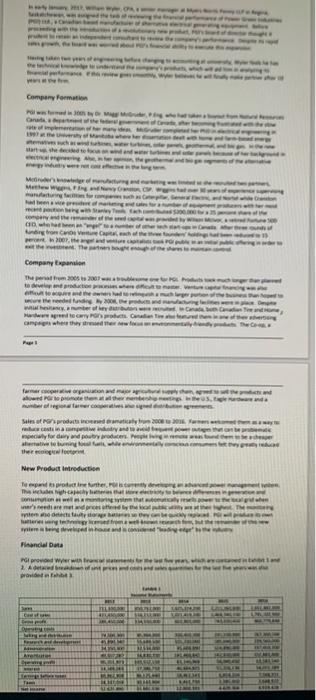

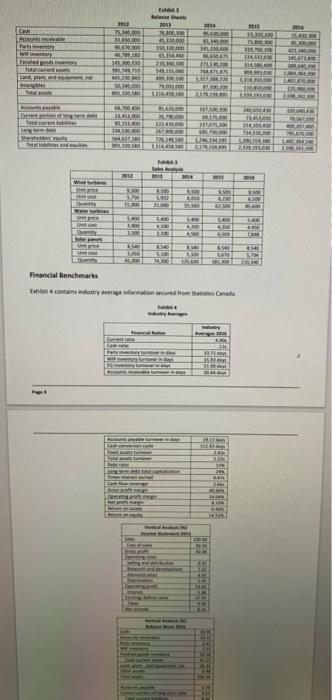

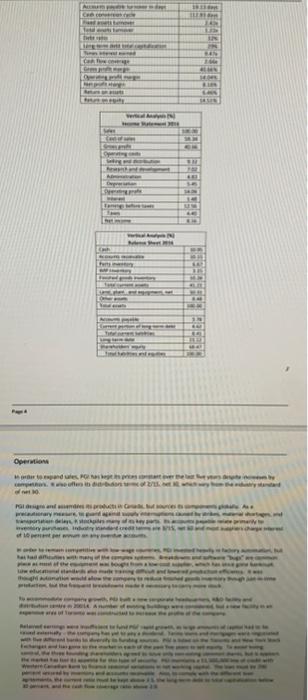

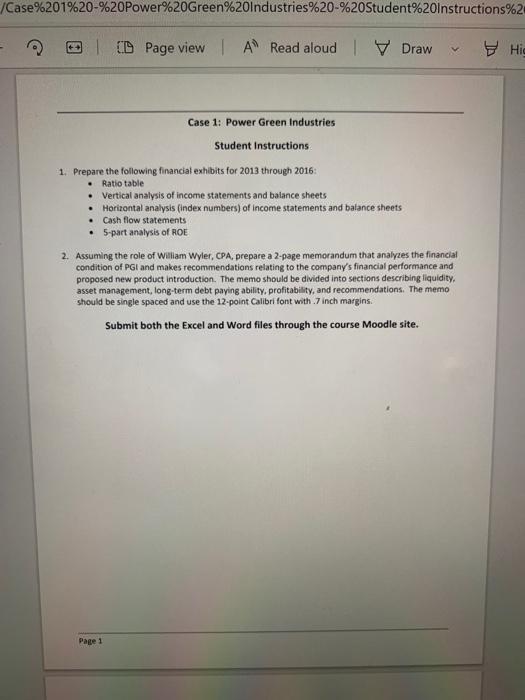

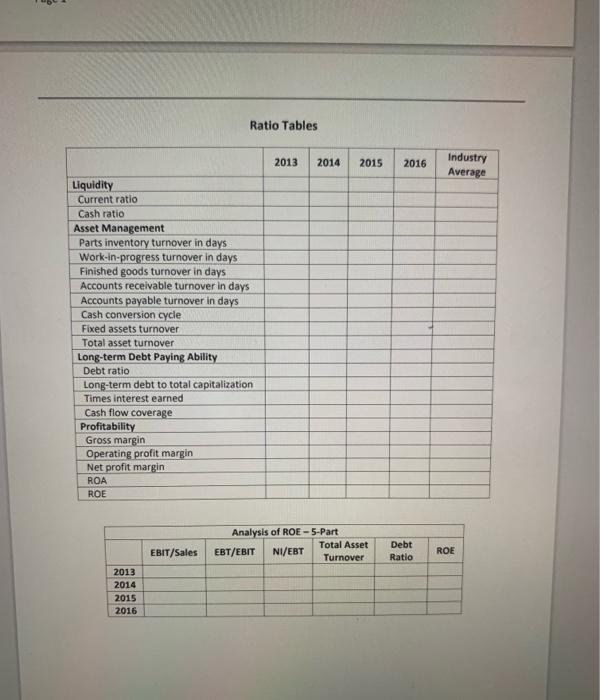

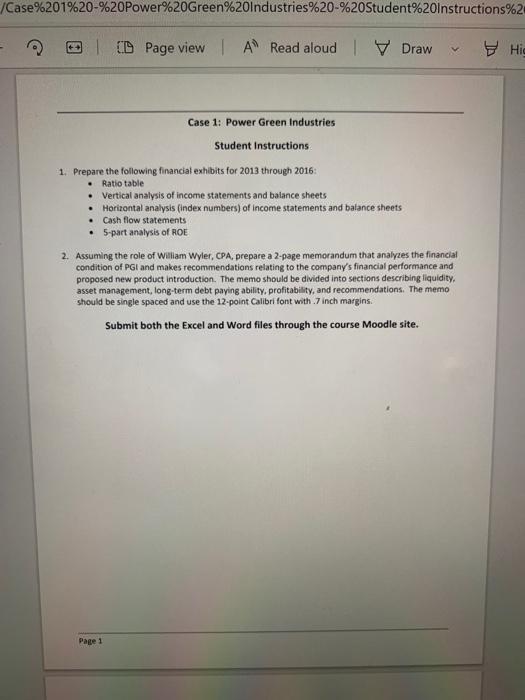

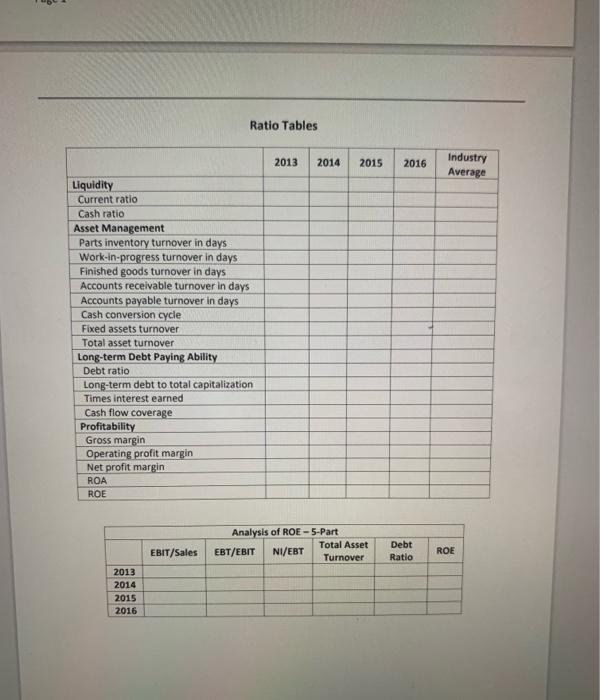

Company Formation want them to new M Melewa ng wer org 010 non se 2007 the Theme Company Expansion The 2007 and when we wewe werdedig 2001 at crow camp whether farmer own PG where Sales to products in 2000 fordybde where to all the New Product introduction Trepand cutter The Why un lietot warmediare pretty the town enge mengenda Financial Data Grower 2 A pro AFLA IM Are SORT 2011 LIO TE BODY BO AL DOBIE MO LALE wwy we TO 105 10 100 INS TAILS LE 140 LITCH 2. LILLA TA M IR UP H. TH Logo ORI RO GROVE ENT THAN ES 14 7 UT MET ET FIE w 6.500 11.000 L sen ME 340 BE LI Financial Benchmarks tahariotannitairy wa 15 Page . CATE A Com Drt * SANI | w BE NE her E E RE Operation hair atta www - Case%201%20-%20Power%20Green%20Industries%20-%20Student%20Instructions%2 ID Page view l A Read aloud | V Draw Hig Case 1: Power Green Industries Student Instructions 1. Prepare the following financial exhibits for 2013 through 2016: Ratio table Vertical analysis of income statements and balance sheets Horizontal analysis (index numbers) of income statements and balance sheets Cash flow statements 5-part analysis of ROE . 2. Assuming the role of William Wyler, CPA, prepare a 2-page memorandum that analyzes the financial condition of PG1 and makes recommendations relating to the company's financial performance and proposed new product introduction. The memo should be divided into sections describing liquidity asset management, long-term debt paying ability, profitability, and recommendations. The memo should be single spaced and use the 12-point Calibri font with 7 inch margins. Submit both the Excel and Word files through the course Moodle site. Page 1 Ratio Tables 2013 2014 2015 2016 Industry Average Liquidity Current ratio Cash ratio Asset Management Parts inventory turnover in days Work-in-progress turnover in days Finished goods turnover in days Accounts receivable turnover in days Accounts payable turnover in days Cash conversion cycle Fixed assets turnover Total asset turnover Long-term Debt Paying Ability Debt ratio Long-term debt to total capitalization Times interest earned Cash flow coverage Profitability Gross margin Operating profit margin Net profit margin ROA ROE Analysis of ROE - 5-Part Total Asset EBT/EBIT NI/EBT Turnover EBIT/Sales Debt Ratio ROE 2013 2014 2015 2016 Company Formation want them to new M Melewa ng wer org 010 non se 2007 the Theme Company Expansion The 2007 and when we wewe werdedig 2001 at crow camp whether farmer own PG where Sales to products in 2000 fordybde where to all the New Product introduction Trepand cutter The Why un lietot warmediare pretty the town enge mengenda Financial Data Grower 2 A pro AFLA IM Are SORT 2011 LIO TE BODY BO AL DOBIE MO LALE wwy we TO 105 10 100 INS TAILS LE 140 LITCH 2. LILLA TA M IR UP H. TH Logo ORI RO GROVE ENT THAN ES 14 7 UT MET ET FIE w 6.500 11.000 L sen ME 340 BE LI Financial Benchmarks tahariotannitairy wa 15 Page . CATE A Com Drt * SANI | w BE NE her E E RE Operation hair atta www - Case%201%20-%20Power%20Green%20Industries%20-%20Student%20Instructions%2 ID Page view l A Read aloud | V Draw Hig Case 1: Power Green Industries Student Instructions 1. Prepare the following financial exhibits for 2013 through 2016: Ratio table Vertical analysis of income statements and balance sheets Horizontal analysis (index numbers) of income statements and balance sheets Cash flow statements 5-part analysis of ROE . 2. Assuming the role of William Wyler, CPA, prepare a 2-page memorandum that analyzes the financial condition of PG1 and makes recommendations relating to the company's financial performance and proposed new product introduction. The memo should be divided into sections describing liquidity asset management, long-term debt paying ability, profitability, and recommendations. The memo should be single spaced and use the 12-point Calibri font with 7 inch margins. Submit both the Excel and Word files through the course Moodle site. Page 1 Ratio Tables 2013 2014 2015 2016 Industry Average Liquidity Current ratio Cash ratio Asset Management Parts inventory turnover in days Work-in-progress turnover in days Finished goods turnover in days Accounts receivable turnover in days Accounts payable turnover in days Cash conversion cycle Fixed assets turnover Total asset turnover Long-term Debt Paying Ability Debt ratio Long-term debt to total capitalization Times interest earned Cash flow coverage Profitability Gross margin Operating profit margin Net profit margin ROA ROE Analysis of ROE - 5-Part Total Asset EBT/EBIT NI/EBT Turnover EBIT/Sales Debt Ratio ROE 2013 2014 2015 2016