Question

Company Information The company's current marginal tax rate is 40% which is expected to remain constant for the foreseeable future. A typical newer motel has

Company Information

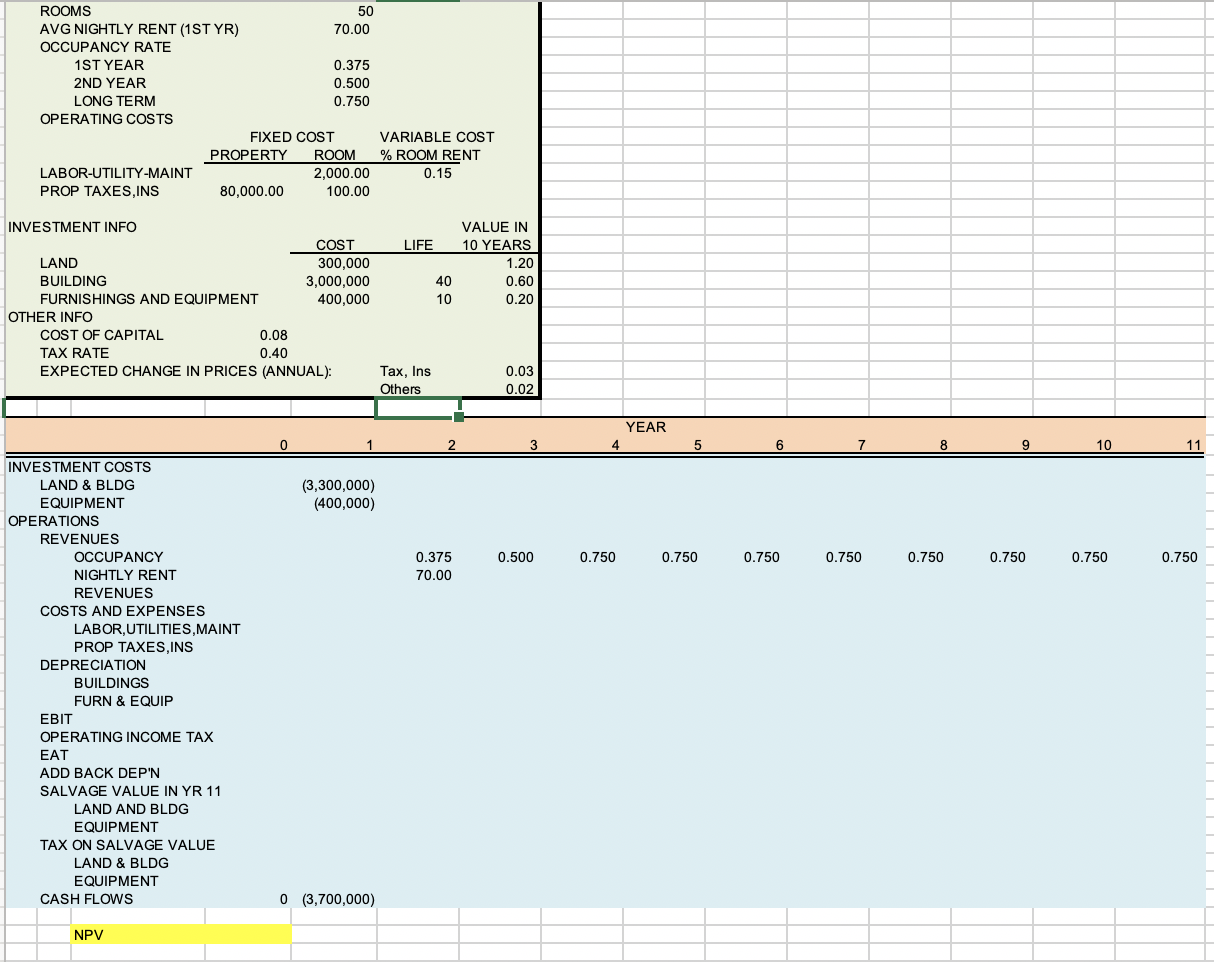

- The company's current marginal tax rate is 40% which is expected to remain constant for the foreseeable future.

- A typical newer motel has 50 rooms that rent for an average of $70 per night. The occupancy rate, again on newer properties, averages 75%. But historically, new motels have had 1st and 2nd year occupancy rates that were about 1/2 and 2/3 of the ultimate occupancy rates, respectively.

- Some of the annual costs directly attributable to individual motels in this class at 2010 prices include:

-Labor, utilities, repairs & maintenance: $2,000 per room plus 15% of gross revenues

-Property taxes, insurance: $80,000 per motel + $100 per room.

- Room rentals are expected to increase by 2% per year due to inflation.

- Property taxes & insurance are expected to increase by 3% per year.

- $2,000 fixed costs per room for labor, utilities, repairs & maintenance are expected to increase by 2% per year.

- The company depreciates all equipment using the straight line method both for tax and book purposes, assuming zero salvage value and using the following lives:

- Buildings 40 years

Equipment and furnishings 10 years

- The company uses a 10 year planning horizon for all major hotel improvements. The company assumes zero salvage value to compute depreciation. However, historically, land, buildings and equipment salvage values after 10 year operation, as a percent of original cost, have averaged:

Land 120%

Buildings 60%

Equipment and furnishings 20%

- The company may or may not sell the properties at the end of the 10 years. However, all properties are subject to a review every ten years to determine whether they should be kept or sold.

Expected capital expenditures are as follows:

Land $300,000

Building 3,000,000

Furnishings & equipment 400,000

Construction and startup typically take a year (total capital expenditures will occur at the end of the first year), and operation begins in the second yearfor 10 years after a decision to build is made. The cost of capital is 8%.

Notes:

- Land is not depreciable.

- Cash inflows will start from Year 2 to Year 11.

- Assume inflation effect on prices and costs will begin after Year 2.

- Evaluate just one motel (if one motel is profitable, total investment would be good).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started