Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company Blah Blah Blah is looking to make an investment. The company has narrowed it down to two mutually exclusive options. Option 1: Purchase

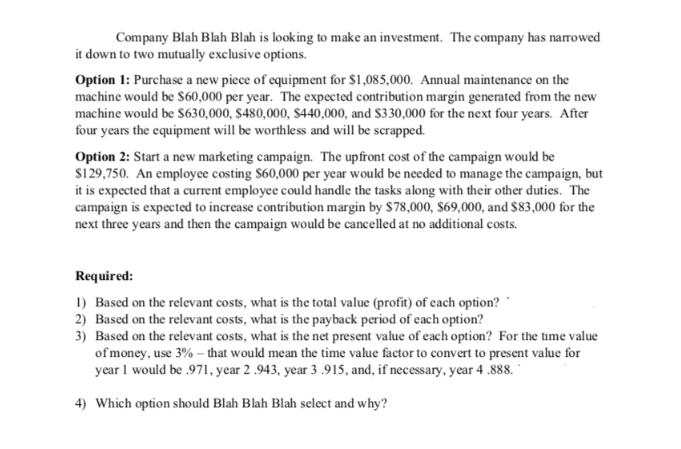

Company Blah Blah Blah is looking to make an investment. The company has narrowed it down to two mutually exclusive options. Option 1: Purchase a new piece of equipment for $1,085,000. Annual maintenance on the machine would be $60,000 per year. The expected contribution margin generated from the new machine would be $630,000, $480,000, $440,000, and $330,000 for the next four years. After four years the equipment will be worthless and will be scrapped. Option 2: Start a new marketing campaign. The upfront cost of the campaign would be $129,750. An employee costing $60,000 per year would be needed to manage the campaign, but it is expected that a current employee could handle the tasks along with their other duties. The campaign is expected to increase contribution margin by $78,000, $69,000, and $83,000 for the next three years and then the campaign would be cancelled at no additional costs. Required: 1) Based on the relevant costs, what is the total value (profit) of each option? 2) Based on the relevant costs, what is the payback period of each option? 3) Based on the relevant costs, what is the net present value of each option? For the time value of money, use 3% - that would mean the time value factor to convert to present value for year I would be 971, year 2 .943, year 3.915, and, if necessary, year 4.888. 4) Which option should Blah Blah Blah select and why?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Option 1 total value profit Year 1 630000 60000 maintenance 570000 Year 2 480000 60000 420000 Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started