Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company ABC, a social media firm, has the following characteristics: There are 200 million shares outstanding, trading at $100 per share. The firm has

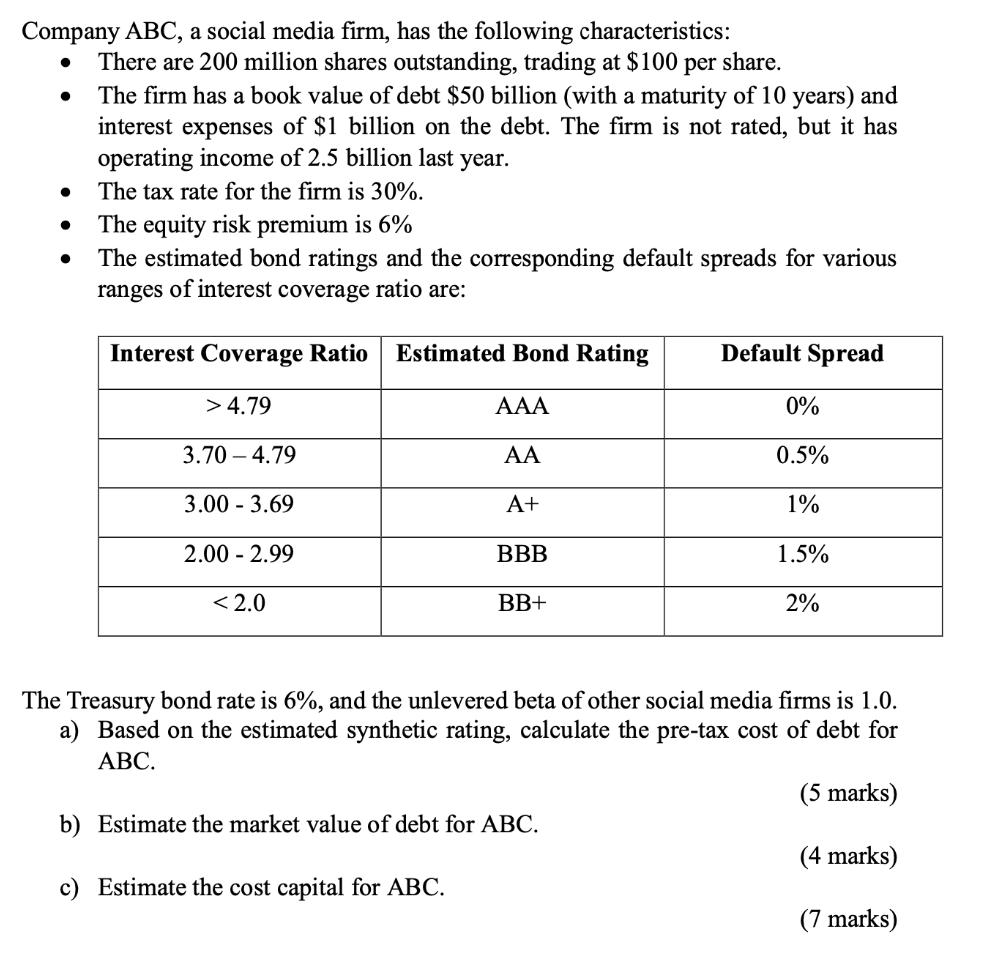

Company ABC, a social media firm, has the following characteristics: There are 200 million shares outstanding, trading at $100 per share. The firm has a book value of debt $50 billion (with a maturity of 10 years) and interest expenses of $1 billion on the debt. The firm is not rated, but it has operating income of 2.5 billion last year. The tax rate for the firm is 30%. The equity risk premium is 6% The estimated bond ratings and the corresponding default spreads for various ranges of interest coverage ratio are: Interest Coverage Ratio > 4.79 3.70 4.79 3.00-3.69 2.00 - 2.99

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution A Pretax cost of debt for ABC We can calculate the pretax cost of debt for ABC by using the estimated synthetic rating default spread and Treasury bond rate First we need to calculate the int...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started