Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company: Coca Cola Required: Use of financial Ratios and Horizontal/vertical analysis to examine critically the performance of the organization for the F.Y.- 2018-19 & 2019-20.

Company: Coca Cola

Required:

Use of financial Ratios and Horizontal/vertical analysis to examine critically the performance of the organization for the F.Y.- 2018-19 & 2019-20.

.

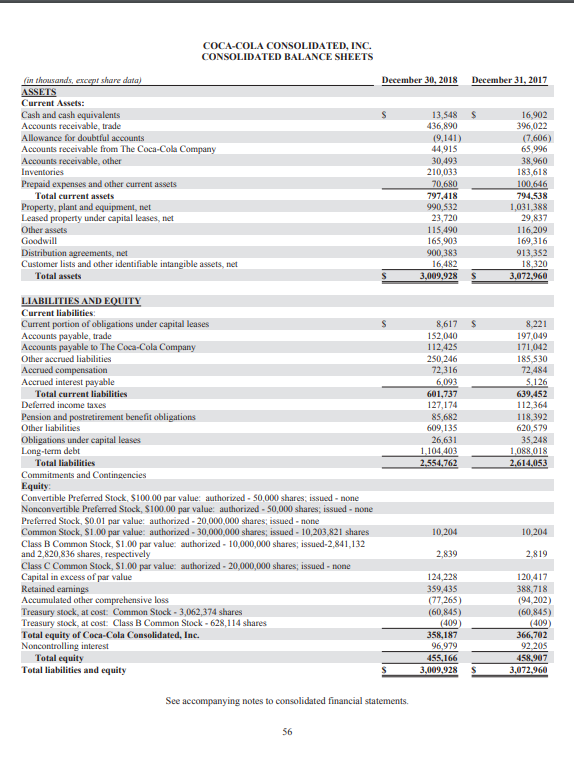

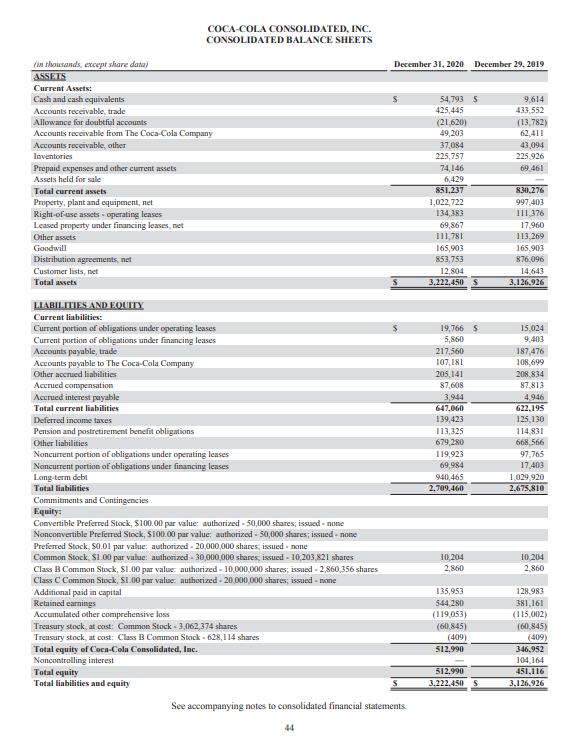

Three years balance sheets 2018, 2019, 2020

.

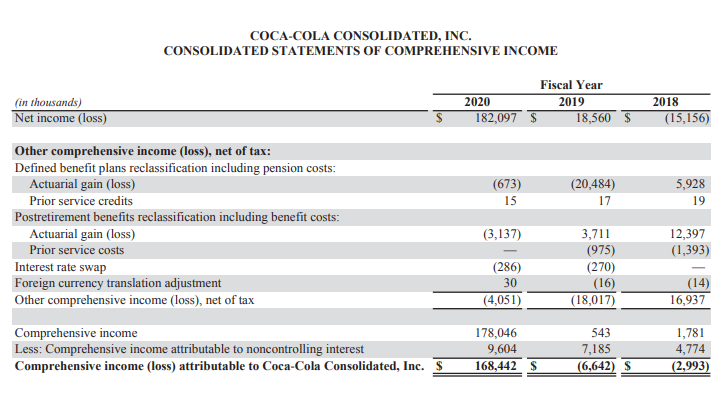

Three years Income statements 2018, 2019, 2020

.

Required:

Use of financial Ratios and Horizontal/vertical analysis to examine critically the performance of the organization for the F.Y.- 2018-19 & 2019-20.

Please do horizontal and vertical analysis of the above company coca cola for 2018 2019 and 2020

COCA-COLA CONSOLIDATED, INC. CONSOLIDATED BALANCE SHEETS LIABILITIES AND EQUITY Current liabilities: Commitments and Contingencies Equity: Convertible Preferred Stock, $100.00 par value: authorized - 50,000 shares; issued - none Nonconvertible Preferred Stock, $100.00 par value: authorized - 50,000 shares; issued - none Preferred Stock, \$0.01 par value: authorized - 20,000,000 shares; issued - none Common Stock, \$1.00 par value: authorized - 30,000,000 shares; issued 10,203,821 shares 10,20410,204 Class B Common Stock, \$1.00 par value: authorized - 10,000,000 shares; issued-2,841,132 See accompanying notes to consolidated financial statements. 56 COCA-COLA CONSOLIDATED, INC. CONSOLIDATED BALANCE SHEETS (in thoursands, except share data) December 31, 2020 December 29, 2019 LIABILITISS AND EQUITY Current liahilities: Current portion of obligations under operating leases Current portion of obligations under financing leases Accounts payable, trade Accounts payable to The Coca-Cola Company Other accrued liabilities Accrued compensation Accrued interest payable Total current liabilities Deferred income taxes Pension and postretirement benefit obligations Other liabilities Noncurrent portion of obligations under operating leases Noncurrent portion of obligations under financing leases Long-term debt Total liabilities Commitments and Contingencies Equity: Convertible Preferred Stock, $100.00 par value: authorized - 50,000 shares; issued = none Nonconvertible Preferred Stock, $100. 00 par value; authorized - 50,000 shares; issued - none Preferred Stock, 90.01 par value: authorized - 20,000,000 shares, issued = none See accompanying notes to consolidated financial statements. 44 COCA-COLA CONSOLIDATED, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME COCA-COLA CONSOLIDATED, INC. CONSOLIDATED BALANCE SHEETS LIABILITIES AND EQUITY Current liabilities: Commitments and Contingencies Equity: Convertible Preferred Stock, $100.00 par value: authorized - 50,000 shares; issued - none Nonconvertible Preferred Stock, $100.00 par value: authorized - 50,000 shares; issued - none Preferred Stock, \$0.01 par value: authorized - 20,000,000 shares; issued - none Common Stock, \$1.00 par value: authorized - 30,000,000 shares; issued 10,203,821 shares 10,20410,204 Class B Common Stock, \$1.00 par value: authorized - 10,000,000 shares; issued-2,841,132 See accompanying notes to consolidated financial statements. 56 COCA-COLA CONSOLIDATED, INC. CONSOLIDATED BALANCE SHEETS (in thoursands, except share data) December 31, 2020 December 29, 2019 LIABILITISS AND EQUITY Current liahilities: Current portion of obligations under operating leases Current portion of obligations under financing leases Accounts payable, trade Accounts payable to The Coca-Cola Company Other accrued liabilities Accrued compensation Accrued interest payable Total current liabilities Deferred income taxes Pension and postretirement benefit obligations Other liabilities Noncurrent portion of obligations under operating leases Noncurrent portion of obligations under financing leases Long-term debt Total liabilities Commitments and Contingencies Equity: Convertible Preferred Stock, $100.00 par value: authorized - 50,000 shares; issued = none Nonconvertible Preferred Stock, $100. 00 par value; authorized - 50,000 shares; issued - none Preferred Stock, 90.01 par value: authorized - 20,000,000 shares, issued = none See accompanying notes to consolidated financial statements. 44 COCA-COLA CONSOLIDATED, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOMEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started