Answered step by step

Verified Expert Solution

Question

1 Approved Answer

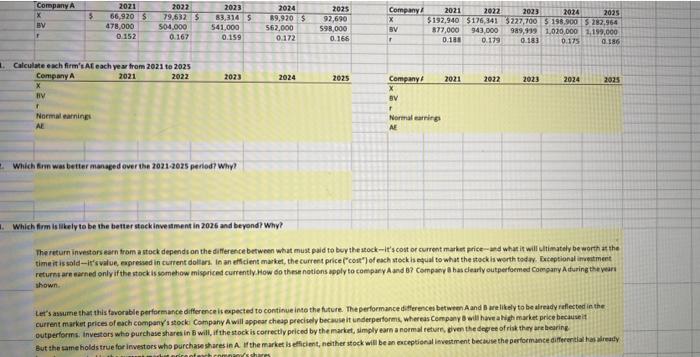

Company A X BV r $ X BV r 2021 66,920 $ 478,000 0.152 1. Calculate each firm's AE each year from 2021 to 2025

Company A X BV r $ X BV r 2021 66,920 $ 478,000 0.152 1. Calculate each firm's AE each year from 2021 to 2025 Company A 2021 2022 Normal earnings AE 2022 79,632 $ 504,000 0.167 2023 83,314 $ 541,000 0.159 2023 2. Which firm was better managed over the 2021-2025 period? Why? 2024 89,920 $ 562,000 0.172 2024 3. Which firm is likely to be the better stock investment in 2026 and beyond? Why? 2025 92,690 598,000 0.166 2025 Company A X BV r Company A X BV r 2021 2022 2023 2024 2025 $ 192,940 $176,341 $227,700 $ 198,900 $ 282,964 877,000 943,000 989,999 1,020,000 1,199,000 0.188 0.179 0.183 0.175 0.186 Normal earnings AE 2021 2022 2023 2024 The return investors earn from a stock depends on the difference between what must paid to buy the stock-it's cost or current market price-and what it will ultimately be worth at the time it is sold-it's value, expressed in current dollars. In an efficient market, the current price ("cost") of each stock is equal to what the stock is worth today. Exceptional investment returns are earned only if the stock is somehow mispriced currently. How do these notions apply to company A and B? Company B has clearly outperformed Company A during the years shown. 2220530 2025 Let's assume that this favorable performance difference is expected to continue into the future. The performance differences between A and B are likely to be already reflected in the current market prices of each company's stock: Company A will appear cheap precisely because it underperforms, whereas Company B will have a high market price because it outperforms. Investors who purchase shares in B will, if the stock is correctly priced by the market, simply earn a normal return, given the degree of risk they are bearing. But the same holds true for investors who purchase shares in A. If the market is efficient, neither stock will be an exceptional investment because the performance differential has already ice of each company's shares 20-22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started