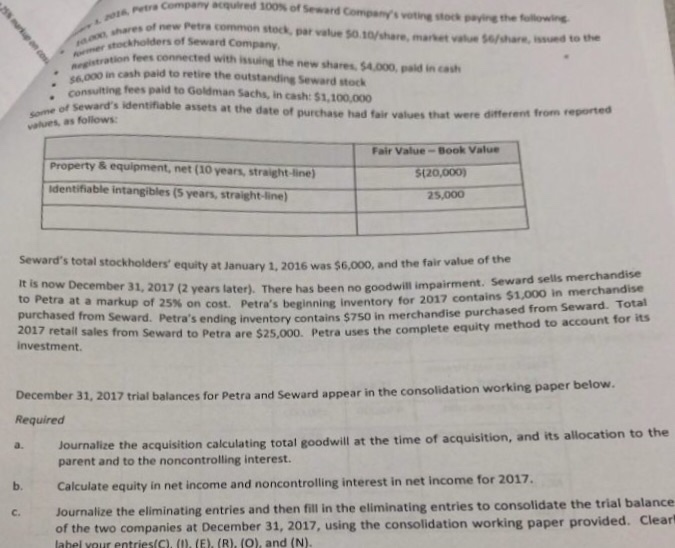

Company acquired 100% of Seward Company's voting stock pnng the fun of new Petra common stock, par value 50.10/share, market au 6fshare, wi e stockholders of Seward Company, -ation fees connected with issuing the new shares, SA,000, paid in cash issued to the in cash paid to retire the outstanding Seward stock fees paid to Goldman Sachs, in cash: $1,100,000 of seward's identifiable assets at the date of purchase had consulting fair values that were different from reported values, as follows Fair Value-Book Value Property & equipment, net (10 years, straight-line identifiable intangibles (S years, straight-line) 5(20,000) 25,000 Seward' s total stockholders' equity at January 1, 2016 was $6,000, and the fair value of the rd sells merchandise It is now December 31, 2017 (2 years later). There has been no goodwill impairment. Sewa to Petra at a markup of 25% on cost. Petra's beginning inventory for 2017 contains $1,000 in merchandise purchased from Seward. Petra's ending inventory contains $750 in merchandise purchased 2017 retail sales from Se investment. ward to Petra are $25,000. Petra uses the complete equity method to account for its December 31, 2017 trial balances for Petra and Seward appear Required a. our b. Calculate equity in net income and noncontrolling interest in net income for 2017. c. Journalize the eliminating entries and then fill in the eliminating entries to consolidate the trial balance in the consolidation working paper below. rnalize the acquisition calculating total goodwill at the time of acquisition, and its allocation to the parent and to the noncontrolling interest. of the two companies at December 31, 2017, using the consolidation working paper provided. Clear label vour entries(C). (m. (E). (R). (O) and (N). Company acquired 100% of Seward Company's voting stock pnng the fun of new Petra common stock, par value 50.10/share, market au 6fshare, wi e stockholders of Seward Company, -ation fees connected with issuing the new shares, SA,000, paid in cash issued to the in cash paid to retire the outstanding Seward stock fees paid to Goldman Sachs, in cash: $1,100,000 of seward's identifiable assets at the date of purchase had consulting fair values that were different from reported values, as follows Fair Value-Book Value Property & equipment, net (10 years, straight-line identifiable intangibles (S years, straight-line) 5(20,000) 25,000 Seward' s total stockholders' equity at January 1, 2016 was $6,000, and the fair value of the rd sells merchandise It is now December 31, 2017 (2 years later). There has been no goodwill impairment. Sewa to Petra at a markup of 25% on cost. Petra's beginning inventory for 2017 contains $1,000 in merchandise purchased from Seward. Petra's ending inventory contains $750 in merchandise purchased 2017 retail sales from Se investment. ward to Petra are $25,000. Petra uses the complete equity method to account for its December 31, 2017 trial balances for Petra and Seward appear Required a. our b. Calculate equity in net income and noncontrolling interest in net income for 2017. c. Journalize the eliminating entries and then fill in the eliminating entries to consolidate the trial balance in the consolidation working paper below. rnalize the acquisition calculating total goodwill at the time of acquisition, and its allocation to the parent and to the noncontrolling interest. of the two companies at December 31, 2017, using the consolidation working paper provided. Clear label vour entries(C). (m. (E). (R). (O) and (N)