Question

Company A's sales is $2000 and Net PPE (plant, property, and equipment) is $500 in the last fiscal year (year 0). The life of

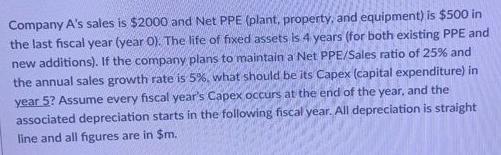

Company A's sales is $2000 and Net PPE (plant, property, and equipment) is $500 in the last fiscal year (year 0). The life of fixed assets is 4 years (for both existing PPE and new additions). If the company plans to maintain a Net PPE/Sales ratio of 25% and the annual sales growth rate is 5%, what should be its Capex (capital expenditure) in year 5? Assume every fiscal year's Capex occurs at the end of the year, and the associated depreciation starts in the following fiscal year. All depreciation is straight line and all figures are in $m.

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To determine the capital expenditure Capex required in year 5 we first need to calculate the desired ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Frank Hodge

9th edition

290-1259222138, 1259222136, 978-1259222139

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App