Answered step by step

Verified Expert Solution

Question

1 Approved Answer

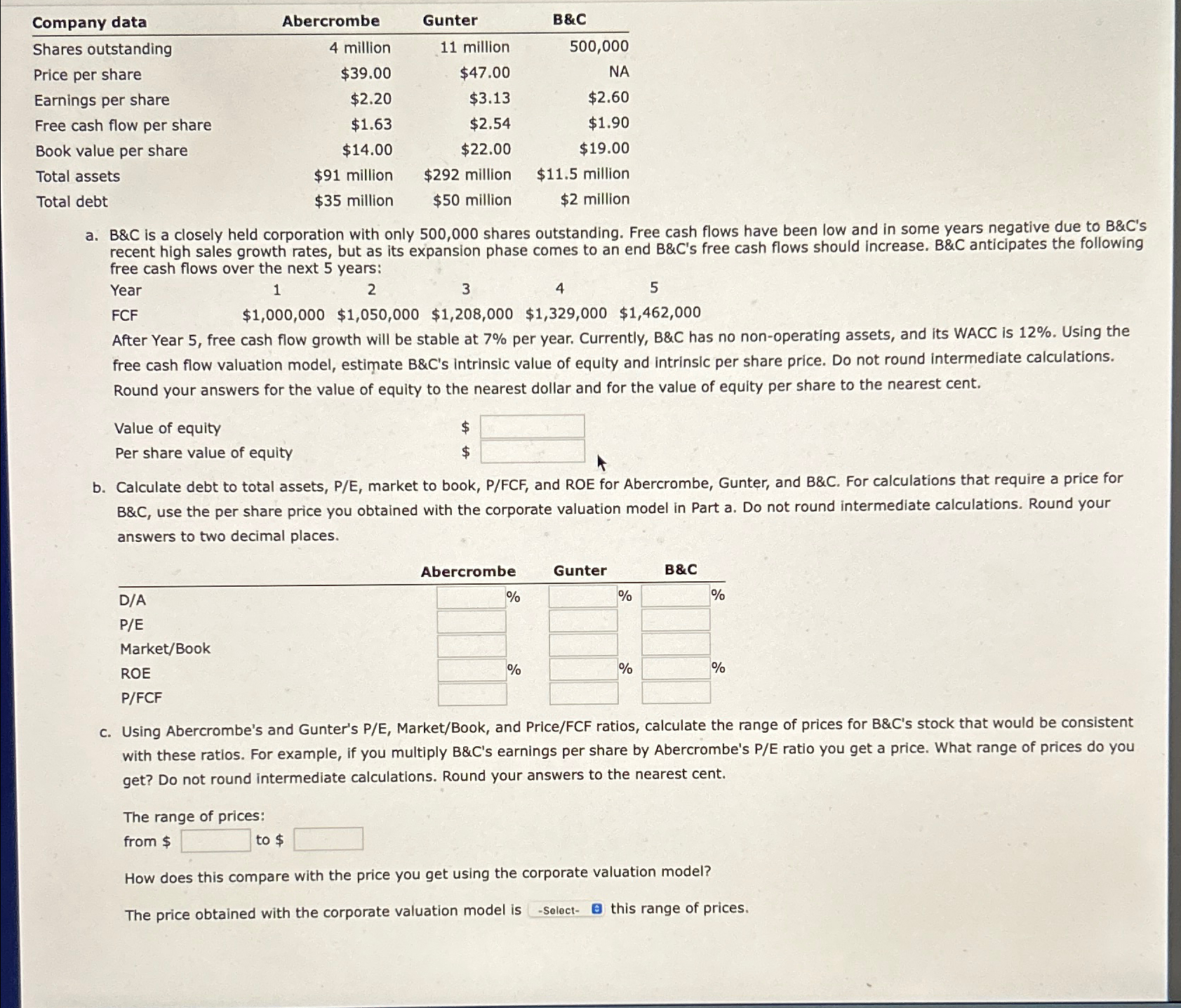

Company data Shares outstanding Price per share Abercrombe Earnings per share Free cash flow per share Book value per share Total assets Total debt

Company data Shares outstanding Price per share Abercrombe Earnings per share Free cash flow per share Book value per share Total assets Total debt Gunter B&C 4 million 11 million. 500,000 $39.00 $47.00 NA $2.20 $3.13 $2.60 $1.63 $2.54 $1.90 $14.00 $22.00 $19.00 $91 million $35 million $292 million $50 million $11.5 million $2 million a. B&C is a closely held corporation with only 500,000 shares outstanding. Free cash flows have been low and in some years negative due to B&C's recent high sales growth rates, but as its expansion phase comes to an end B&C's free cash flows should increase. B&C anticipates the following free cash flows over the next 5 years: Year FCF 1 2 3 4 5 $1,000,000 $1,050,000 $1,208,000 $1,329,000 $1,462,000 After Year 5, free cash flow growth will be stable at 7% per year. Currently, B&C has no non-operating assets, and its WACC is 12%. Using the free cash flow valuation model, estimate B&C's intrinsic value of equity and intrinsic per share price. Do not round intermediate calculations. Round your answers for the value of equity to the nearest dollar and for the value of equity per share to the nearest cent. Value of equity Per share value of equity $ b. Calculate debt to total assets, P/E, market to book, P/FCF, and ROE for Abercrombe, Gunter, and B&C. For calculations that require a price for B&C, use the per share price you obtained with the corporate valuation model in Part a. Do not round intermediate calculations. Round your answers to two decimal places. D/A P/E Market/Book ROE P/FCF Abercrombe Gunter B&C % % % % % % c. Using Abercrombe's and Gunter's P/E, Market/Book, and Price/FCF ratios, calculate the range of prices for B&C's stock that would be consistent with these ratios. For example, if you multiply B&C's earnings per share by Abercrombe's P/E ratio you get a price. What range of prices do you get? Do not round intermediate calculations. Round your answers to the nearest cent. The range of prices: from $ to $ How does this compare with the price you get using the corporate valuation model? The price obtained with the corporate valuation model is -Select- this range of prices.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started