Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company listed Etisalat telecommunication company Step 1: Choosing your company Pick a UAE listed company that is listed on either Abu Dhabi Securities Exchange (ADX)

Company listed Etisalat telecommunication company

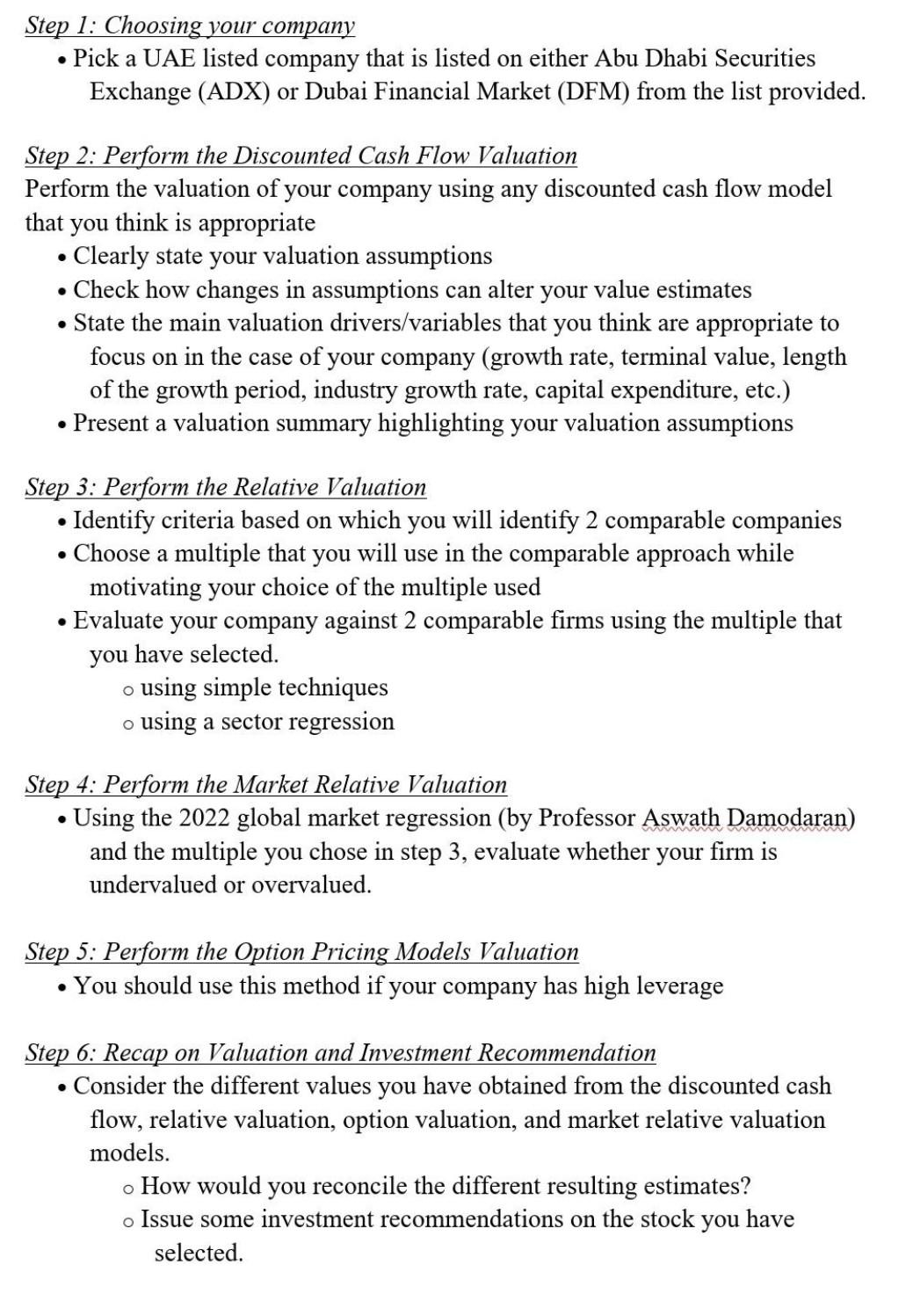

Step 1: Choosing your company Pick a UAE listed company that is listed on either Abu Dhabi Securities Exchange (ADX) or Dubai Financial Market (DFM) from the list provided. . Step 2: Perform the Discounted Cash Flow Valuation Perform the valuation of your company using any discounted cash flow model that you think is appropriate Clearly state your valuation assumptions Check how changes in assumptions can alter your value estimates State the main valuation drivers/variables that you think are appropriate to focus on in the case of your company (growth rate, terminal value, length of the growth period, industry growth rate, capital expenditure, etc.) Present a valuation summary highlighting your valuation assumptions Step 3: Perform the Relative Valuation Identify criteria based on which you will identify 2 comparable companies Choose a multiple that you will use in the comparable approach while motivating your choice of the multiple used Evaluate your company against 2 comparable firms using the multiple that you have selected. using simple techniques using a sector regression . O O Step 4: Perform the Market Relative Valuation Using the 2022 global market regression (by Professor Aswath Damodaran) and the multiple you chose in step 3, evaluate whether your firm undervalued or overvalued. Step 5: Perform the Option Pricing Models Valuation You should use this method if your company has high leverage . Step 6: Recap on Valuation and Investment Recommendation Consider the different values you have obtained from the discounted cash flow, relative valuation, option valuation, and market relative valuation models. o How would you reconcile the different resulting estimates? o Issue some investment recommendations on the stock you have selected. Step 1: Choosing your company Pick a UAE listed company that is listed on either Abu Dhabi Securities Exchange (ADX) or Dubai Financial Market (DFM) from the list provided. . Step 2: Perform the Discounted Cash Flow Valuation Perform the valuation of your company using any discounted cash flow model that you think is appropriate Clearly state your valuation assumptions Check how changes in assumptions can alter your value estimates State the main valuation drivers/variables that you think are appropriate to focus on in the case of your company (growth rate, terminal value, length of the growth period, industry growth rate, capital expenditure, etc.) Present a valuation summary highlighting your valuation assumptions Step 3: Perform the Relative Valuation Identify criteria based on which you will identify 2 comparable companies Choose a multiple that you will use in the comparable approach while motivating your choice of the multiple used Evaluate your company against 2 comparable firms using the multiple that you have selected. using simple techniques using a sector regression . O O Step 4: Perform the Market Relative Valuation Using the 2022 global market regression (by Professor Aswath Damodaran) and the multiple you chose in step 3, evaluate whether your firm undervalued or overvalued. Step 5: Perform the Option Pricing Models Valuation You should use this method if your company has high leverage . Step 6: Recap on Valuation and Investment Recommendation Consider the different values you have obtained from the discounted cash flow, relative valuation, option valuation, and market relative valuation models. o How would you reconcile the different resulting estimates? o Issue some investment recommendations on the stock you have selectedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started