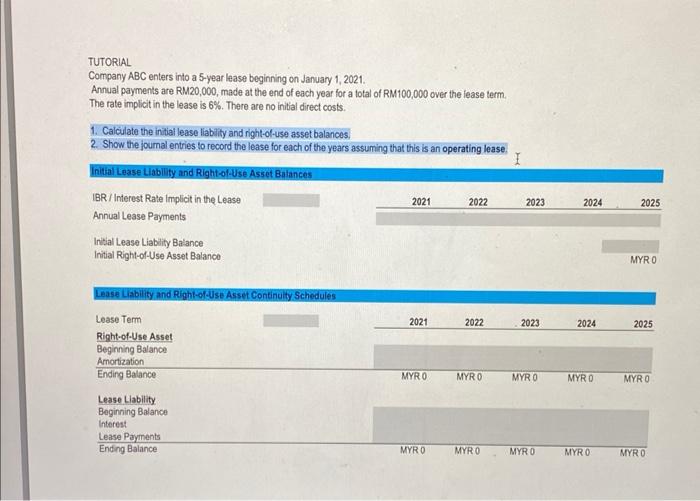

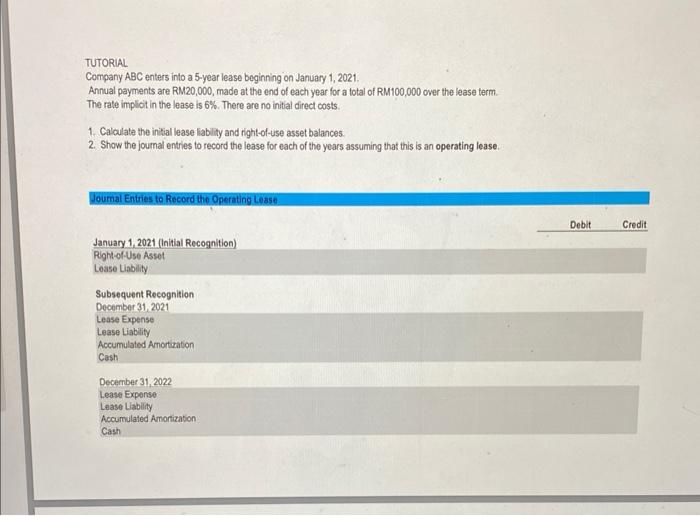

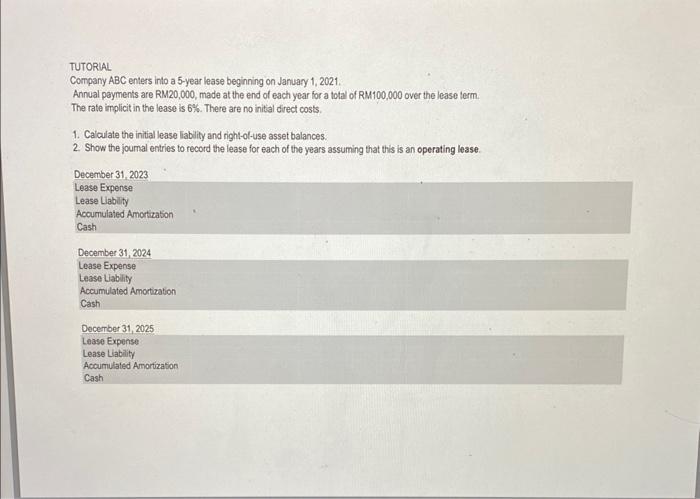

Company ABC enters into a 5-year lease beginning on January 1, 2021.

Annual payments are RM20,000, made at the end of each year for a total of RM100,000 over the lease term. The rate implicit in the lease is 6%. There are no initial direct costs.

1. Calculate the initial lease liability and right-of-use asset balances. 2. Show the journal entries to record the lease for each of the years assuming that this is an operating lease.

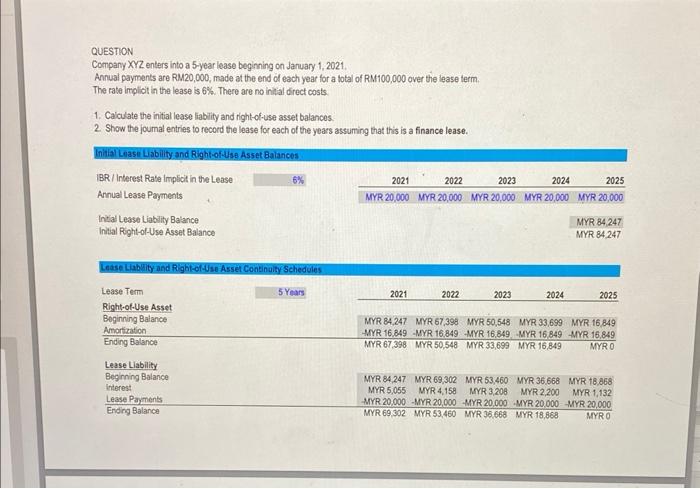

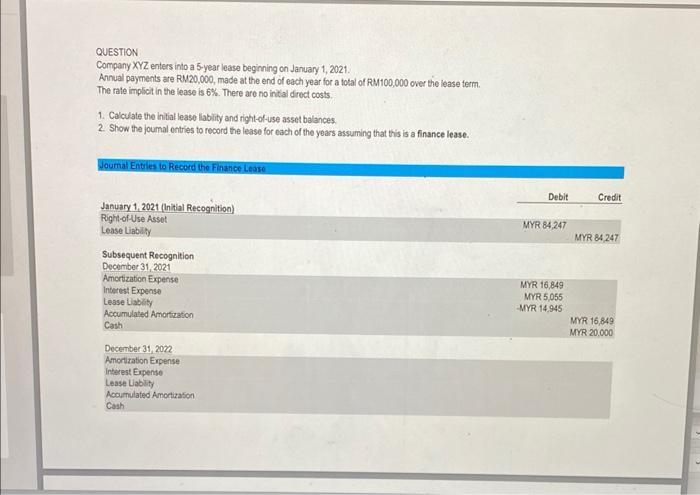

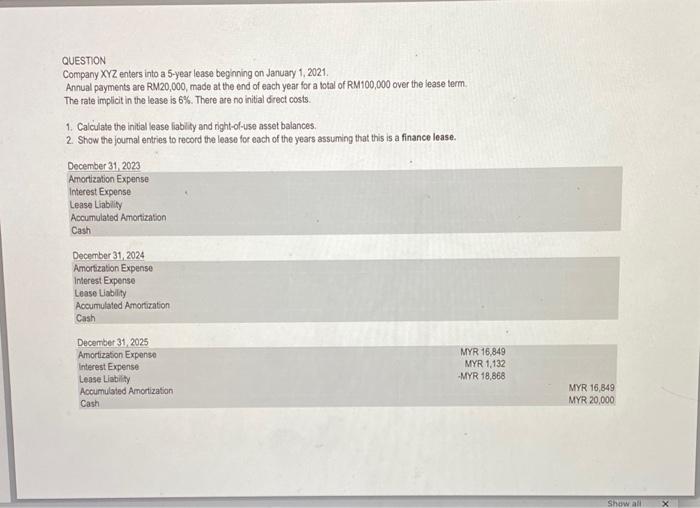

TUTORIAL Company ABC enters into a 5 -year lease beginning on January 1, 2021. Annual payments are RM20,000, made at the end of each year for a total of RM100,000 over the lease term. The rate implicit in the lease is 6%. There are no initial direct costs. 1. Calculate the initial lease liablity and right-of-use asset balances. 2. Show the joumal entries to record the lease for each of the years assuming that this is an operating lease. TUTORIAL Company ABC enters into a 5-year lease beginning on January 1, 2021. Annual payments are RM20,000, made at the end of each year for a total of RM100,000 over the lease term. The rate impliot in the lease is 6%. There are no initial direct costs. 1. Calculate the initial lease liablity and right-of-use asset balances. 2. Show the joumal entries to record the lease for each of the years assuming that this is an operating lease. TUTORIAL Company ABC enters into a 5 -year lease beginning on January 1, 2021. Annual payments are RM20,000, made at the end of each year for a total of RM100,000 over the lease lerm. The rate implicit in the lease is 6%. There are no initial direct costs. 1. Calculate the initial lease liablity and right-of-use asset balances. 2. Show the joumal entries to record the lease for each of the years assuming that this is an operating lease. QUESTION Company XYZ enters into a 5 -year lease beginning on January 1,2021. Annual payments are RM20,000, made at the end of each year for a total of RM100,000 over the lease term. The rate irpilicit in the lease is 6%. There are no initial direct costs. 1. Caiculate the initial lease liablity and right-of-use asset balances. 2. Show the joumal entries to record the lease for each of the years assuming that this is a finance lease. QUESTION Company XYZ enters into a 5 -year lease beginning on January 1, 2021. Annual payments are RU20,000, made at the end of each year for a tolal of RM100,000 over the lease ferm. The rate implicit in the lease is 6\%. There are no initial drect costs. 1. Calculate the initial lease liablity and right-of-use asset balances. 2. Show the joumal ontries to record the lease for each of the years assuming that this is a finance lease. QUESTION Company XYZ enters into a 5-year lease beginning on January 1, 2021. Annual payments are RM20,000, made at the end of each year for a hatal of RM100,000 over the lease term. The rate implicit in the lease is 6%. There are no initial direct costs. 1. Calculate the initial lease liability and right-of-use asset balances. 2. Show the joumal entries to record the lease foc each of the years assuming that this is a finance lease