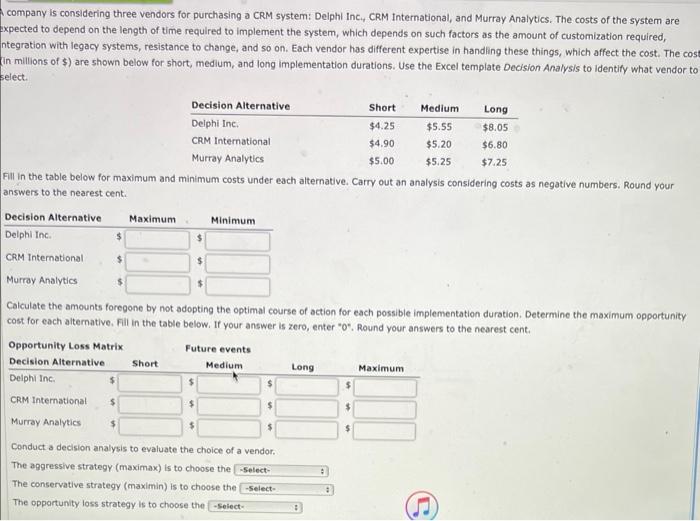

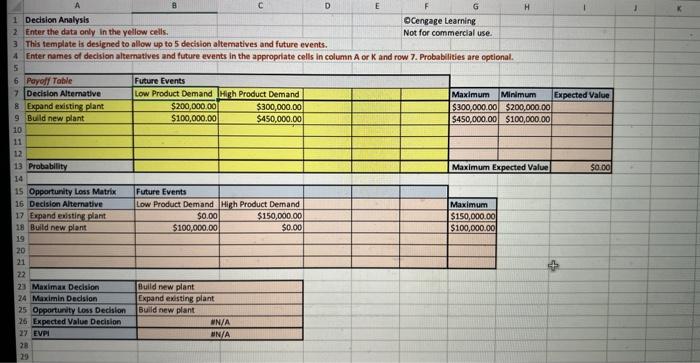

company is considering three vendors for purchasing a CRM system: Delphl Inc., CRM International, and Murray Analytics. The costs of the system are xpected to depend on the length of time required to implement the system, which depends on such factors as the amount of customization required, ategration with legacy systems, resistance to change, and so on. Each vendor has different expertise in handing these things, which affect the cost. The cos in millions of \$) are shown below for short, medium, and long implementation durations. Use the Excel template Decision Analysis to identify what vendor t elect. Fill in the table below for maximum and minimum costs under each alternative. Carry out an analysis considering costs as negative numbers. Round your answers to the nearest cent. Calculate the amounts foregone by not adopting the optimal course of action for each possible implementation duration. Determine the maximum opportunity cost for each alternative. Fil in the table below. If your answer is zero, enter " 0 ". Round your answers to the nearest cent. Conduct a decision analysis to evaluate the choice of a vendor. The aggressive strategy (maximax) is to choose the The conservative strategy (maximin) is to choose the The opportunity loss strategy is to choose the Enter the data only in the vellow cells. Not for commercial use. This template is designed to allow up to 5 decision altematives and future events. Enter names of decision alternatives and future events in the appropriate cells in column A or K and row 7 . Probabilities are cptional. company is considering three vendors for purchasing a CRM system: Delphl Inc., CRM International, and Murray Analytics. The costs of the system are xpected to depend on the length of time required to implement the system, which depends on such factors as the amount of customization required, ategration with legacy systems, resistance to change, and so on. Each vendor has different expertise in handing these things, which affect the cost. The cos in millions of \$) are shown below for short, medium, and long implementation durations. Use the Excel template Decision Analysis to identify what vendor t elect. Fill in the table below for maximum and minimum costs under each alternative. Carry out an analysis considering costs as negative numbers. Round your answers to the nearest cent. Calculate the amounts foregone by not adopting the optimal course of action for each possible implementation duration. Determine the maximum opportunity cost for each alternative. Fil in the table below. If your answer is zero, enter " 0 ". Round your answers to the nearest cent. Conduct a decision analysis to evaluate the choice of a vendor. The aggressive strategy (maximax) is to choose the The conservative strategy (maximin) is to choose the The opportunity loss strategy is to choose the Enter the data only in the vellow cells. Not for commercial use. This template is designed to allow up to 5 decision altematives and future events. Enter names of decision alternatives and future events in the appropriate cells in column A or K and row 7 . Probabilities are cptional