Answered step by step

Verified Expert Solution

Question

1 Approved Answer

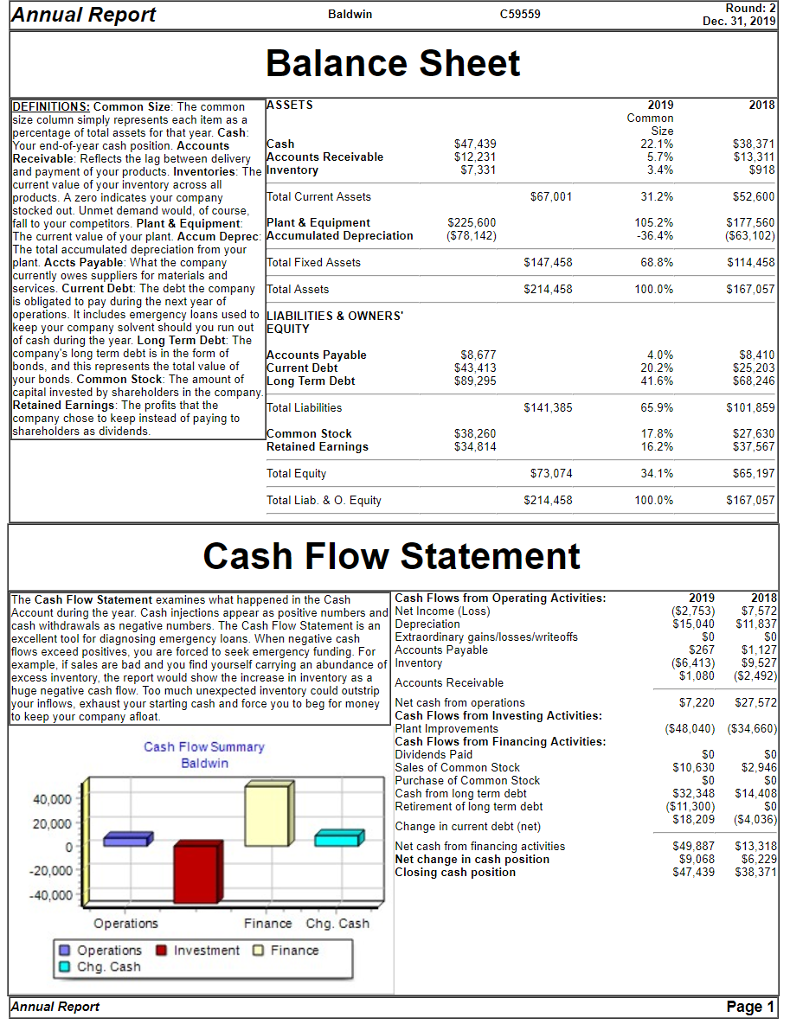

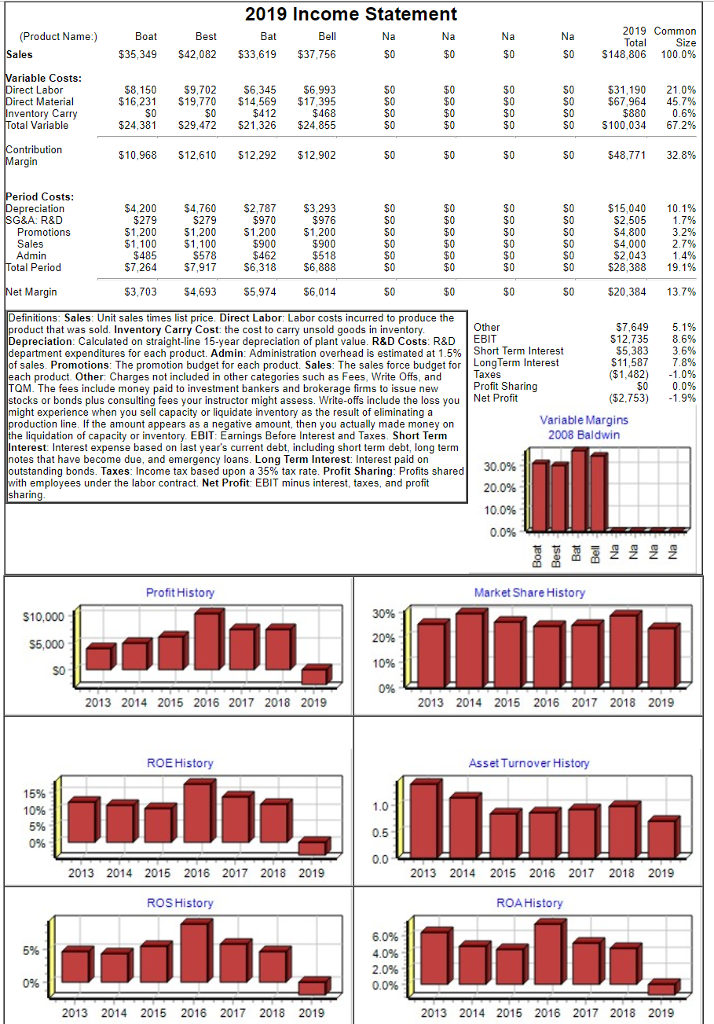

Company Baldwin invested $48,040,000 in plant and equipment last year. The plant investment was funded with bonds at a face value of $32,348,499 at 13.8%

| Company Baldwin invested $48,040,000 in plant and equipment last year. The plant investment was funded with bonds at a face value of $32,348,499 at 13.8% interest, and equity of $15,691,501. Depreciation is 15 years straight line. For this transaction alone which of the following statements are true? | ||||||||||||||||

| Select: 5 | ||||||||||||||||

|

Annual Report 59559 Dec. 31, 2019 Balance Sheet DEFINITIONS: Common Size: The common ASSETS size column simply represents each item as a percentage of total assets for that year. Cash Your end-of-year cash position. Accounts Receivable: Reflects the lag between delivery Accounts Receivable and payment of your products. Inventories: The Inventory current value of your inventory across all products. A zero indicates your company stocked out. Unmet demand would, of course S38,371 Total Current Assets $67,001 5225,600 The current value of your plant. Accum Deprec: Accumulated Depreciation The total accumulated depreciation from your plant. Accts Payable: What the company currently owes suppliers for materials and services. Curent Debt: The debt the company Total Assets s obligated to pay during the next year of operations. It includes emergency loans used to LIABILITIES & OWNERS keep your company solvent should you run out EQUITY Total Fixed Assets $167,057 f cash during the year. Long Term Debt: The company's long term debt is in the form of Accounts Payable and this represents the total value of urrent Debt Long Term Debt our bonds. Common Stock: The amount of $89,295 apital invested by shareholders in the company Retained Earnings: The profits that the company chose to keep instead of paying to shareholders as dividends S68,246 $101,859 $27,630 Total Liabilities ommon Stock Retained Earnings $73,074 Total Liab. &O. Equity $167,057 Cash Flow Statement Cash Flows from Operating Activities: 2018 ($2,753) $7,572 $15,040 $11,837 S0 S267$1,127 ($6,413) $9,527 $1,080 (S2,492) The Cash Flow Statement examines what happened in the Cash ccount during the year. Cash injections appear as positive numbers and Net Income (Loss) cash withdrawals as negative numbers. The Cash Flow Statement is anDepreciation S0 lows exceed positives, you are forced to seek emergency funding. For Accounts Payable example, if sales are bad and you find yourself carrying an abundance of Inventory excess inventory, the report would show the increase in inventory as a huge negative cash flow. Too much unexpected inventory could outstrip your inflows, exhaust your starting cash and force you to beg for money Net cash from operations o keep your company afloat Accounts Receivable $7,220 $27.572 Cash Flows from Investing Activities: Plant Improvements Cash Flows from Financing Activities: Dividends Paid Sales of Common Stock Purchase of Common Stock Cash from long term debt Retirement of long term debt (548,040) ($34,660) Cash Flow Summary S0 $10,630$2,946 50 50 532,348 $14,408 50 18,209 (54,036) Change in current debt (net) Net cash from financing activities Net change in cash position $49,887 $13,318 $9,068 $6,229 $47,439 $38,371 Finance Chg. Cash Operations Investment Finance nnual Report

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started