Answered step by step

Verified Expert Solution

Question

1 Approved Answer

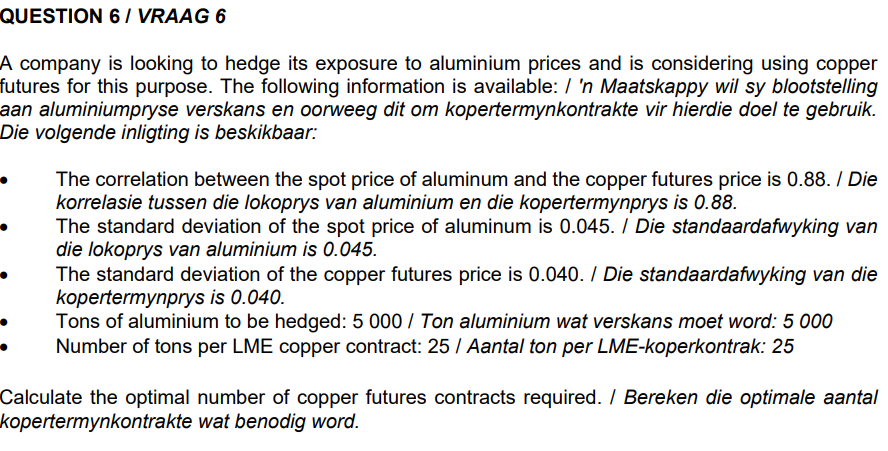

company is looking to hedge its exposure to aluminium prices and is considering using copper utures for this purpose. The following information is available: /

company is looking to hedge its exposure to aluminium prices and is considering using copper utures for this purpose. The following information is available: / 'n Maatskappy wil sy blootstelling an aluminiumpryse verskans en oorweeg dit om kopertermynkontrakte vir hierdie doel te gebruik. Die volgende inligting is beskikbaar: The correlation between the spot price of aluminum and the copper futures price is 0.88 . / Die korrelasie tussen die lokoprys van aluminium en die kopertermynprys is 0.88 . The standard deviation of the spot price of aluminum is 0.045. / Die standaardafwyking van die lokoprys van aluminium is 0.045 . The standard deviation of the copper futures price is 0.040 . / Die standaardafwyking van die kopertermynprys is 0.040 . Tons of aluminium to be hedged: 5000 / Ton aluminium wat verskans moet word: 5000 Number of tons per LME copper contract: 25 / Aantal ton per LME-koperkontrak: 25 Salculate the optimal number of copper futures contracts required. / Bereken die optimale aantal ropertermynkontrakte wat benodig word

company is looking to hedge its exposure to aluminium prices and is considering using copper utures for this purpose. The following information is available: / 'n Maatskappy wil sy blootstelling an aluminiumpryse verskans en oorweeg dit om kopertermynkontrakte vir hierdie doel te gebruik. Die volgende inligting is beskikbaar: The correlation between the spot price of aluminum and the copper futures price is 0.88 . / Die korrelasie tussen die lokoprys van aluminium en die kopertermynprys is 0.88 . The standard deviation of the spot price of aluminum is 0.045. / Die standaardafwyking van die lokoprys van aluminium is 0.045 . The standard deviation of the copper futures price is 0.040 . / Die standaardafwyking van die kopertermynprys is 0.040 . Tons of aluminium to be hedged: 5000 / Ton aluminium wat verskans moet word: 5000 Number of tons per LME copper contract: 25 / Aantal ton per LME-koperkontrak: 25 Salculate the optimal number of copper futures contracts required. / Bereken die optimale aantal ropertermynkontrakte wat benodig word Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started