Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company EJ plans to build a new plant to manufacture bicycles. EJ sells its bicycles in the world market for $400 per bike. It

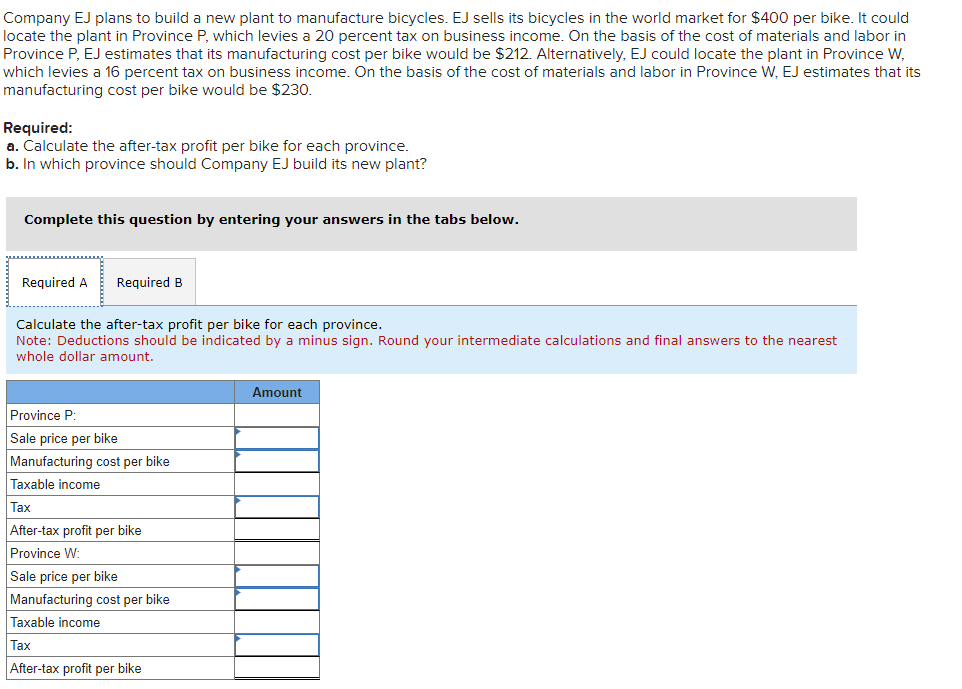

Company EJ plans to build a new plant to manufacture bicycles. EJ sells its bicycles in the world market for $400 per bike. It could locate the plant in Province P, which levies a 20 percent tax on business income. On the basis of the cost of materials and labor in Province P, EJ estimates that its manufacturing cost per bike would be $212. Alternatively, EJ could locate the plant in Province W, which levies a 16 percent tax on business income. On the basis of the cost of materials and labor in Province W, EJ estimates that its manufacturing cost per bike would be $230. Required: a. Calculate the after-tax profit per bike for each province. b. In which province should Company EJ build its new plant? Complete this question by entering your answers in the tabs below. Required A Required B Calculate the after-tax profit per bike for each province. Note: Deductions should be indicated by a minus sign. Round your intermediate calculations and final answers to the nearest whole dollar amount. Province P: Sale price per bike Manufacturing cost per bike Taxable income Tax After-tax profit per bike Province W: Sale price per bike Manufacturing cost per bike Taxable income Tax After-tax profit per bike Amount

Step by Step Solution

★★★★★

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the aftertax profit per bike for each province a Province P Sale price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started