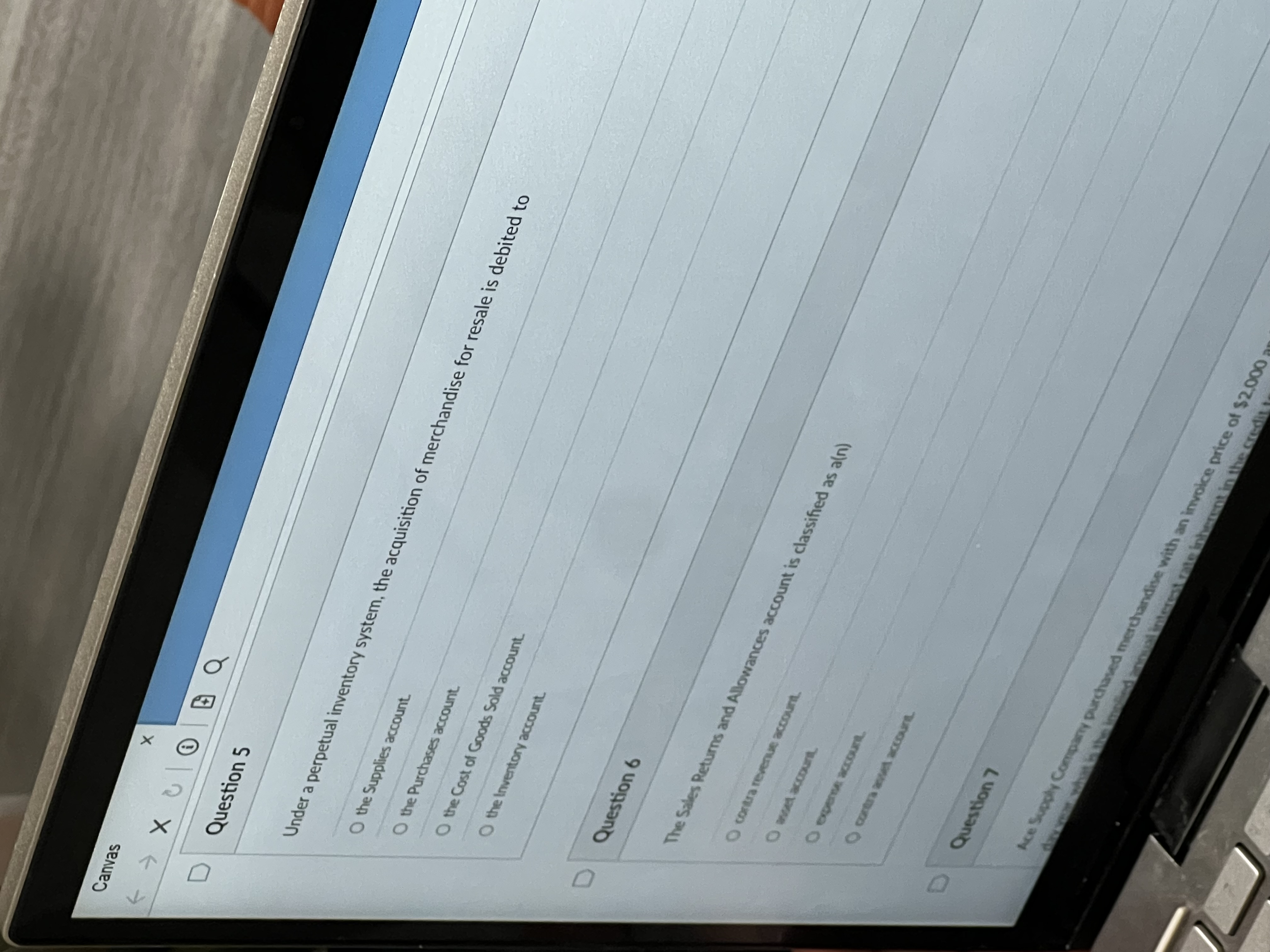

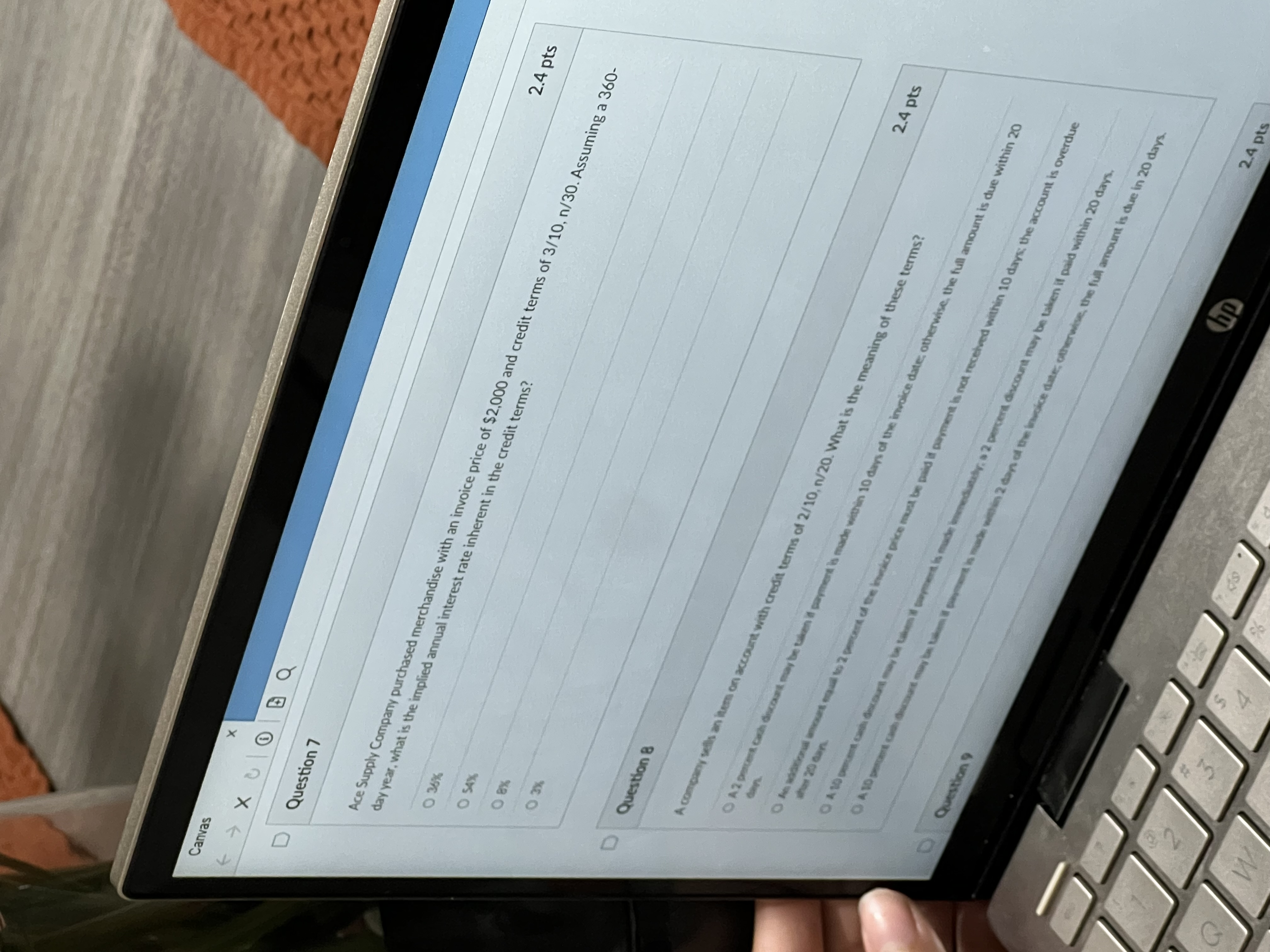

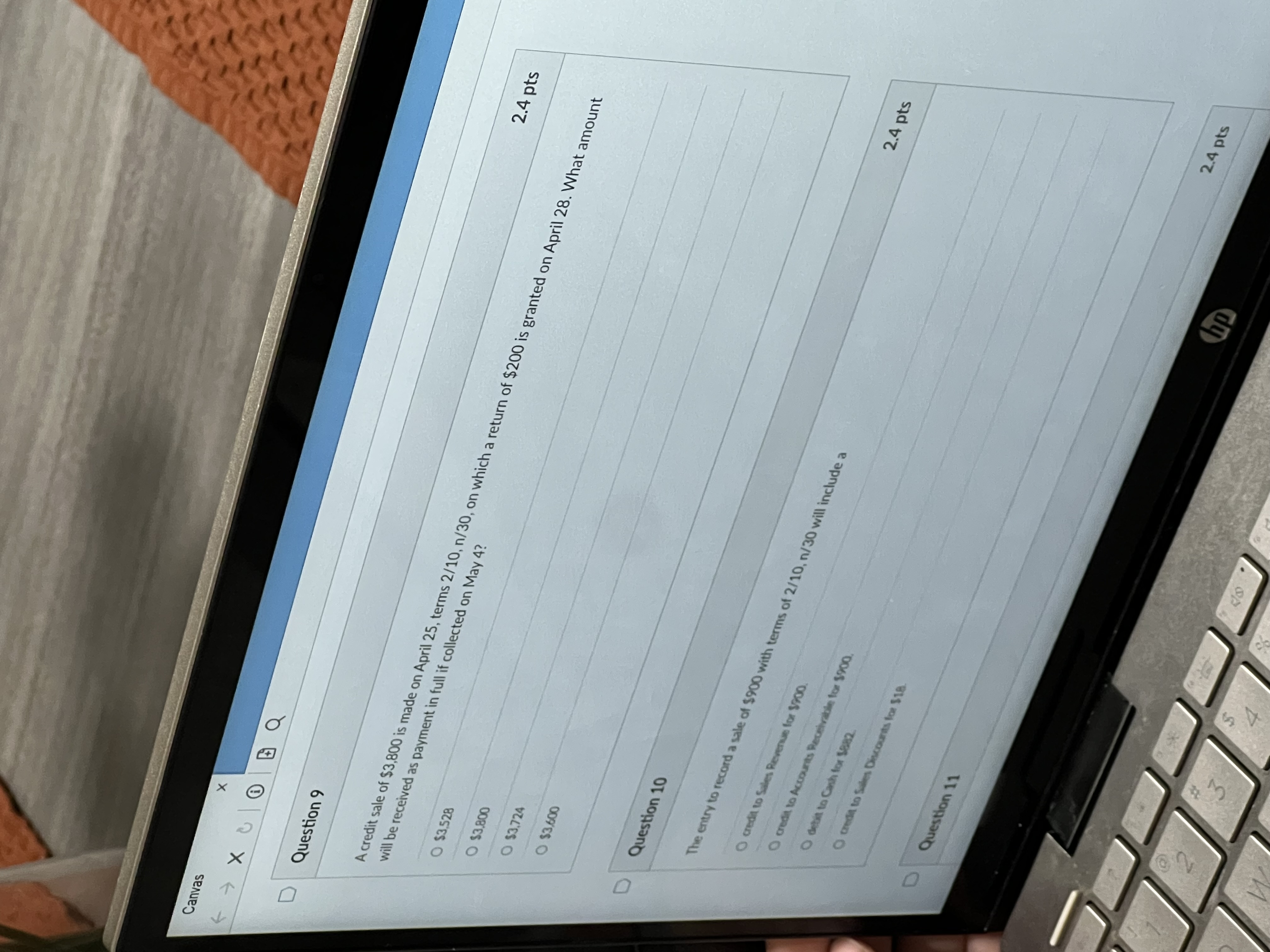

Company A sold merchandise for $171,000 cash during July. Returns that month to rate is 40%, the company $171,000 and $102,600. $171,000 and $100,440. $167,400 and $100,440. At December 31, 2025, suppose that ENO Company's inventory records indicated a balance of $632,000. Upon further investigation it was determined that this amount included the following: - $112,000 in in - $7,2025 t,000 in goods sold by ENO with terms FOB deceived until January 2, 2026 2.4 pts The goods are not expected to reach their destination until J on December 27,2025 . What is ENO's correct ending consignment from Tepui Company $520,000 $514,000 $626,000 $440,000 Question 9 A credit sale of $3,800 is made on April 25 , terms 2/10,n/30, on which a return of $200 is granted on will be received as payment in full if collected on May 4 ? $3,528 83.00 $3,600 Financial information is presenta.. Oneme. $64.000 Question? Ace Supply Co0 daryear, 4x - What is the implied merchandise with an invoice ice price of ex 3x $2,000 What is a LIFO reserve? 2.4 pts The extra cost a company incurs as a result of using LIFO costing compared to FIFO costing in periods of rising prices. The arnount of income taxes sar costing. Question 29 At December 31, 2025, suppose that ENO Company's inventory records indicated a balance of this a mined that tont - \$112,000 The goods are nots sold by ENO with terms to be received until Janua seller on December - \$6,000 of goods rected to reach their destin destination on Decy 2, 2026 What is ENO's con consignment from until January 6,202627,2025. $520,000 $514,000 ending inventory Tompany 6,2026 goods sold in the income statement using LJFO Question 26 An aircraft manufacturer would most likely have a O lowinventory turnover. 0 low profit margin. 2.4 pts O high inventory tumover. 0 high volume Question 27 The LIFO reserve is 0 an amount used to adjust invent ony to the lower of cost or market. Question 28 and sales of $125, more than $5,000. indeterminate. less than $5,000 Which inventory cost flow assumption generally results in costs allocated to ending inventory the cost? UFO FIFO Average-cost method Under a perpetual inventory system, the acquisition of merchandise for resale is debited to the supplies account. the Purch units on hand, Using the dic inventory system. A $1,361 $1/416. $1320 $1344

Company A sold merchandise for $171,000 cash during July. Returns that month to rate is 40%, the company $171,000 and $102,600. $171,000 and $100,440. $167,400 and $100,440. At December 31, 2025, suppose that ENO Company's inventory records indicated a balance of $632,000. Upon further investigation it was determined that this amount included the following: - $112,000 in in - $7,2025 t,000 in goods sold by ENO with terms FOB deceived until January 2, 2026 2.4 pts The goods are not expected to reach their destination until J on December 27,2025 . What is ENO's correct ending consignment from Tepui Company $520,000 $514,000 $626,000 $440,000 Question 9 A credit sale of $3,800 is made on April 25 , terms 2/10,n/30, on which a return of $200 is granted on will be received as payment in full if collected on May 4 ? $3,528 83.00 $3,600 Financial information is presenta.. Oneme. $64.000 Question? Ace Supply Co0 daryear, 4x - What is the implied merchandise with an invoice ice price of ex 3x $2,000 What is a LIFO reserve? 2.4 pts The extra cost a company incurs as a result of using LIFO costing compared to FIFO costing in periods of rising prices. The arnount of income taxes sar costing. Question 29 At December 31, 2025, suppose that ENO Company's inventory records indicated a balance of this a mined that tont - \$112,000 The goods are nots sold by ENO with terms to be received until Janua seller on December - \$6,000 of goods rected to reach their destin destination on Decy 2, 2026 What is ENO's con consignment from until January 6,202627,2025. $520,000 $514,000 ending inventory Tompany 6,2026 goods sold in the income statement using LJFO Question 26 An aircraft manufacturer would most likely have a O lowinventory turnover. 0 low profit margin. 2.4 pts O high inventory tumover. 0 high volume Question 27 The LIFO reserve is 0 an amount used to adjust invent ony to the lower of cost or market. Question 28 and sales of $125, more than $5,000. indeterminate. less than $5,000 Which inventory cost flow assumption generally results in costs allocated to ending inventory the cost? UFO FIFO Average-cost method Under a perpetual inventory system, the acquisition of merchandise for resale is debited to the supplies account. the Purch units on hand, Using the dic inventory system. A $1,361 $1/416. $1320 $1344 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started