Answered step by step

Verified Expert Solution

Question

1 Approved Answer

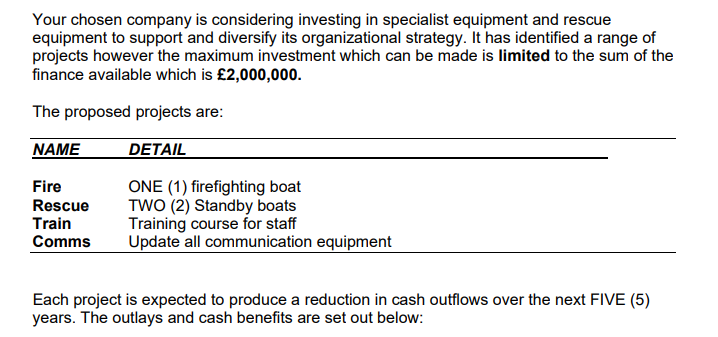

Company Microsoft Your chosen company is considering investing in specialist equipment and rescue equipment to support and diversify its organizational strategy. It has identified a

Company Microsoft

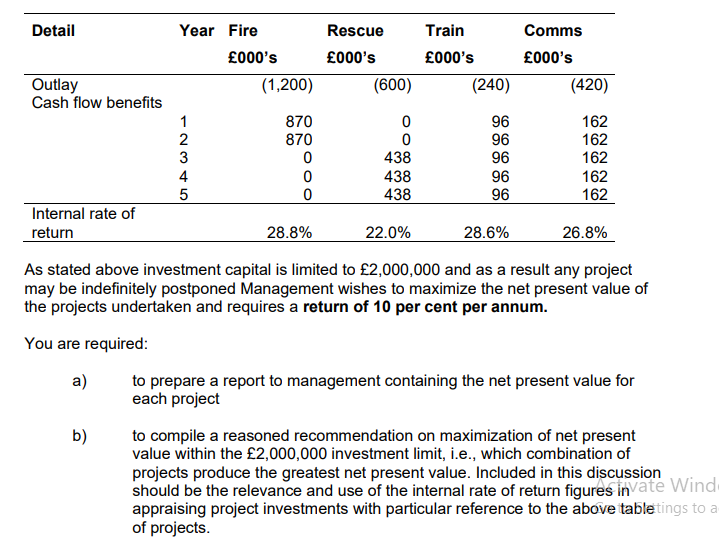

Your chosen company is considering investing in specialist equipment and rescue equipment to support and diversify its organizational strategy. It has identified a range of projects however the maximum investment which can be made is limited to the sum of the finance available which is 2,000,000. The proposed projects are: Each project is expected to produce a reduction in cash outflows over the next FIVE (5) years. The outlays and cash benefits are set out below: As stated above investment capital is limited to 2,000,000 and as a result any project may be indefinitely postponed Management wishes to maximize the net present value of the projects undertaken and requires a return of 10 per cent per annum. You are required: a) to prepare a report to management containing the net present value for each project b) to compile a reasoned recommendation on maximization of net present value within the 2,000,000 investment limit, i.e., which combination of projects produce the greatest net present value. Included in this discussion should be the relevance and use of the internal rate of return figures in appraising project investments with particular reference to the above table ting of projectsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started