Answered step by step

Verified Expert Solution

Question

1 Approved Answer

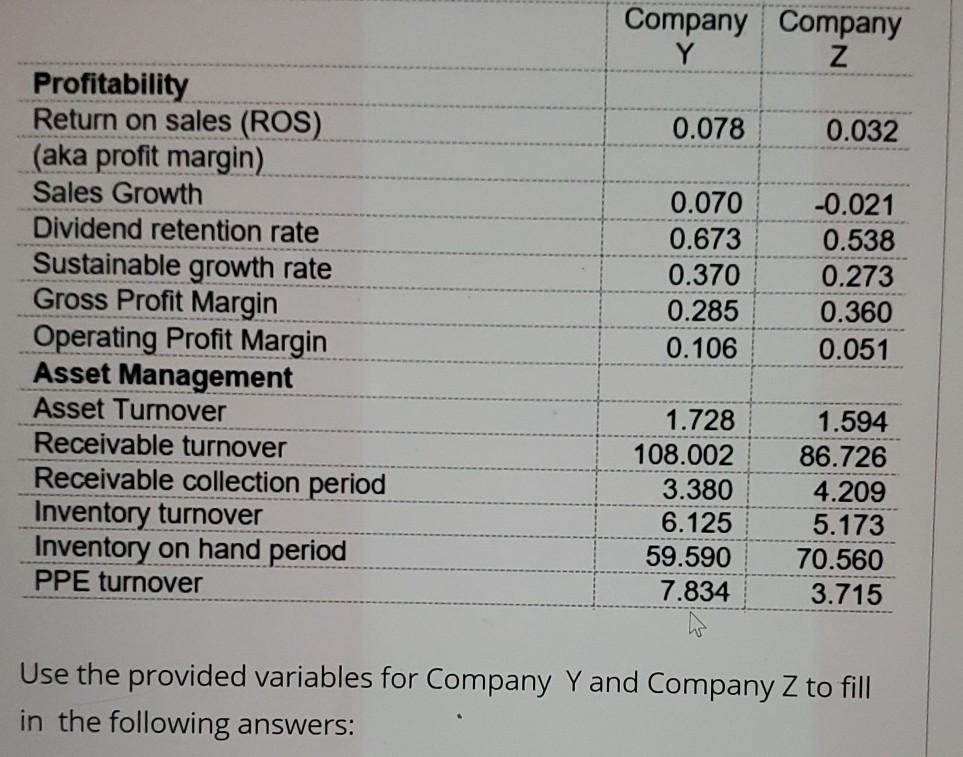

Company Company Y Z 0.078 0.032 Profitability Return on sales (ROS) (aka profit margin). Sales Growth Dividend retention rate Sustainable growth rate Gross Profit Margin

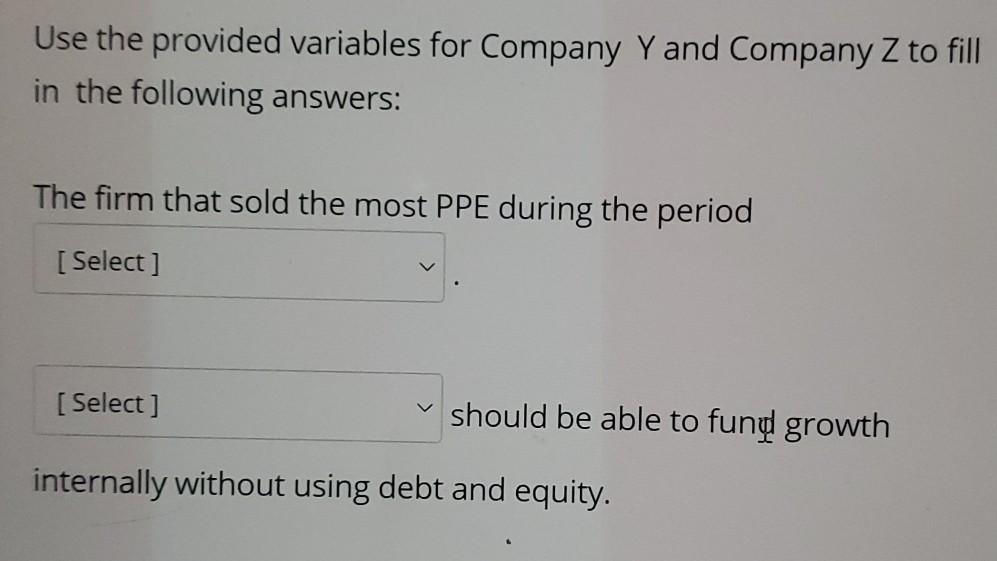

Company Company Y Z 0.078 0.032 Profitability Return on sales (ROS) (aka profit margin). Sales Growth Dividend retention rate Sustainable growth rate Gross Profit Margin Operating Profit Margin Asset Management Asset Turnover Receivable turnover Receivable collection period Inventory turnover Inventory on hand period PPE turnover 0.070 0.673 0.370 0.285 0.106 -0.021 0.538 0.273 0.360 0.051 1.728 108.002 3.380 6.125 59.590 7.834 1.594 86.726 4.209 5.173 70.560 3.715 Use the provided variables for Company Y and Company Z to fill in the following answers: Use the provided variables for Company Y and Company Z to fill in the following answers: The firm that sold the most PPE during the period [ Select ] [ Select ] should be able to fund growth internally without using debt and equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started