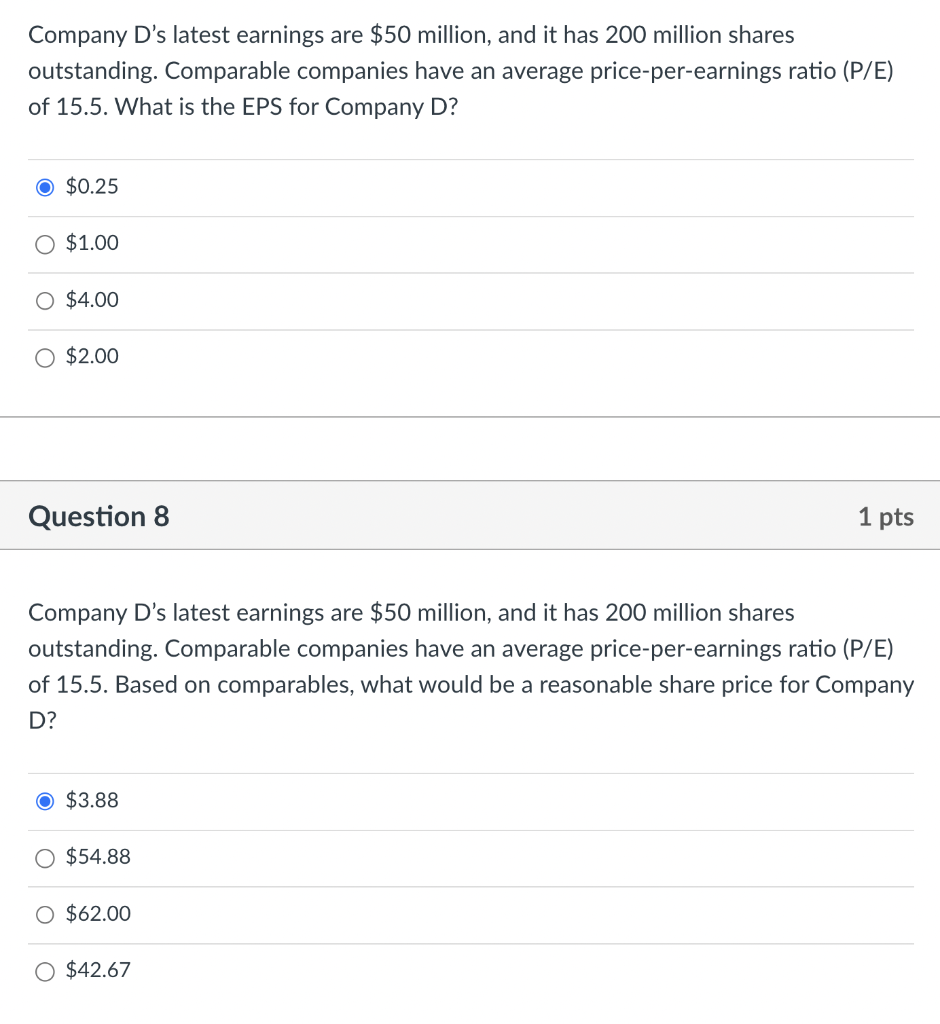

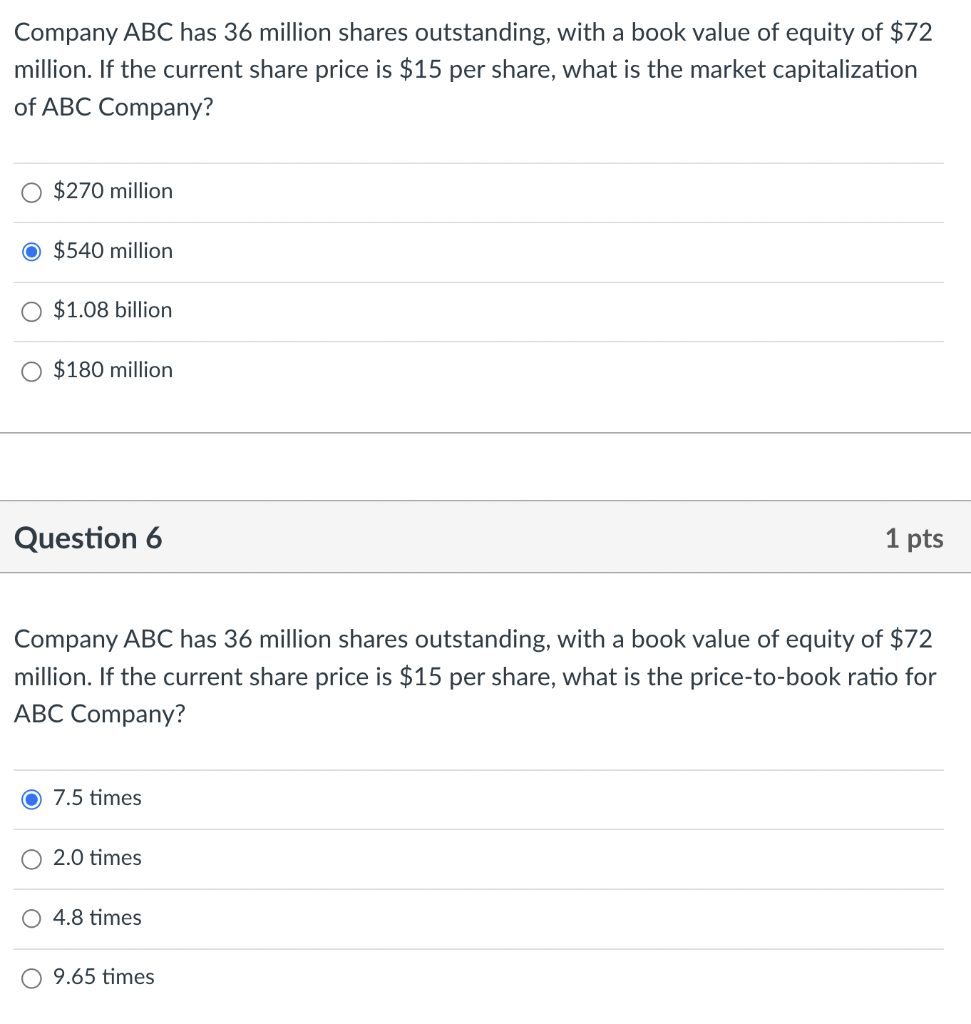

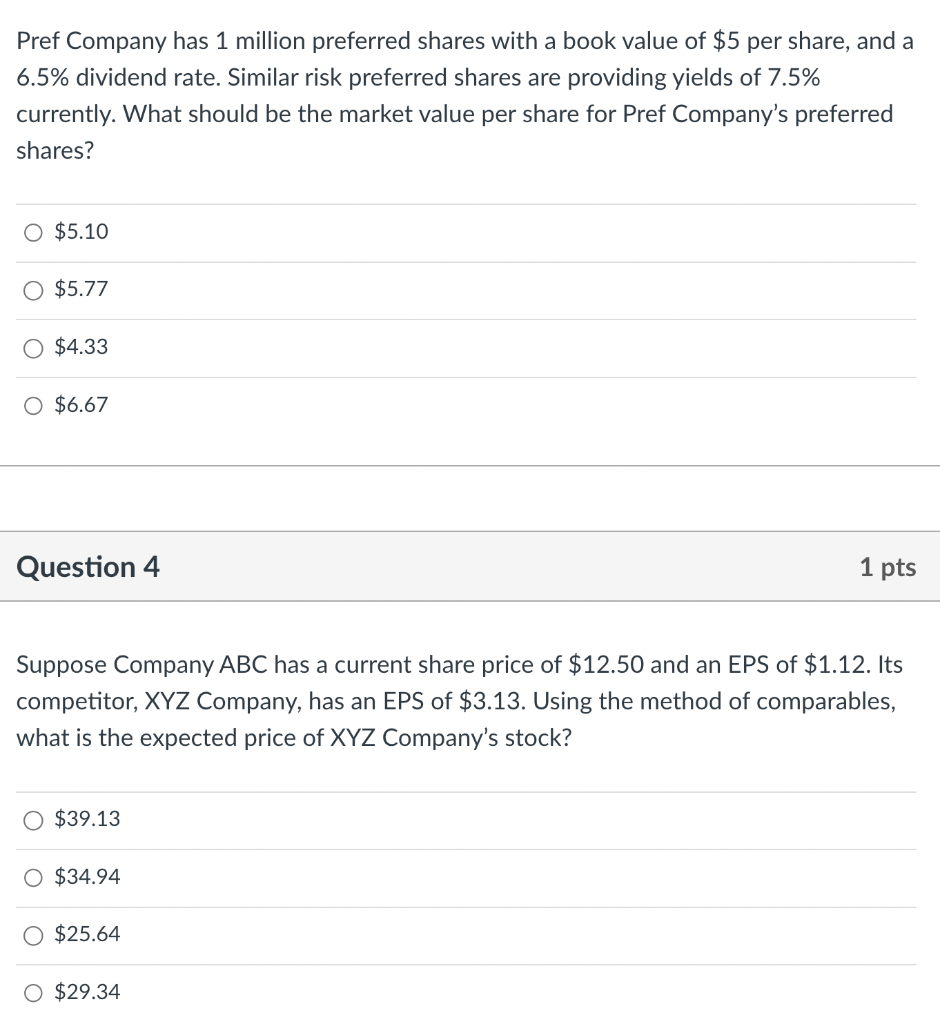

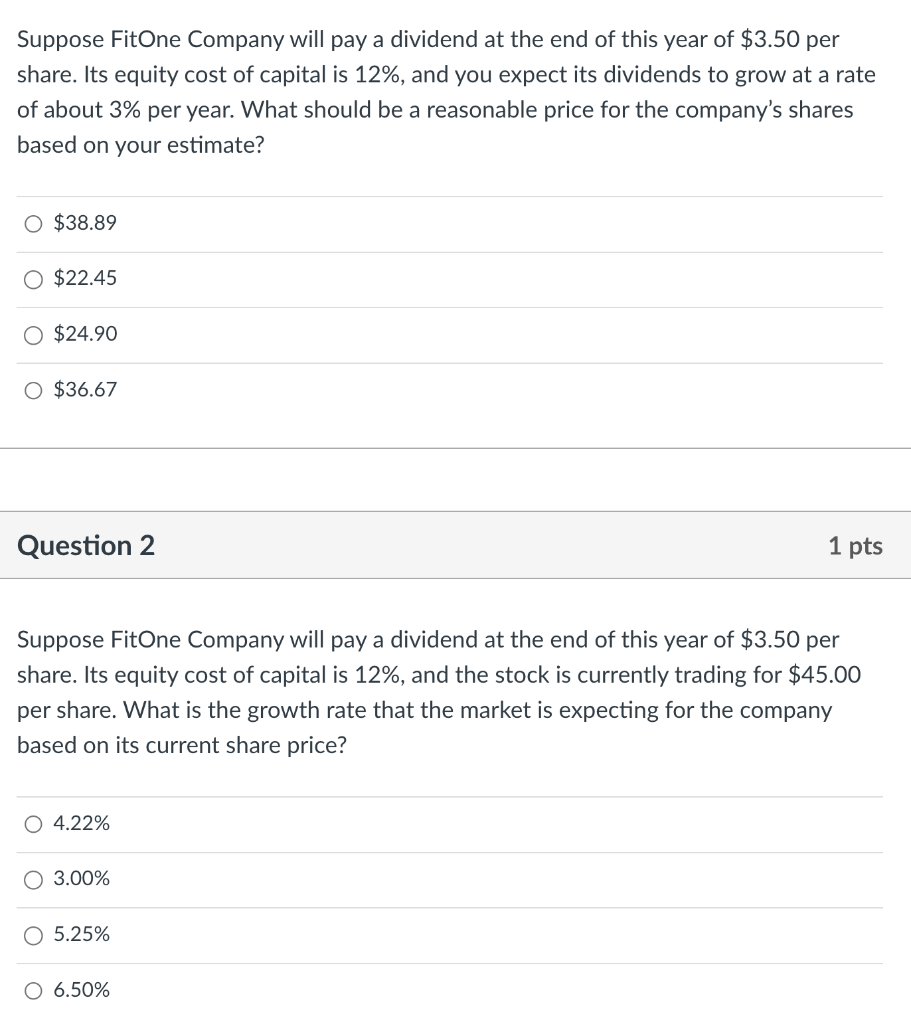

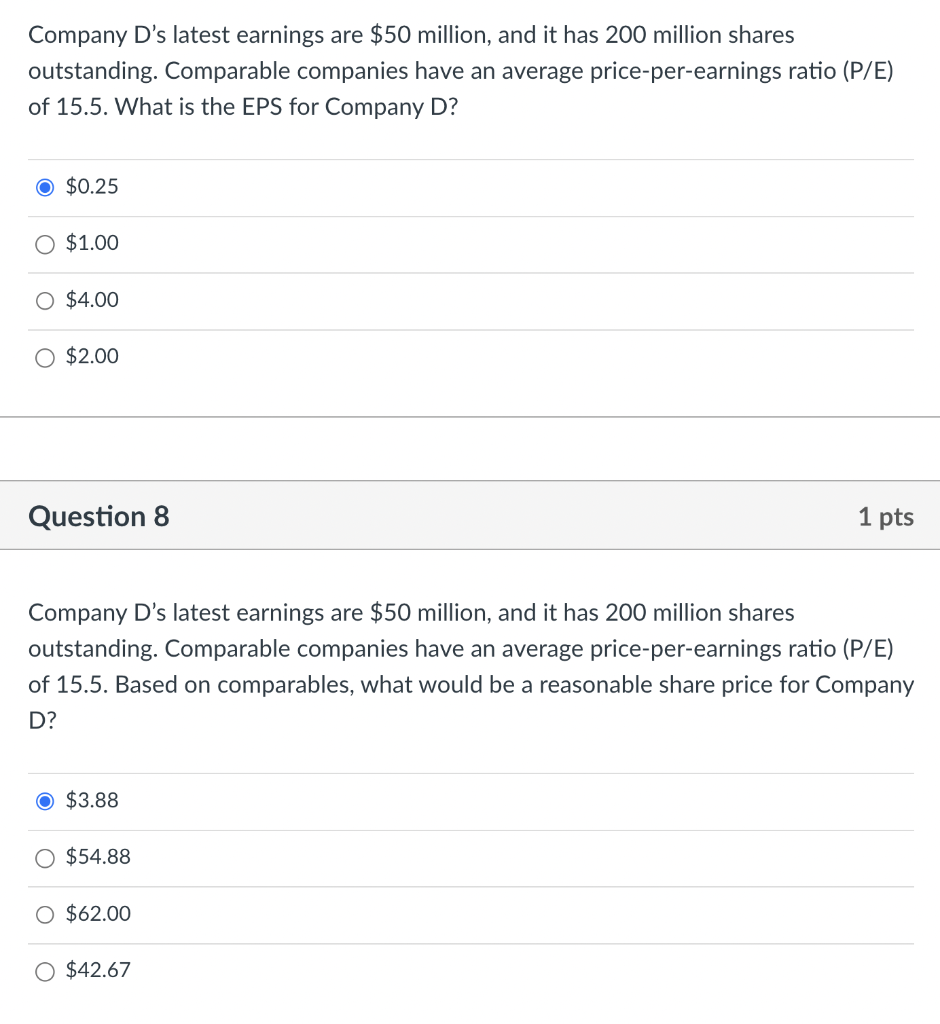

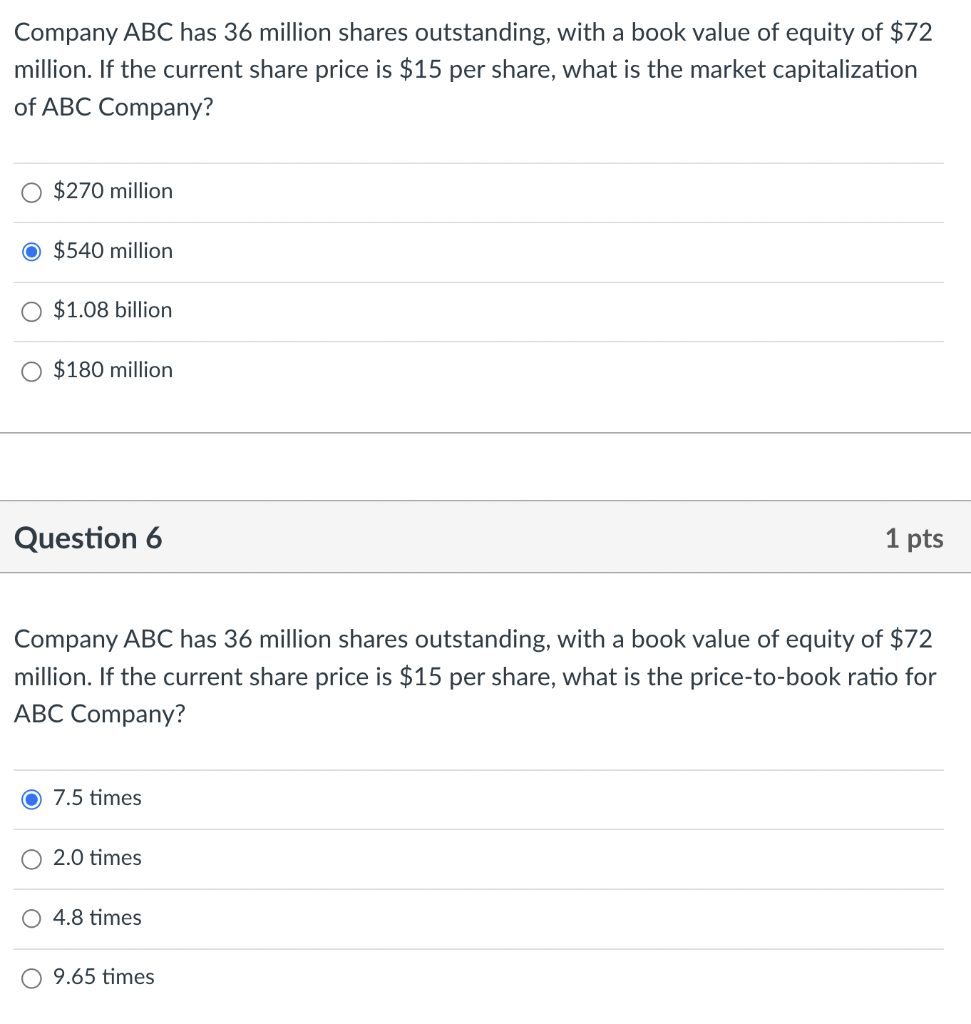

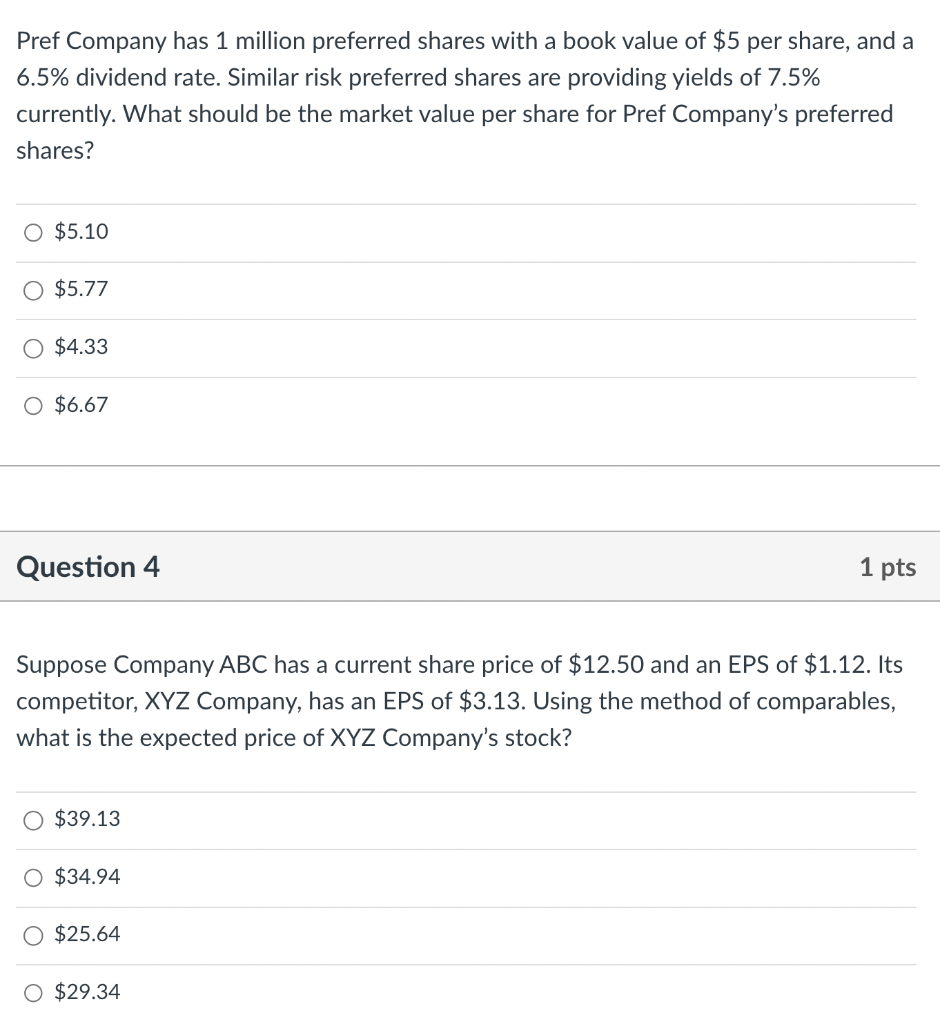

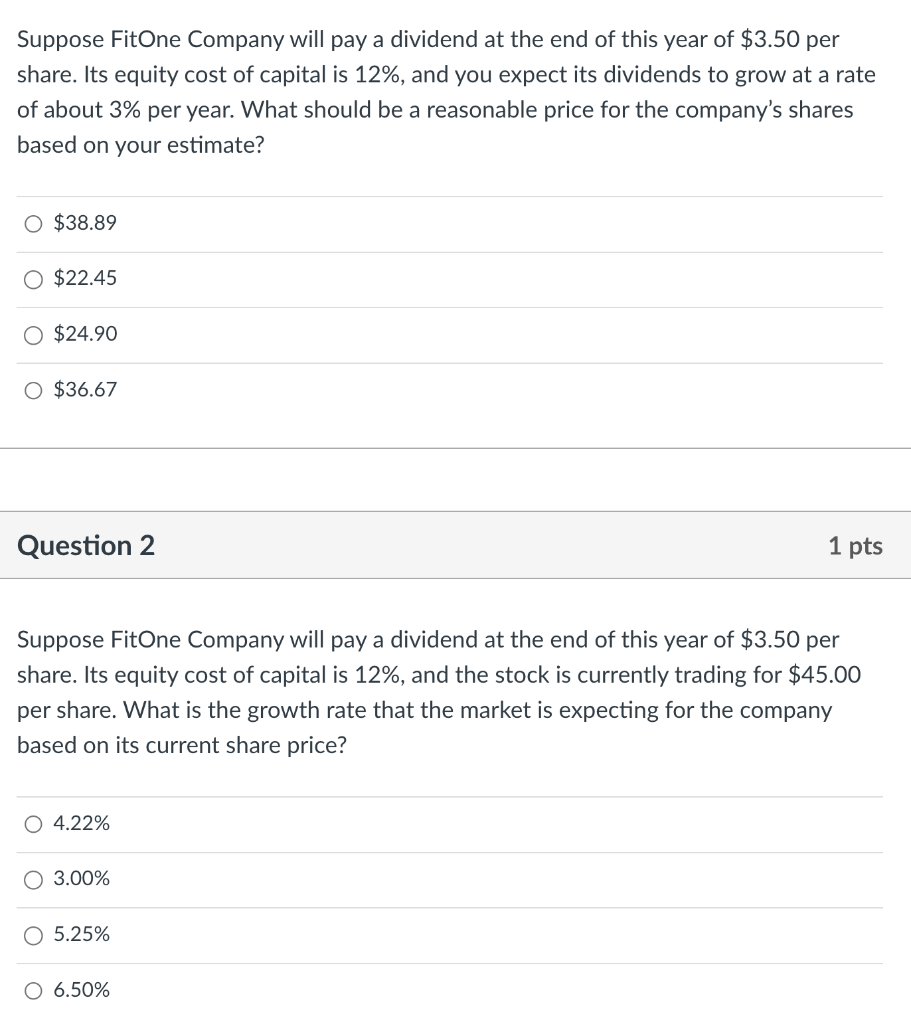

Company D's latest earnings are $50 million, and it has 200 million shares outstanding. Comparable companies have an average price-per-earnings ratio (P/E) of 15.5. What is the EPS for Company D? $0.25$1.00$4.00$2.00 Question 8 1 pts Company D's latest earnings are $50 million, and it has 200 million shares outstanding. Comparable companies have an average price-per-earnings ratio (P/E) of 15.5. Based on comparables, what would be a reasonable share price for Company D? $3.88$54.88$62.00$42.67 Company ABC has 36 million shares outstanding, with a book value of equity of $72 million. If the current share price is $15 per share, what is the market capitalization of ABC Company? $270 million $540 million \$1.08 billion $180 million Question 6 Company ABC has 36 million shares outstanding, with a book value of equity of $72 million. If the current share price is $15 per share, what is the price-to-book ratio for ABC Company? 7.5 times 2.0 times 4.8 times 9.65 times Pref Company has 1 million preferred shares with a book value of $5 per share, and a 6.5% dividend rate. Similar risk preferred shares are providing yields of 7.5% currently. What should be the market value per share for Pref Company's preferred shares? $5.10$5.77$4.33$6.67 Question 4 1 pts Suppose Company ABC has a current share price of $12.50 and an EPS of $1.12. Its competitor, XYZ Company, has an EPS of $3.13. Using the method of comparables, what is the expected price of XYZ Company's stock? $39.13 $34.94 $25.64 $29.34 Suppose FitOne Company will pay a dividend at the end of this year of $3.50 per share. Its equity cost of capital is 12%, and you expect its dividends to grow at a rate of about 3% per year. What should be a reasonable price for the company's shares based on your estimate? $38.89$22.45$24.90$36.67 Question 2 1pts Suppose FitOne Company will pay a dividend at the end of this year of $3.50 per share. Its equity cost of capital is 12%, and the stock is currently trading for $45.00 per share. What is the growth rate that the market is expecting for the company based on its current share price? 4.22% 3.00% 5.25% 6.50%