Answered step by step

Verified Expert Solution

Question

1 Approved Answer

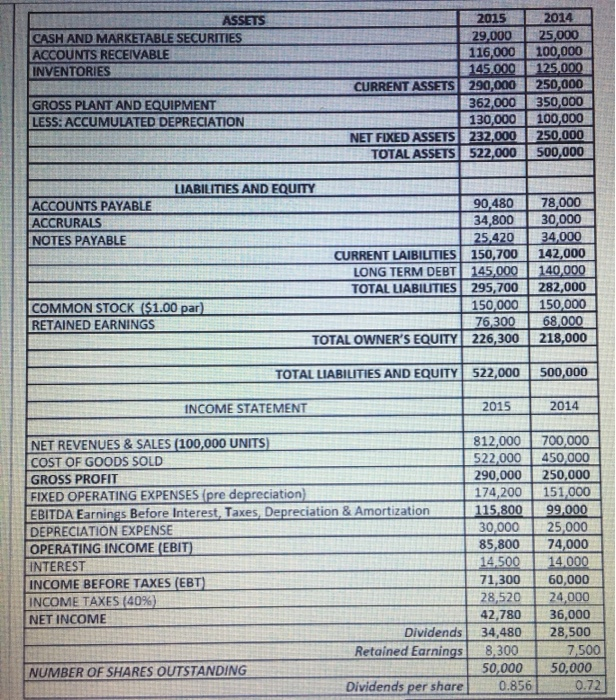

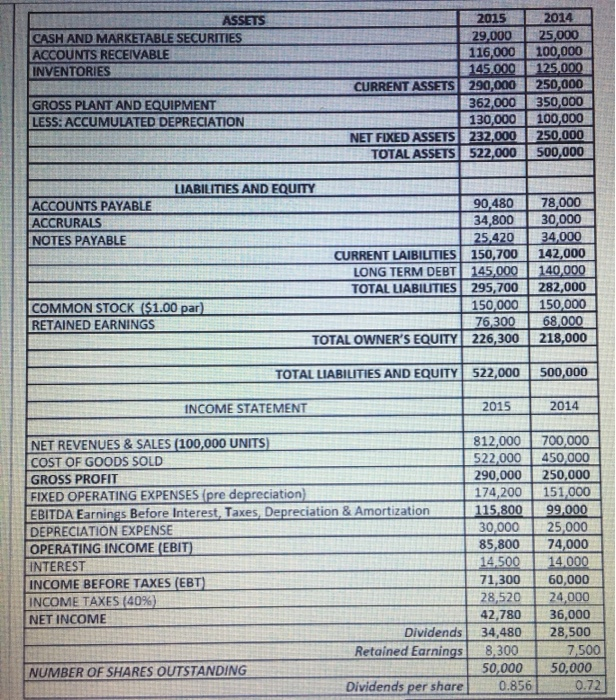

company is operating at full capacity. based on a 10% sales increase and a declared dividend of $0.50 per share compute the additional financing needs

company is operating at full capacity. based on a 10% sales increase and a declared dividend of $0.50 per share compute the additional financing needs for the next year

ASSETS CASH AND MARKETABLE SECURITIES ACCOUNTS RECEIVABLE INVENTORIES 2015 29,000 116.000 145.000 CURRENT ASSETS 290,000 362000 130,000 NET FIXED ASSETS 232.000 TOTAL ASSETS 522.000 2014 25,000 100,000 125.000 250,000 350,000 100,000 250.000 500.000 ERE GROSS PLANT AND EQUIPMENTR LESS: ACCUMULATED DEPRECIATION LIABILITIES AND EQUITY ACCOUNTS PAYABLE 90,480 78,000 ACCRURALS 34,800 30,000 NOTES PAYABLE 25,420 34,000 CURRENT LAIBILITIES 150,700 142,000 LONG TERM DEBT 145,000 140,000 TOTAL LIABILITIES 295,700 282,000 COMMON STOCK ($1.00 par 150,000 150,000 RETAINED EARNINGS 76 30068,000 TOTAL OWNER'S EQUITY 226,300 TOTAL LIABILITIES AND EQUITY 522,000 500,000 INCOME STATEMENT 2015 2014 NET REVENUES & SALES (100,000 UNITS) COST OF GOODS SOLD GROSS PROFIT FIXED OPERATING EXPENSES (pre depreciation) EBITDA Earnings Before Interest, Taxes, Depreciation & Amortization DEPRECIATION EXPENSE OPERATING INCOME (EBIT) INTEREST INCOME BEFORE TAXES (EBU). INCOME TAXES (40%) NET INCOME Dividends Retained Earnings NUMBER OF SHARES OUTSTANDING Dividends per share 812,000 522,000 290,000 174,200 115,800 30,000 85,800 14.500 71,300 28,520 42,780 34,480 8,3001 50,000 0.856 700,000 450,000 250.000 151,000 99,000 25,000 74,000 14.000 60,000 24,000 36,000 28,500 7,500 50,000 0 .72 a) 19914

b) 3172

c) 16744

d) 12522

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started