Answered step by step

Verified Expert Solution

Question

1 Approved Answer

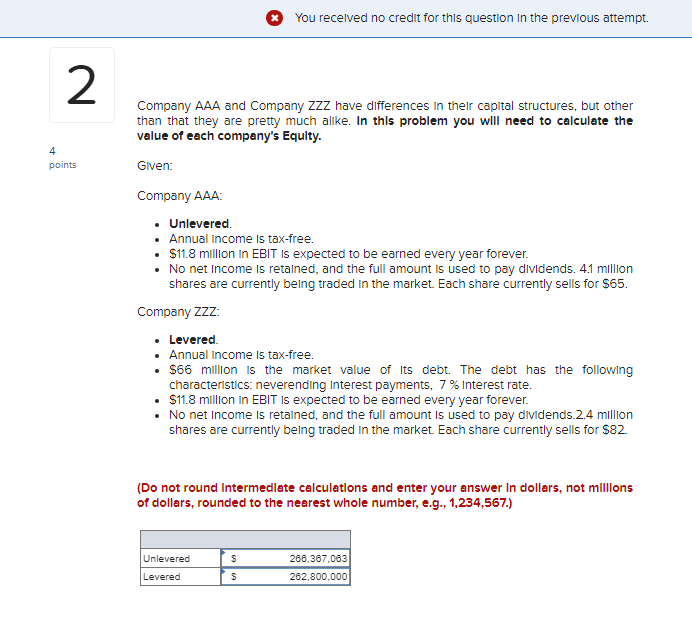

Company AAA and Company ZZZ have differences in thelr capital structures, but other than that they are pretty much allike. In thls problem you will

Company AAA and Company ZZZ have differences in thelr capital structures, but other

than that they are pretty much allike. In thls problem you will need to calculate the

value of each company's Equity.

GIven:

Company AAA:

Unlevered.

Annual Income is taxfree.

$ million in EBIT is expected to be earned every year forever.

No net income is retalned, and the full amount is used to pay dividends. million

shares are currently belng traded in the market. Each share currently sells for $

Company ZZZ:

Levered.

Annual income is taxfree.

$ million is the market value of its debt. The debt has the following

characteristics: neverending interest payments, interest rate.

$ million in EBIT is expected to be earned every year forever.

No net income is retained, and the full amount is used to pay dividends. million

shares are currently being traded in the market. Each share currently sells for $

Do not round intermediate calculations and enter your answer In dollars, not millions

of dollars, rounded to the nearest whole number, eg

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started