Answered step by step

Verified Expert Solution

Question

1 Approved Answer

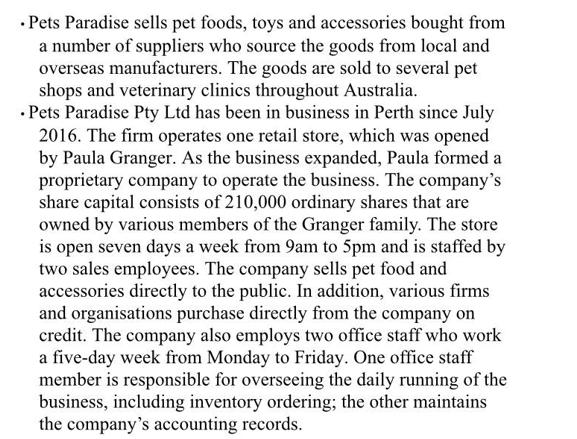

Pets Paradise sells pet foods, toys and accessories bought from a number of suppliers who source the goods from local and overseas manufacturers. The

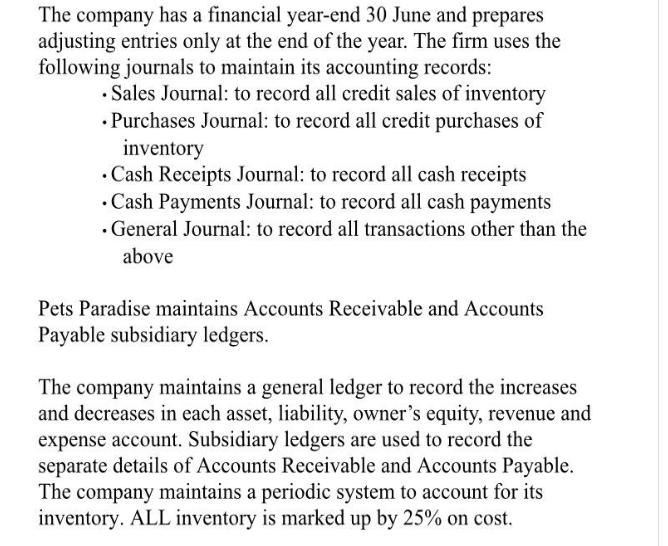

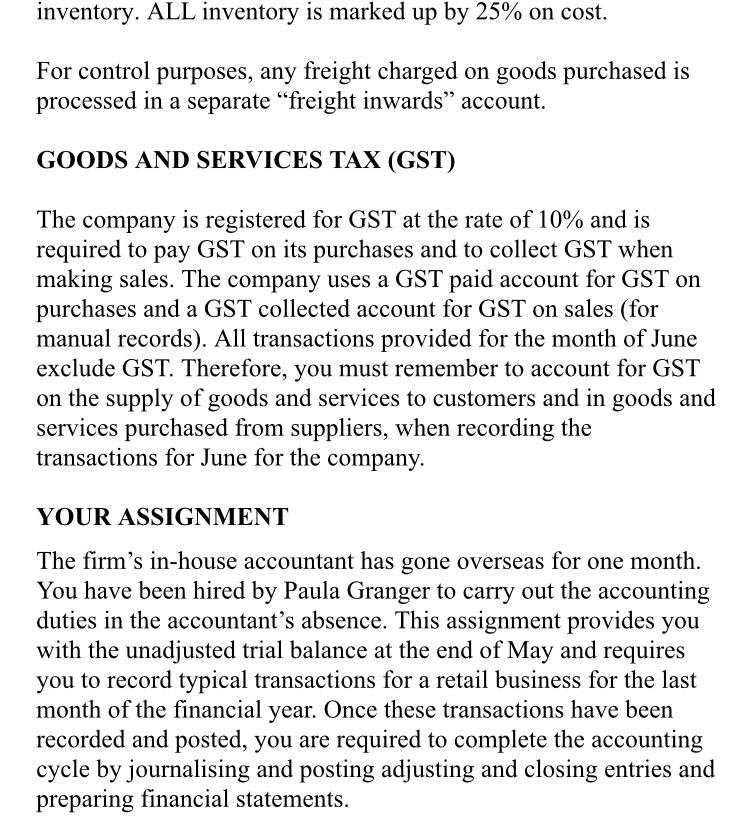

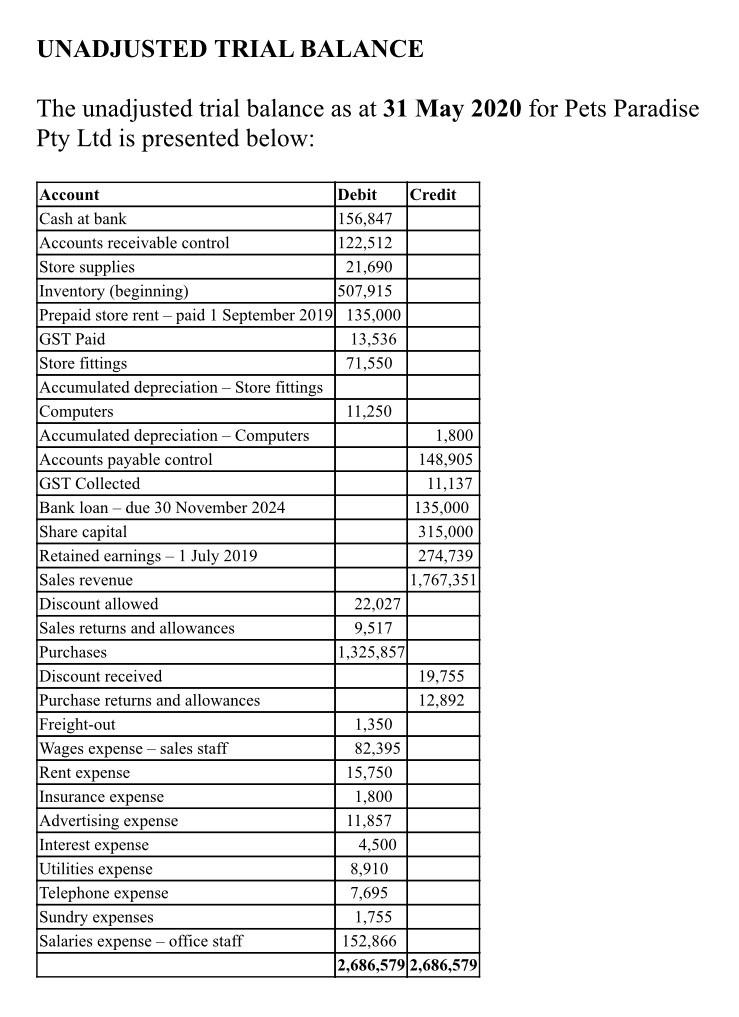

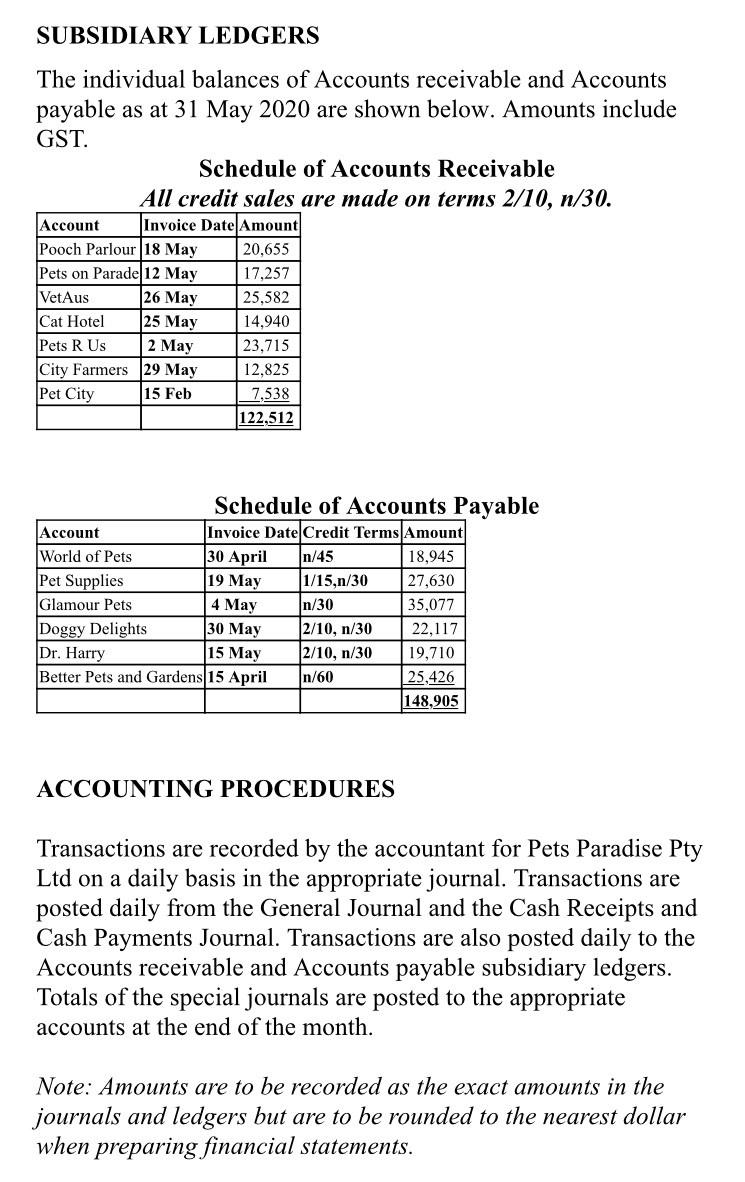

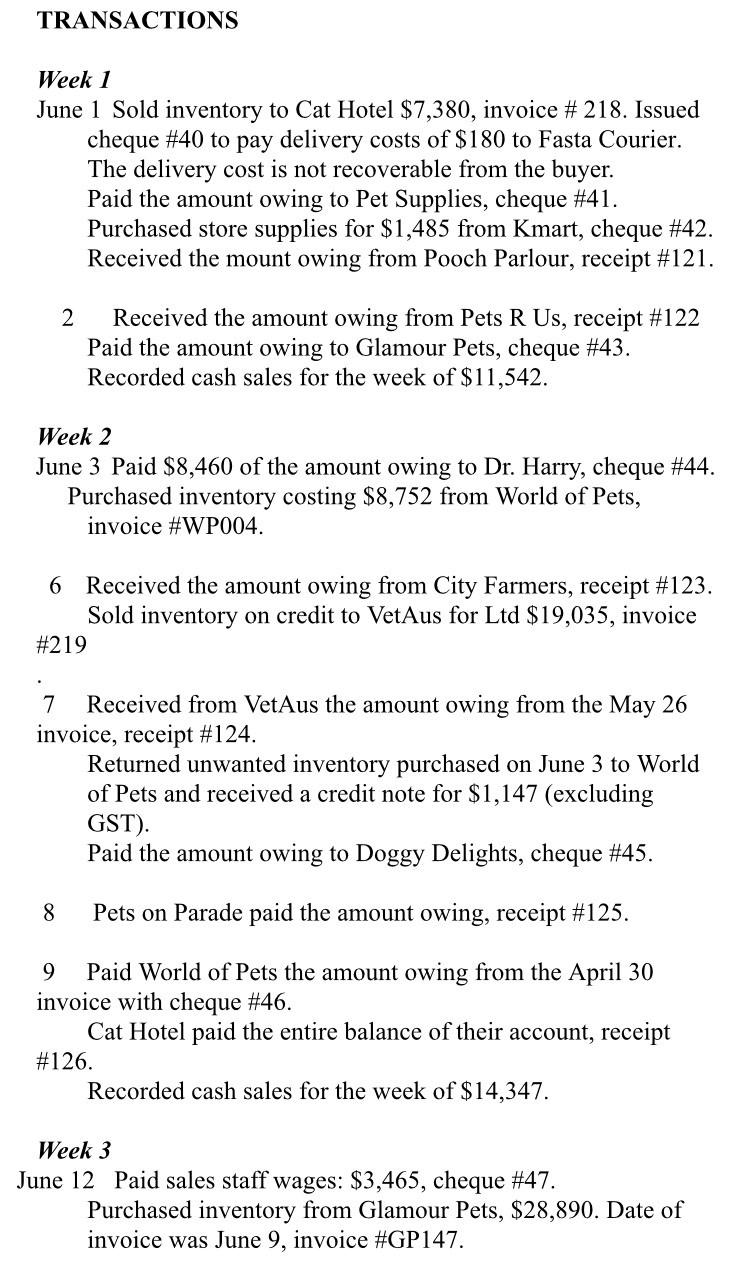

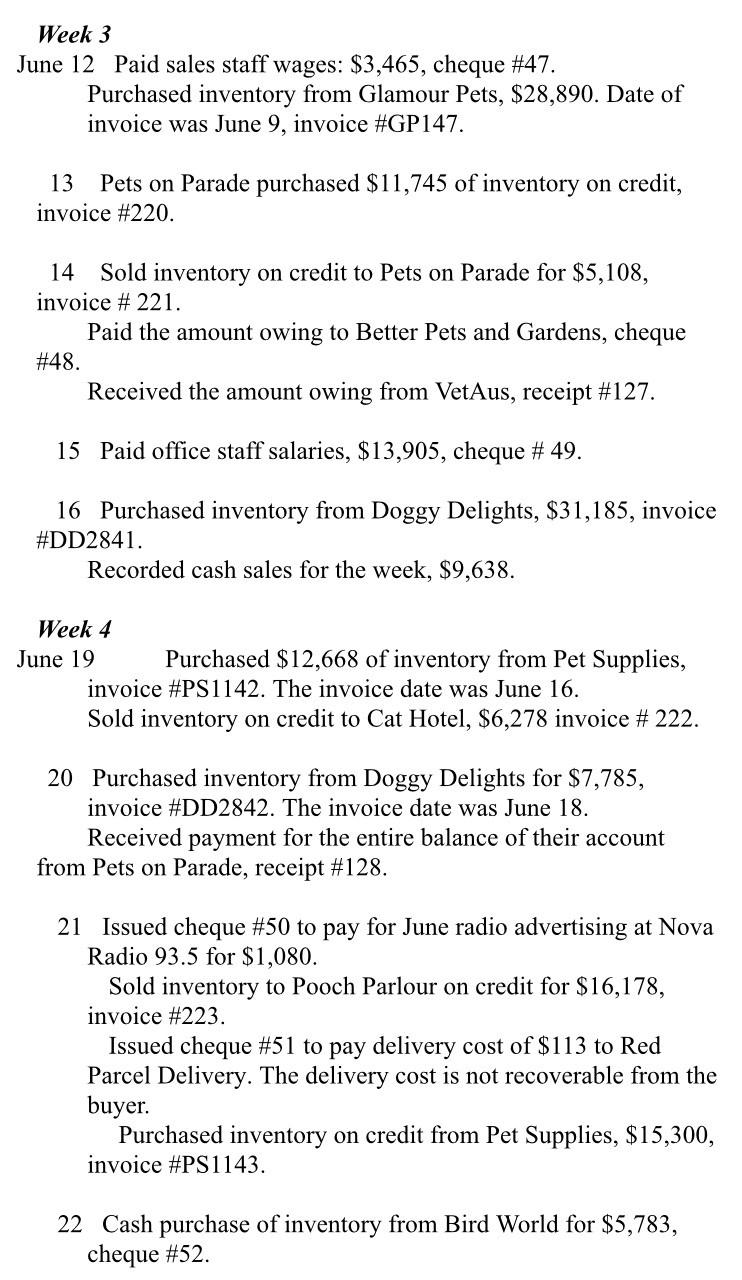

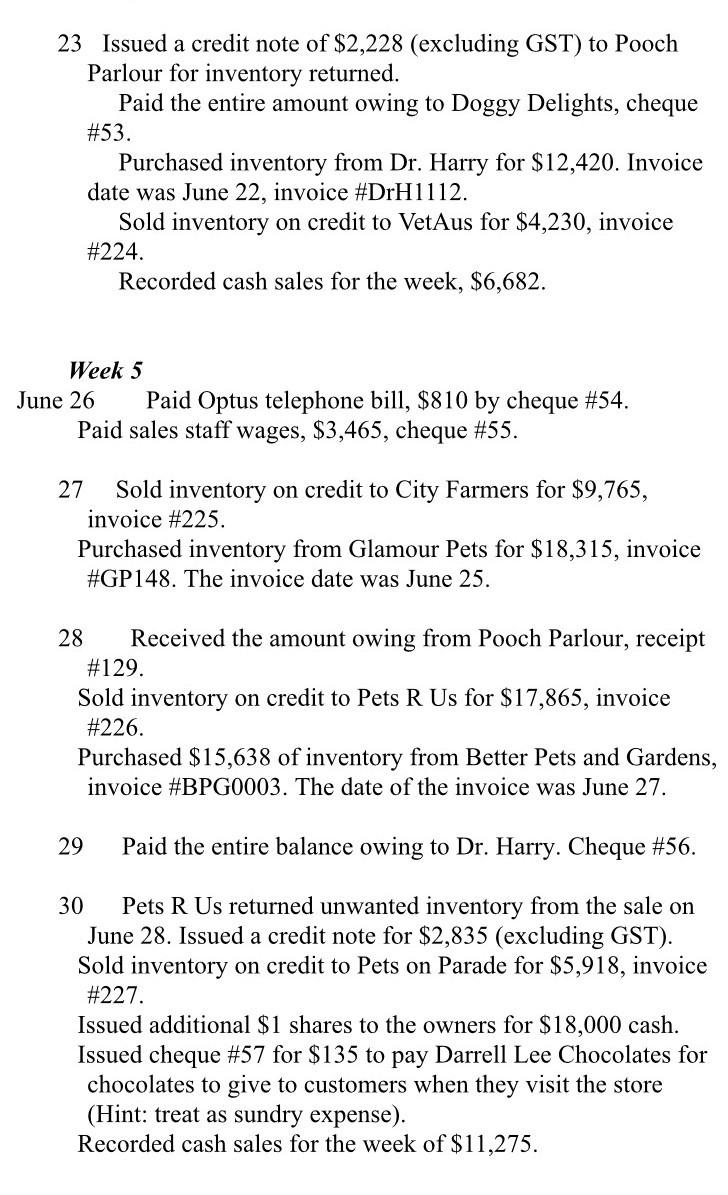

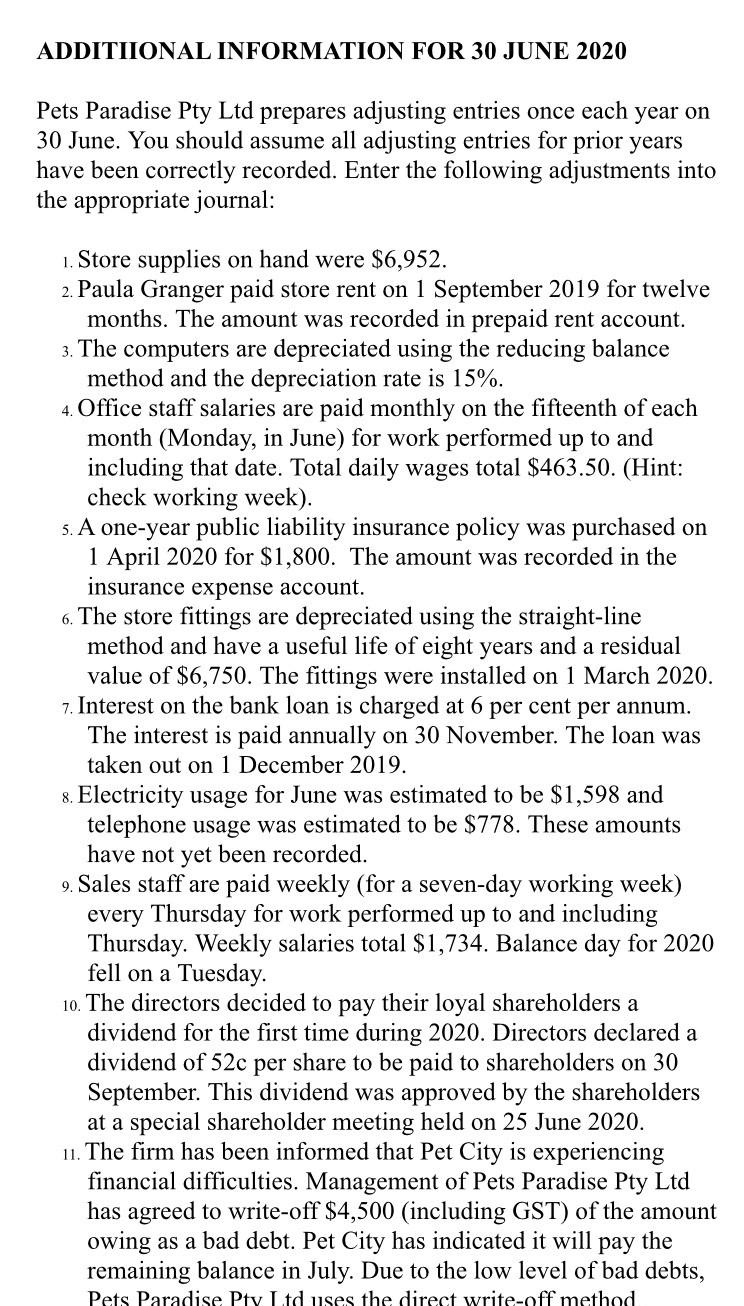

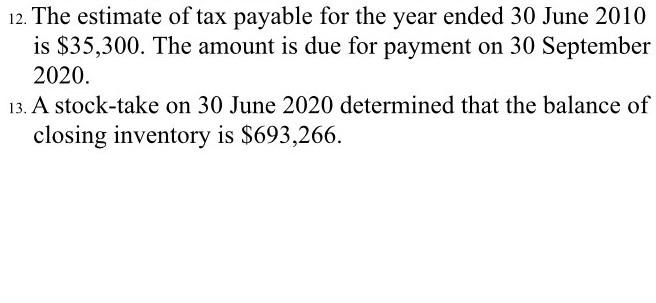

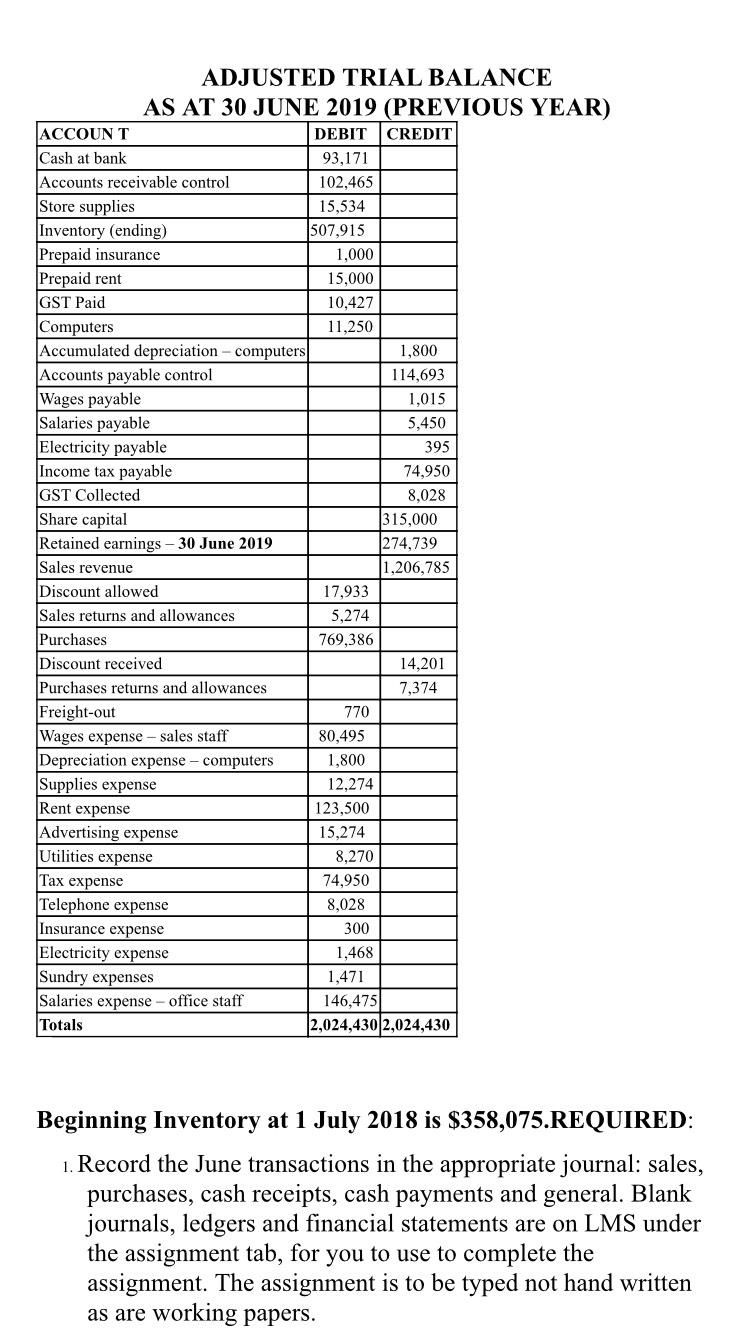

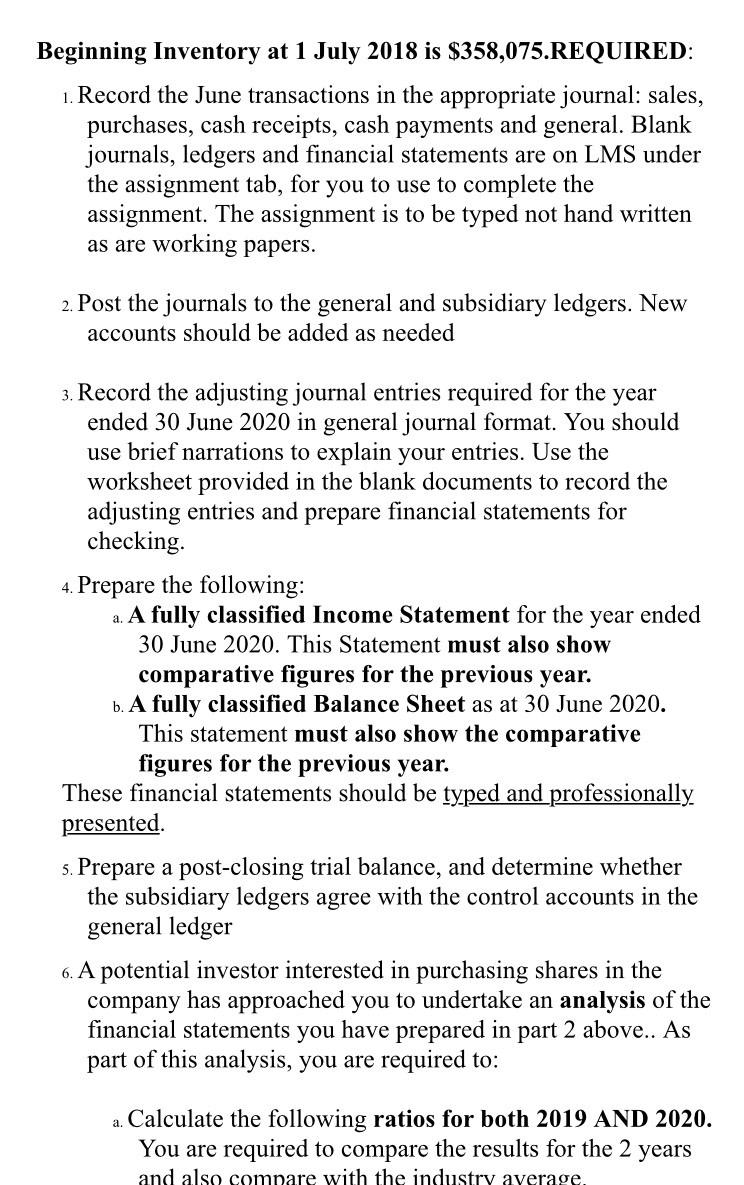

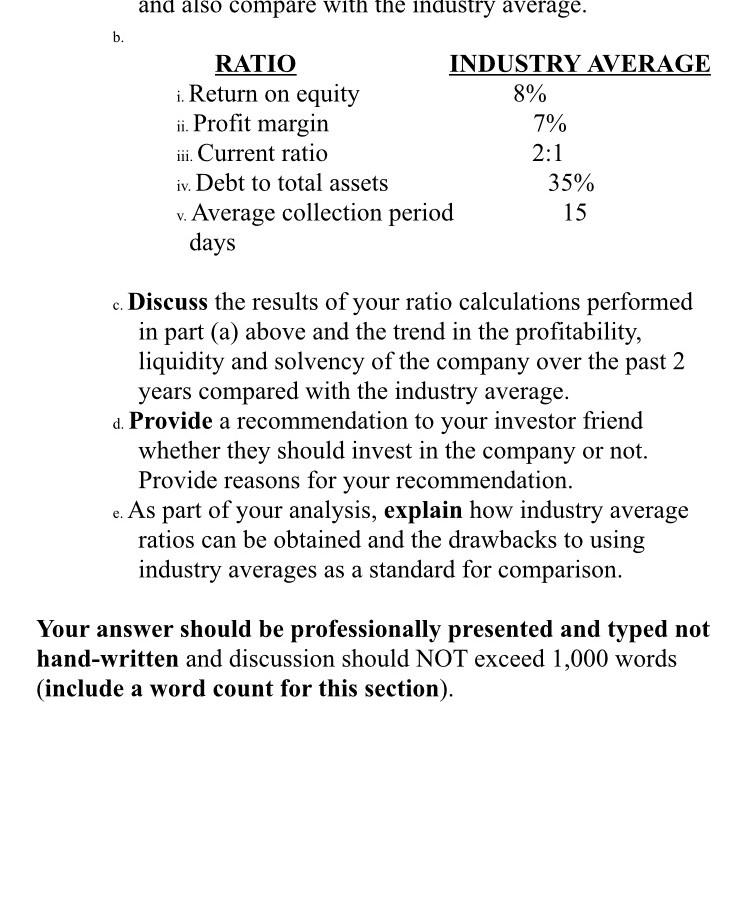

Pets Paradise sells pet foods, toys and accessories bought from a number of suppliers who source the goods from local and overseas manufacturers. The goods are sold to several pet shops and veterinary clinics throughout Australia. .Pets Paradise Pty Ltd has been in business in Perth since July 2016. The firm operates one retail store, which was opened by Paula Granger. As the business expanded, Paula formed a proprietary company to operate the business. The company's share capital consists of 210,000 ordinary shares that are owned by various members of the Granger family. The store is open seven days a week from 9am to 5pm and is staffed by two sales employees. The company sells pet food and accessories directly to the public. In addition, various firms and organisations purchase directly from the company on credit. The company also employs two office staff who work a five-day week from Monday to Friday. One office staff member is responsible for overseeing the daily running of the business, including inventory ordering; the other maintains the company's accounting records. The company has a financial year-end 30 June and prepares adjusting entries only at the end of the year. The firm uses the following journals to maintain its accounting records: Sales Journal: to record all credit sales of inventory Purchases Journal: to record all credit purchases of inventory Cash Receipts Journal: to record all cash receipts . Cash Payments Journal: to record all cash payments . General Journal: to record all transactions other than the above Pets Paradise maintains Accounts Receivable and Accounts Payable subsidiary ledgers. The company maintains a general ledger to record the increases and decreases in each asset, liability, owner's equity, revenue and expense account. Subsidiary ledgers are used to record the separate details of Accounts Receivable and Accounts Payable. The company maintains a periodic system to account for its inventory. ALL inventory is marked up by 25% on cost. inventory. ALL inventory is marked up by 25% on cost. For control purposes, any freight charged on goods purchased is processed in a separate "freight inwards" account. GOODS AND SERVICES TAX (GST) The company is registered for GST at the rate of 10% and is required to pay GST on its purchases and to collect GST when making sales. The company uses a GST paid account for GST on purchases and a GST collected account for GST on sales (for manual records). All transactions provided for the month of June exclude GST. Therefore, you must remember to account for GST on the supply of goods and services to customers and in goods and services purchased from suppliers, when recording the transactions for June for the company. YOUR ASSIGNMENT The firm's in-house accountant has gone overseas for one month. You have been hired by Paula Granger to carry out the accounting duties in the accountant's absence. This assignment provides you with the unadjusted trial balance at the end of May and requires you to record typical transactions for a retail business for the last month of the financial year. Once these transactions have been recorded and posted, you are required to complete the accounting cycle by journalising and posting adjusting and closing entries and preparing financial statements. UNADJUSTED TRIAL BALANCE The unadjusted trial balance as at 31 May 2020 for Pets Paradise Pty Ltd is presented below: Account Debit Credit Cash at bank 156,847 Accounts receivable control 122,512 Store supplies 21,690 Inventory (beginning) 507,915 Prepaid store rent - paid 1 September 2019 135,000 GST Paid 13,536 Store fittings 71,550 Accumulated depreciation - Store fittings Computers Accumulated depreciation - Computers Accounts payable control GST Collected Bank loan- due 30 November 2024 Share capital Retained earnings-1 July 2019 Sales revenue Discount allowed Sales returns and allowances. Purchases Discount received Purchase returns and allowances Freight-out Wages expense - sales staff Rent expense Insurance expense Advertising expense Interest expense Utilities expense Telephone expense Sundry expenses Salaries expense - office staff 11,250 22,027 9,517 1,325,857 1,350 82,395 15,750 1,800 11,857 4,500 8,910 7,695 1,800 148,905 11,137 135,000 315,000 274,739 1,767,351 19,755 12,892 1,755 152,866 2,686,579 2,686,579 SUBSIDIARY LEDGERS The individual balances of Accounts receivable and Accounts payable as at 31 May 2020 are shown below. Amounts include GST. Account Pooch Parlour 18 May Pets on Parade 12 May VetAus 26 May 25 May 2 May 29 May 15 Feb Cat Hotel Pets R Us City Farmers Pet City Schedule of Accounts Receivable All credit sales are made on terms 2/10, n/30. Invoice Date Amount 20,655 17,257 25,582 14,940 Account World of Pets Pet Supplies 23,715 12,825 7,538 122,512 Schedule of Accounts Payable Invoice Date Credit Terms Amount 18,945 27,630 35,077 22,117 19,710 25,426 148,905 30 April n/45 19 May Glamour Pets 4 May Doggy Delights 30 May Dr. Harry 15 May Better Pets and Gardens 15 April 1/15,n/30 n/30 2/10, n/30 2/10, n/30 n/60 ACCOUNTING PROCEDURES Transactions are recorded by the accountant for Pets Paradise Pty Ltd on a daily basis in the appropriate journal. Transactions are posted daily from the General Journal and the Cash Receipts and Cash Payments Journal. Transactions are also posted daily to the Accounts receivable and Accounts payable subsidiary ledgers. Totals of the special journals are posted to the appropriate accounts at the end of the month. Note: Amounts are to be recorded as the exact amounts in the journals and ledgers but are to be rounded to the nearest dollar when preparing financial statements. TRANSACTIONS Week 1 June 1 Sold inventory to Cat Hotel $7,380, invoice # 218. Issued cheque # 40 to pay delivery costs of $180 to Fasta Courier. The delivery cost is not recoverable from the buyer. Paid the amount owing to Pet Supplies, cheque #41. Purchased store supplies for $1,485 from Kmart, cheque #42. Received the mount owing from Pooch Parlour, receipt #121. 2 Received the amount owing from Pets R Us, receipt #122 Paid the amount owing to Glamour Pets, cheque #43. Recorded cash sales for the week of $11,542. Week 2 June 3 Paid $8,460 of the amount owing to Dr. Harry, cheque #44. Purchased inventory costing $8,752 from World of Pets, invoice #WP004. 6 Received the amount owing from City Farmers, receipt #123. Sold inventory on credit to VetAus for Ltd $19,035, invoice 8 #219 7 Received from VetAus the amount owing from the May 26 invoice, receipt #124. Returned unwanted inventory purchased on June 3 to World of Pets and received a credit note for $1,147 (excluding GST). Paid the amount owing to Doggy Delights, cheque #45. Pets on Parade paid the amount owing, receipt #125. 9 Paid World of Pets the amount owing from the April 30 invoice with cheque #46. Cat Hotel paid the entire balance of their account, receipt #126. Recorded cash sales for the week of $14,347. Week 3 June 12 Paid sales staff wages: $3,465, cheque #47. Purchased inventory from Glamour Pets, $28,890. Date of invoice was June 9, invoice #GP147. Week 3 June 12 Paid sales staff wages: $3,465, cheque #47. Purchased inventory from Glamour Pets, $28,890. Date of invoice was June 9, invoice #GP147. 13 Pets on Parade purchased $11,745 of inventory on credit, invoice #220. 14 Sold inventory on credit to Pets on Parade for $5,108, invoice # 221. Paid the amount owing to Better Pets and Gardens, cheque #48. Received the amount owing from VetAus, receipt #127. 15 Paid office staff salaries, $13,905, cheque # 49. 16 Purchased inventory from Doggy Delights, $31,185, invoice #DD2841. Recorded cash sales for the week, $9,638. Week 4 Purchased $12,668 of inventory from Pet Supplies, invoice #PS1142. The invoice date was June 16. Sold inventory on credit to Cat Hotel, $6,278 invoice # 222. June 19 20 Purchased inventory from Doggy Delights for $7,785, invoice #DD2842. The invoice date was June 18. Received payment for the entire balance of their account from Pets on Parade, receipt #128. 21 Issued cheque #50 to pay for June radio advertising at Nova Radio 93.5 for $1,080. Sold inventory to Pooch Parlour on credit for $16,178, invoice #223. Issued cheque # 51 to pay delivery cost of $113 to Red Parcel Delivery. The delivery cost is not recoverable from the buyer. Purchased inventory on credit from Pet Supplies, $15,300, invoice #PS1143. 22 Cash purchase of inventory from Bird World for $5,783, cheque #52. 23 Issued a credit note of $2,228 (excluding GST) to Pooch Parlour for inventory returned. Paid the entire amount owing to Doggy Delights, cheque #53. Week 5 Purchased inventory from Dr. Harry for $12,420. Invoice date was June 22, invoice #DrH1112. Sold inventory on credit to VetAus for $4,230, invoice #224. Recorded cash sales for the week, $6,682. Paid Optus telephone bill, $810 by cheque #54. Paid sales staff wages, $3,465, cheque #55. June 26 27 Sold inventory on credit to City Farmers for $9,765, invoice #225. Purchased inventory from Glamour Pets for $18,315, invoice #GP148. The invoice date was June 25. 28 Received the amount owing from Pooch Parlour, receipt #129. Sold inventory on credit to Pets R Us for $17,865, invoice #226. Purchased $15,638 of inventory from Better Pets and Gardens, invoice #BPG0003. The date of the invoice was June 27. Paid the entire balance owing to Dr. Harry. Cheque #56. 30 Pets R Us returned unwanted inventory from the sale on June 28. Issued a credit note for $2,835 (excluding GST). Sold inventory on credit to Pets on Parade for $5,918, invoice #227. 29 Issued additional $1 shares to the owners for $18,000 cash. Issued cheque # 57 for $135 to pay Darrell Lee Chocolates for chocolates to give to customers when they visit the store (Hint: treat as sundry expense). Recorded cash sales for the week of $11,275. ADDITIONAL INFORMATION FOR 30 JUNE 2020 Pets Paradise Pty Ltd prepares adjusting entries once each year on 30 June. You should assume all adjusting entries for prior years have been correctly recorded. Enter the following adjustments into the appropriate journal: 1. Store supplies on hand were $6,952. 2. Paula Granger paid store rent on 1 September 2019 for twelve months. The amount was recorded in prepaid rent account. 3. The computers are depreciated using the reducing balance method and the depreciation rate is 15%. 4. Office staff salaries are paid monthly on the fifteenth of each month (Monday, in June) for work performed up to and including that date. Total daily wages total $463.50. (Hint: check working week). 5. A one-year public liability insurance policy was purchased on 1 April 2020 for $1,800. The amount was recorded in the insurance expense account. 6. The store fittings are depreciated using the straight-line method and have a useful life of eight years and a residual value of $6,750. The fittings were installed on 1 March 2020. 7. Interest on the bank loan is charged at 6 per cent per annum. The interest is paid annually on 30 November. The loan was taken out on 1 December 2019. 8. Electricity usage for June was estimated to be $1,598 and telephone usage was estimated to be $778. These amounts have not yet been recorded. 9. Sales staff are paid weekly (for a seven-day working week) every Thursday for work performed up to and including Thursday. Weekly salaries total $1,734. Balance day for 2020 fell on a Tuesday. 10. The directors decided to pay their loyal shareholders a dividend for the first time during 2020. Directors declared a dividend of 52c per share to be paid to shareholders on 30 September. This dividend was approved by the shareholders at a special shareholder meeting held on 25 June 2020. 11. The firm has been informed that Pet City is experiencing financial difficulties. Management of Pets Paradise Pty Ltd has agreed to write-off $4,500 (including GST) of the amount owing as a bad debt. Pet City has indicated it will pay the remaining balance in July. Due to the low level of bad debts, Pets Paradise Pty Ltd uses the direct write-off method 12. The estimate of tax payable for the year ended 30 June 2010 is $35,300. The amount is due for payment on 30 September 2020. 13. A stock-take on 30 June 2020 determined that the balance of closing inventory is $693,266. ADJUSTED TRIAL BALANCE AS AT 30 JUNE 2019 (PREVIOUS YEAR) DEBIT CREDIT ACCOUNT Cash at bank Accounts receivable control Store supplies Inventory (ending) Prepaid insurance Prepaid rent GST Paid Computers Accumulated depreciation - computers Accounts payable control Wages payable Salaries payable Electricity payable Income tax payable GST Collected Share capital Retained earnings - 30 June 2019 Sales revenue Discount allowed Sales returns and allowances Purchases Discount received Purchases returns and allowances Freight-out Wages expense - sales staff Depreciation expense- computers Supplies expense Rent expense Advertising expense Utilities expense Tax expense Telephone expense Insurance expense Electricity expense Sundry expenses Salaries expense - office staff Totals 93,171 102,465 15,534 507,915 1,000 15,000 10,427 11,250 17,933 5,274 769,386 770 80,495 1,800 12,274 123,500 15,274 8,270 74,950 8,028 300 1,468 1,800 114,693 1,015 5,450 395 74,950 8,028 315,000 274,739 1,206,785 14,201 7,374 1,471 146,475 2,024,430 2,024,430 Beginning Inventory at 1 July 2018 is $358,075.REQUIRED: 1. Record the June transactions in the appropriate journal: sales, purchases, cash receipts, cash payments and general. Blank journals, ledgers and financial statements are on LMS under the assignment tab, for you to use to complete the assignment. The assignment is to be typed not hand written as are working papers. Beginning Inventory at 1 July 2018 is $358,075.REQUIRED: 1. Record the June transactions in the appropriate journal: sales, purchases, cash receipts, cash payments and general. Blank journals, ledgers and financial statements are on LMS under the assignment tab, for you to use to complete the assignment. The assignment is to be typed not hand written as are working papers. 2. Post the journals to the general and subsidiary ledgers. New accounts should be added as needed 3. Record the adjusting journal entries required for the year ended 30 June 2020 in general journal format. You should use brief narrations to explain your entries. Use the worksheet provided in the blank documents to record the adjusting entries and prepare financial statements for checking. 4. Prepare the following: a. A fully classified Income Statement for the year ended 30 June 2020. This Statement must also show comparative figures for the previous year. b. A fully classified Balance Sheet as at 30 June 2020. This statement must also show the comparative figures for the previous year. These financial statements should be typed and professionally presented. 5. Prepare a post-closing trial balance, and determine whether the subsidiary ledgers agree with the control accounts in the general ledger 6. A potential investor interested in purchasing shares in the company has approached you to undertake an analysis of the financial statements you have prepared in part 2 above.. As part of this analysis, you are required to: a. Calculate the following ratios for both 2019 AND 2020. You are required to compare the results for the 2 years and also compare with the industry average. b. and also compare with the industry average. RATIO i. Return on equity ii. Profit margin iii. Current ratio iv. Debt to total assets V. INDUSTRY AVERAGE 8% Average collection period days 7% 2:1 35% 15 Discuss the results of your ratio calculations performed in part (a) above and the trend in the profitability, liquidity and solvency of the company over the past 2 years compared with the industry average. d. Provide a recommendation to your investor friend whether they should invest in the company or not. Provide reasons for your recommendation. As part of your analysis, explain how industry average ratios can be obtained and the drawbacks to using industry averages as a standard for comparison. Your answer should be professionally presented and typed not hand-written and discussion should NOT exceed 1,000 words (include a word count for this section).

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

StepbyStep Explanation Ratio Calculation Analysis Ratio analysis is an important discipline as well as a complex one in the accounting field of study ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started