Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company: My News Holding Berhad Kindly pls do the cash flow analysis and explain why increase or decrease in detail. You need to refer My

Company: My News Holding Berhad

Kindly pls do the cash flow analysis and explain why increase or decrease in detail.

You need to refer My News Holding Berhad annual report year 2021 for more detail.

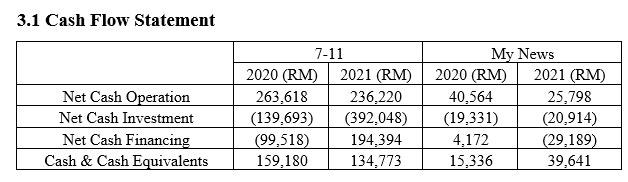

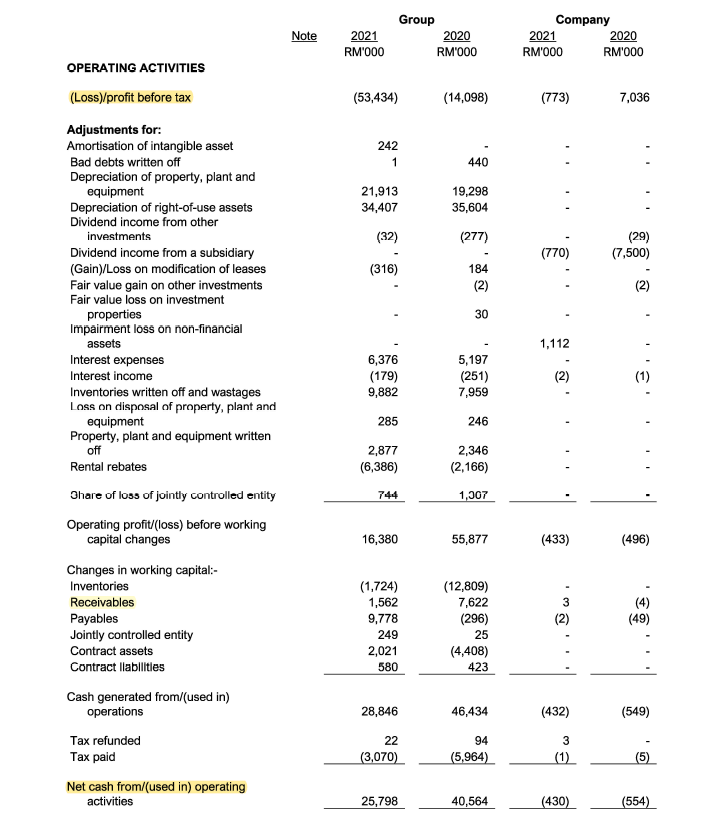

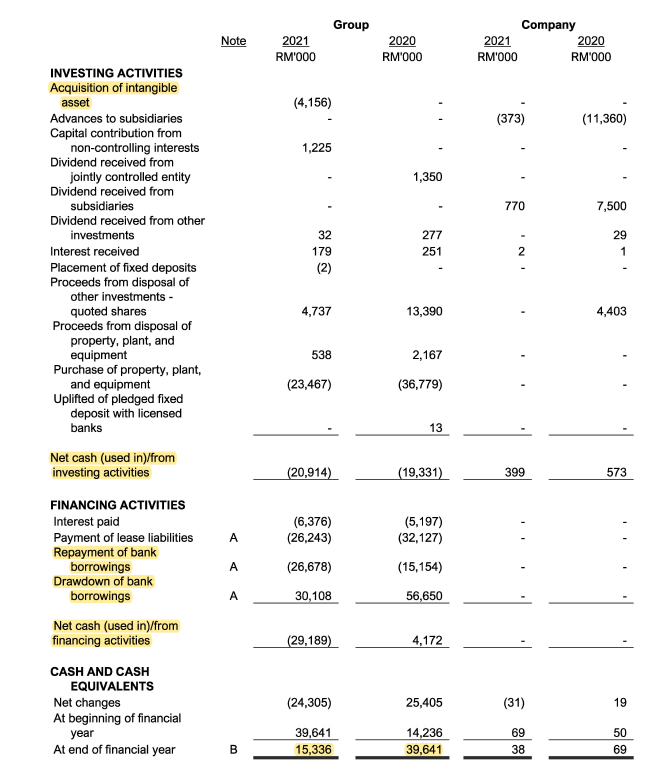

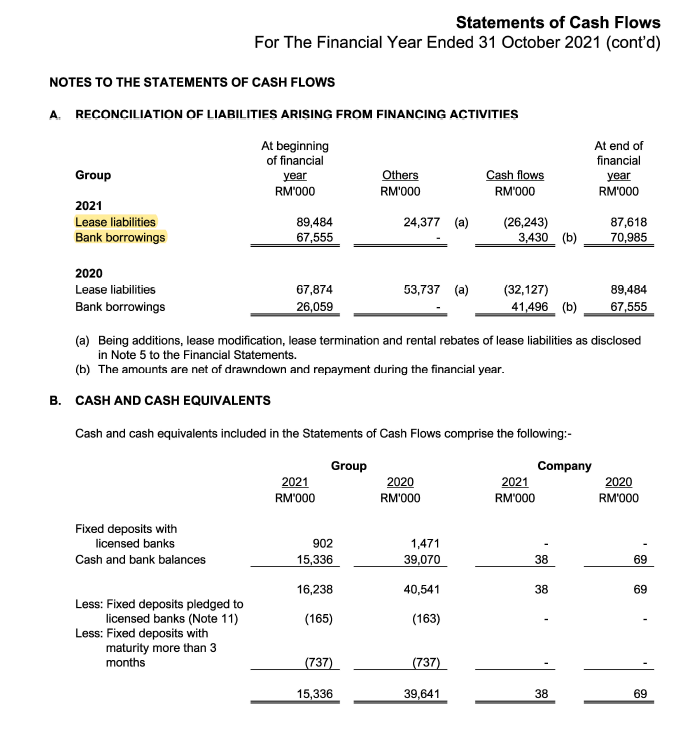

3.1 Cash Flow Statement \begin{tabular}{ccccc} & \multicolumn{2}{c}{ Group } & \multicolumn{2}{c}{ Company } \\ Note & 2021 & 2020 & 2021 & 2020 \\ & RM'000 & RM'000 & RM'000 & RM'000 \end{tabular} OPERATING ACTIVITIES (Loss)/profit before tax (53,434)(14,098)(773)7,036 Adjustments for: Amortisation of intangible asset Bad debts written off Depreciation of property, plant and equipment Depreciation of right-of-use assets Dividend income from other investments Dividend income from a subsidiary (Gain)/Loss on modification of leases Fair value gain on other investments (2) Fair value loss on investment properties Impaiiment loss onn nn-finncil assets Interest expenses Interest income (2) (1) Inventories written off and wastages Loss on disposal of property, plant and equipment Property, plant and equipment written off Rental rebates Ohare of loss of jointly controlled entity Operating profit/(loss) before working capital changes 16,38055,877 (433) (496) Changes in working capital:- Inventories Receivables (4) Payables (49) Jointly controlled entity Contract assets Contract Ilabilities Cash generated from/(used in) operations 28,84646,434 (432) (549) Tax refunded Tax paid \begin{tabular}{rrr} 22 & 94 \\ (3,070) & (5,964) \\ \hline \end{tabular} (1) Net cash from/(used in) operating activities 25,798 (5) 554) Group Company Note RM0002021 RM0002020 RM0002021 RM00022020 INVESTING ACTIVITIES Acquisition of intangible asset (4,156) Advances to subsidiaries (373) (11,360) Capital contribution from non-controlling interests 1,225 Dividend received from jointly controlled entity Dividend received from subsidiaries Dividend received from other investments Interest received Placement of fixed deposits Proceeds from disposal of other investments - quoted shares Proceeds from disposal of property, plant, and equipment Purchase of property, plant, and equipment Uplifted of pledged fixed deposit with licensed banks Net cash (used in)/from investing activities 573 FINANCING ACTIVITIES Net cash (used in)/from financing activities (29,189) 4,172 CASH AND CASH EQUIVALENTS Net changes (31) 19 At beginning of financial year At end of financial year B Statements of Cash Flows For The Financial Year Ended 31 October 2021 (cont'd) NOTES TO THE STATEMENTS OF CASH FLOWS A. RECONCILIATION OF LIABILITIES ARISING FROM FINANCING ACTIVITIES (a) Being additions, lease modification, lease termination and rental rebates of lease liabilities as disclosed in Note 5 to the Financial Statements. (b) The amounts are net of drawndown and repayment during the financial year. B. CASH AND CASH EQUIVALENTS Cash and cash equivalents included in the Statements of Cash Flows comprise the following:- 3.1 Cash Flow Statement \begin{tabular}{ccccc} & \multicolumn{2}{c}{ Group } & \multicolumn{2}{c}{ Company } \\ Note & 2021 & 2020 & 2021 & 2020 \\ & RM'000 & RM'000 & RM'000 & RM'000 \end{tabular} OPERATING ACTIVITIES (Loss)/profit before tax (53,434)(14,098)(773)7,036 Adjustments for: Amortisation of intangible asset Bad debts written off Depreciation of property, plant and equipment Depreciation of right-of-use assets Dividend income from other investments Dividend income from a subsidiary (Gain)/Loss on modification of leases Fair value gain on other investments (2) Fair value loss on investment properties Impaiiment loss onn nn-finncil assets Interest expenses Interest income (2) (1) Inventories written off and wastages Loss on disposal of property, plant and equipment Property, plant and equipment written off Rental rebates Ohare of loss of jointly controlled entity Operating profit/(loss) before working capital changes 16,38055,877 (433) (496) Changes in working capital:- Inventories Receivables (4) Payables (49) Jointly controlled entity Contract assets Contract Ilabilities Cash generated from/(used in) operations 28,84646,434 (432) (549) Tax refunded Tax paid \begin{tabular}{rrr} 22 & 94 \\ (3,070) & (5,964) \\ \hline \end{tabular} (1) Net cash from/(used in) operating activities 25,798 (5) 554) Group Company Note RM0002021 RM0002020 RM0002021 RM00022020 INVESTING ACTIVITIES Acquisition of intangible asset (4,156) Advances to subsidiaries (373) (11,360) Capital contribution from non-controlling interests 1,225 Dividend received from jointly controlled entity Dividend received from subsidiaries Dividend received from other investments Interest received Placement of fixed deposits Proceeds from disposal of other investments - quoted shares Proceeds from disposal of property, plant, and equipment Purchase of property, plant, and equipment Uplifted of pledged fixed deposit with licensed banks Net cash (used in)/from investing activities 573 FINANCING ACTIVITIES Net cash (used in)/from financing activities (29,189) 4,172 CASH AND CASH EQUIVALENTS Net changes (31) 19 At beginning of financial year At end of financial year B Statements of Cash Flows For The Financial Year Ended 31 October 2021 (cont'd) NOTES TO THE STATEMENTS OF CASH FLOWS A. RECONCILIATION OF LIABILITIES ARISING FROM FINANCING ACTIVITIES (a) Being additions, lease modification, lease termination and rental rebates of lease liabilities as disclosed in Note 5 to the Financial Statements. (b) The amounts are net of drawndown and repayment during the financial year. B. CASH AND CASH EQUIVALENTS Cash and cash equivalents included in the Statements of Cash Flows comprise the followingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started