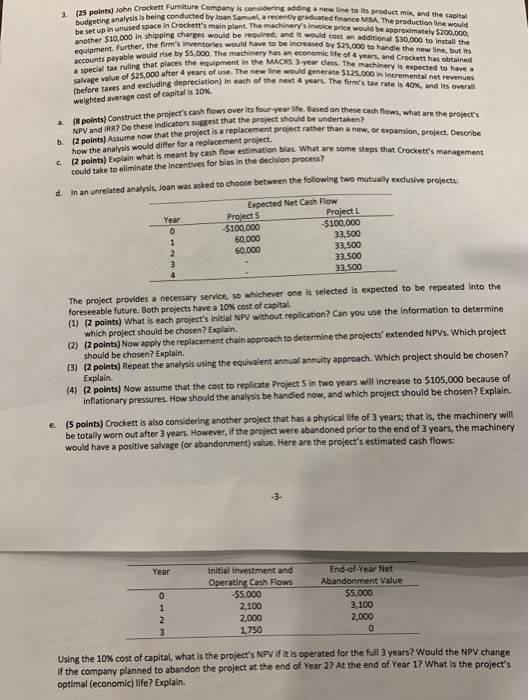

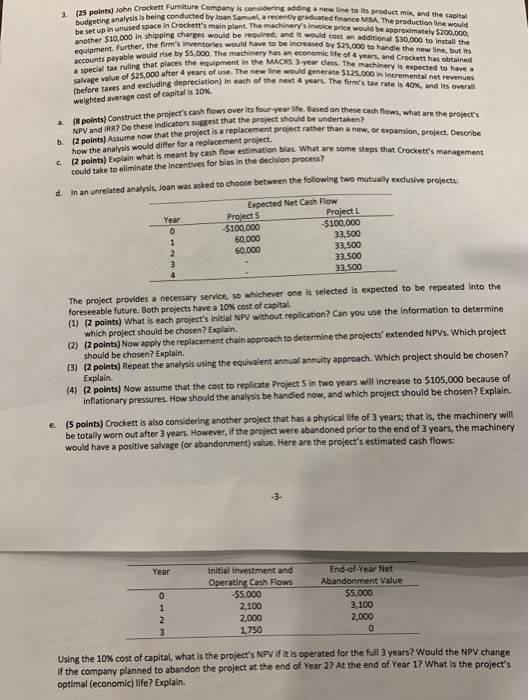

Company is considering adding a new line to its product mix, and the capital condueted by Joan Samuel, a recently graduated finance MBA. The production line would The machinery's invoice price would be required, and it would cost an additional $30,000 to install the have to be increased by $25,000 to handle the new line, but its (25 points) John Crockett Furniture Company is 3. budgeting be set up in unused in another $10,000 in shipping charges would be ed space in Crockett's main plant. nt. Further, the firm's inventories would be econemic life of 4 years, and Crockett has obtained accounts payable would rise by 55,000. The machinery has an a special tax ruling that places the equipment in the MACRS 3-year class salvage value of $25,000 after 4 years of use. The new line would (before taxes and excluding depreciation) in each of the next 4 years The weighted average cost of capital is 10%. The machinery is expected to have a generate $125,000 in incremental net revervues is 40%, and its overal (8points) Construct the project's cash flows over its fortalie on NPV and IRR? Do these indicators suggest that the project should be undertaken (2 points) Assume now that the project is a replacement ar life. Based on these cash flows, what are the project's project rather than a new, or expansion, project. Describe b. how the analysis would differ for a replacement project. (2 points) Explain what is meant by cash flow estimation bias. what are some c. could take to eliminate the incentives for bias in the decision process? exclusive projects d. In an unrelated analysis, Joan was asked to choose between the folowing two mutually exclusive Expected Net Cash Flow Project S $100,000 60,000 Project L 100,000 33,500 Year 33,500 60,000 33,500 33,500 The project provides a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have a 10% cost of capital. (1) (2 points) What is each project's initial NPV without replication? Can you use the information to determine which project should be chosen? Explain. (2) (2 points) Now apply the replacement chain approach to determine the projects' extended NPVs. Which project should be chosen? Explain. (3) (2 points) Repeat the analysis using the equivalent annual annuity approach. Which project should be chosen? (4) (12 points) Now assume that the cost to replicate Project S in two years will increase to $105,000 because of inflationary pressures. How should the analysis be handied now, and which project should be chosen? Explain. also considering another project that has a physical life of 3 years; that is, the machinery will (S points) Crockett is another project e totally worn out after 3 years. However, if the project were abandoned prior to the end of 3 years, the machinery would have a positive salvage (or abandonment) value. Here are the project's estimated cash flows e. Initial Investment and End-of-Year Net Operating Cash Flows $5,000 2,100 Abandonment Value $5,000 3,100 2,000 2,000 1,750 Using the 10% cost of capital, what is the project's NPV if it s operated for the full 3 years? would the NPV change planned to abandon the project at the end of Year 2? At the end of Year 1? What is the projects optimal (economic) life? Explain