Answered step by step

Verified Expert Solution

Question

1 Approved Answer

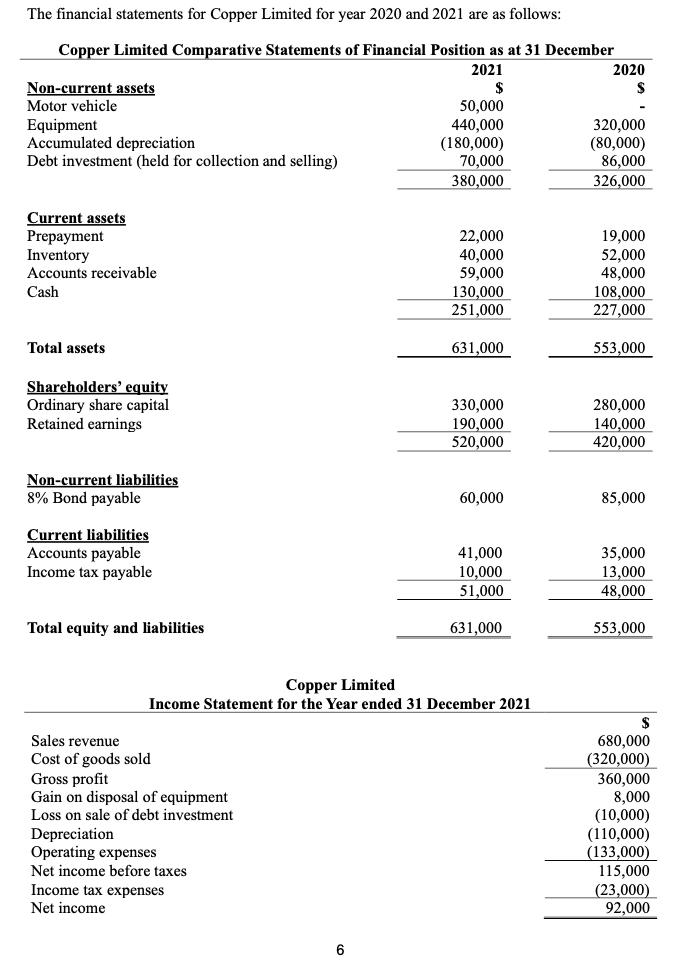

The financial statements for Copper Limited for year 2020 and 2021 are as follows: Copper Limited Comparative Statements of Financial Position as at 31

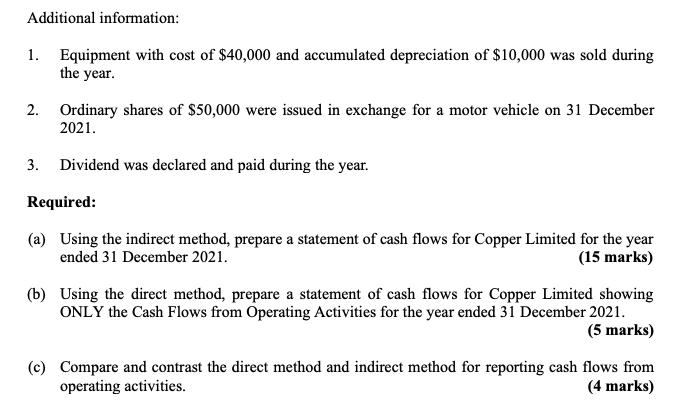

The financial statements for Copper Limited for year 2020 and 2021 are as follows: Copper Limited Comparative Statements of Financial Position as at 31 December 2021 $ Non-current assets Motor vehicle Equipment Accumulated depreciation Debt investment (held for collection and selling) Current assets Prepayment Inventory Accounts receivable Cash Total assets Shareholders' equity Ordinary share capital Retained earnings Non-current liabilities 8% Bond payable Current liabilities Accounts payable Income tax payable Total equity and liabilities Sales revenue Cost of goods sold Gross profit Gain on disposal of equipment Loss on sale of debt investment Depreciation Operating expenses Net income before taxes Income tax expenses Net income 50,000 440,000 6 (180,000) 70,000 380,000 22,000 40,000 59,000 130,000 251,000 631,000 330,000 190,000 520,000 Copper Limited Income Statement for the Year ended 31 December 2021 60,000 41,000 10,000 51,000 631,000 2020 $ 320,000 (80,000) 86,000 326,000 19,000 52,000 48,000 108,000 227,000 553,000 280,000 140,000 420,000 85,000 35,000 13,000 48,000 553,000 $ 680,000 (320,000) 360,000 8,000 (10,000) (110,000) (133,000) 115,000 (23,000) 92,000 Additional information: 1. Equipment with cost of $40,000 and accumulated depreciation of $10,000 was sold during the year. 2. Ordinary shares of $50,000 were issued in exchange for a motor vehicle on 31 December 2021. 3. Dividend was declared and paid during the year. Required: (a) Using the indirect method, prepare a statement of cash flows for Copper Limited for the year ended 31 December 2021. (15 marks) (b) Using the direct method, prepare a statement of cash flows for Copper Limited showing ONLY the Cash Flows from Operating Activities for the year ended 31 December 2021. (5 marks) (c) Compare and contrast the direct method and indirect method for reporting cash flows from operating activities. (4 marks)

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started