Question

Company AAA is a new company. In its balance sheet, it has only a project which lasts for one year. The projects cost is $

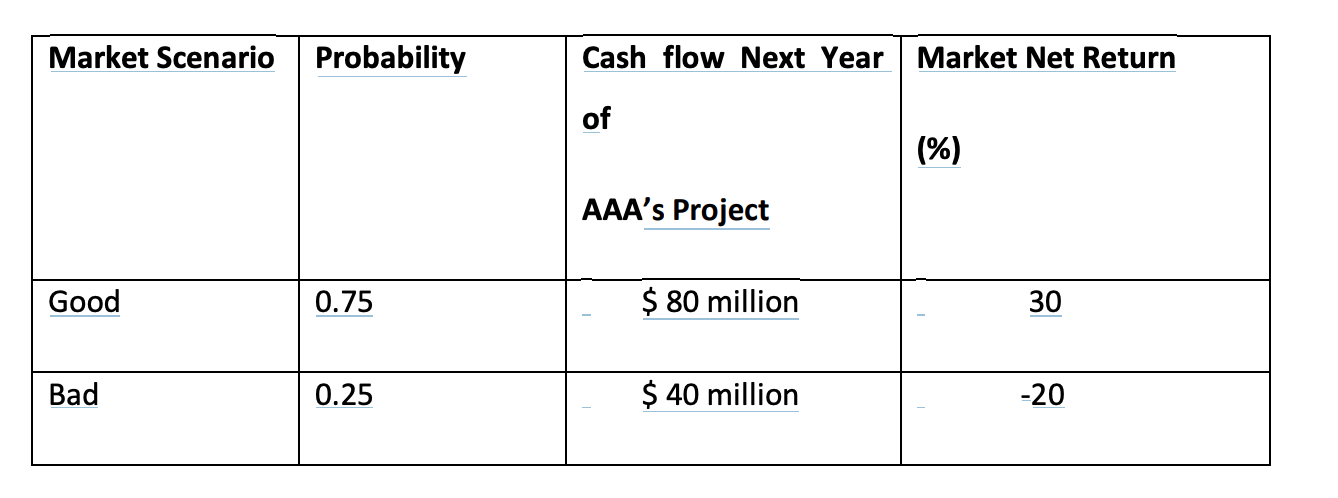

Company AAA is a new company. In its balance sheet, it has only a project which lasts for one year. The projects cost is $ 50 million occurring now (T0). The cash flow of the project in one year (T1) has the following joint distribution with the market portfolio.

Based on the above information, do the following questions 1)-7).

1) Find the risk-neutral probability for the "Good" state and "Bad" state. Based on the risk-neutral probability, calculate the present value (PV) of the project.

2) Use direct tracking method to work out: the tracking portfolio, the PV of the project, the NPV, the expected (required) return of the project, the actual return of the project (IRR), the beta of the projects expected return. Plot the expected return and actual return in Mean return-Beta diagram and comment.

3) Based on the expected returns beta you have worked out in 2), use CAPM to calculate the expected (required) return of the project and use DCF method to find the PV of the project.

4) Find the certainty equivalent (CE) value of the project's cash flow.

Suppose there are no corporate tax or other frictions. Do questions 5)-7)

5) Suppose the company finances the project entirely by its internal capital. What is the (net) expected return of equity, ?

6) Suppose the company issues one-year zero-coupon corporate bonds with face value F= 21 and the remaining funding from the internal capital to finance the project. What is the cash flow at T1 for the debtholders and for the equityholder, respectively? What are the market value of debt and the market value of equity at T0? What are the (net) expected return of debt () and the (net) expected return of equity ()? Give the MM2 equation.

7) Suppose the company issues one-year zero-coupon corporate bonds with face value F= 50 and the remaining funding from the internal capital to finance the project. What is the cash flow at T1 for the debtholders and for the equityholder, respectively? What are the market value of debt and the market value of equity at T0? What are the (net) expected return of debt ( ) and the (net) expected return of equity ()? Give the MM2 equation.

Market Scenario | Probability Cash flow Next Year Market Net Return (%) AAA's Project Good 0.75 $ 80 million 30 Bad 0.25 $ 40 million Market Scenario | Probability Cash flow Next Year Market Net Return (%) AAA's Project Good 0.75 $ 80 million 30 Bad 0.25 $ 40 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started