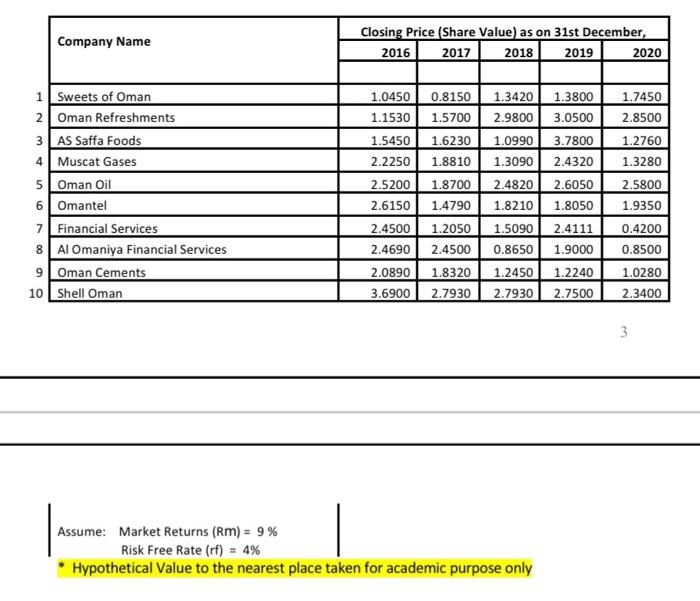

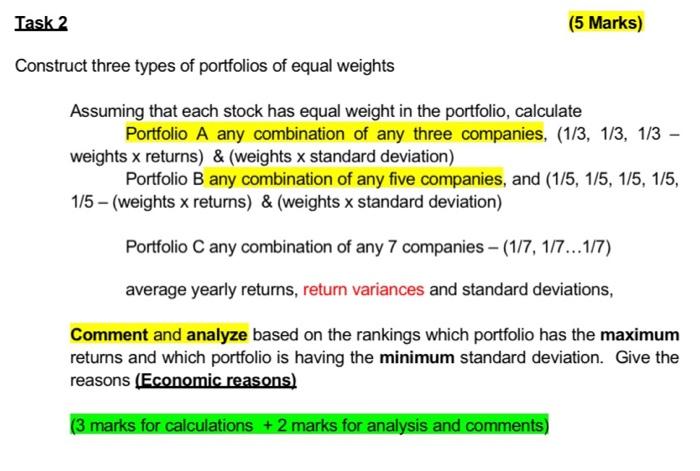

Company Name Closing Price (Share Value) as on 31st December, 2016 2017 2018 2019 2020 1.0450 0.8150 1.1530 1.5700 1.5450 2.2250 1.6230 1.8810 1.8700 2.5200 1 Sweets of Oman 2 Oman Refreshments 3 AS Saffa Foods 4 Muscat Gases 5 Oman Oil 6 Omantel 7 Financial Services 8 Al Omaniya Financial Services 9 Oman Cements 10 Shell Oman 1.3420 1.3800 2.9800 3.0500 1.0990 3.7800 1.3090 2.4320 2.4820 2.6050 1.8210 1.8050 1.5090 2.4111 0.8650 1.9000 1.2450 1.2240 2.7930 2.7500 1.7450 2.8500 1.2760 1.3280 2.5800 1.9350 0.4200 0.8500 1.0280 2.3400 2.6150 1.4790 2.4500 2.4690 2.0890 3.6900 1.2050 2.4500 1.8320 2.7930 3 Assume: Market Returns (Rm) = 9% Risk Free Rate (rf) = 4% Hypothetical Value to the nearest place taken for academic purpose only Task 2 (5 Marks) Construct three types of portfolios of equal weights Assuming that each stock has equal weight in the portfolio, calculate Portfolio A any combination of any three companies, (1/3, 1/3, 1/3 - weights x returns) & (weights x standard deviation) Portfolio B any combination of any five companies, and (1/5, 1/5, 1/5, 1/5, 1/5 (weights x returns) & (weights x standard deviation) Portfolio C any combination of any 7 companies - (1/7, 1/7...1/7) average yearly returns, return variances and standard deviations, Comment and analyze based on the rankings which portfolio has the maximum returns and which portfolio is having the minimum standard deviation. Give the reasons (Economic reasons) (3 marks for calculations + 2 marks for analysis and comments) Company Name Closing Price (Share Value) as on 31st December, 2016 2017 2018 2019 2020 1.0450 0.8150 1.1530 1.5700 1.5450 2.2250 1.6230 1.8810 1.8700 2.5200 1 Sweets of Oman 2 Oman Refreshments 3 AS Saffa Foods 4 Muscat Gases 5 Oman Oil 6 Omantel 7 Financial Services 8 Al Omaniya Financial Services 9 Oman Cements 10 Shell Oman 1.3420 1.3800 2.9800 3.0500 1.0990 3.7800 1.3090 2.4320 2.4820 2.6050 1.8210 1.8050 1.5090 2.4111 0.8650 1.9000 1.2450 1.2240 2.7930 2.7500 1.7450 2.8500 1.2760 1.3280 2.5800 1.9350 0.4200 0.8500 1.0280 2.3400 2.6150 1.4790 2.4500 2.4690 2.0890 3.6900 1.2050 2.4500 1.8320 2.7930 3 Assume: Market Returns (Rm) = 9% Risk Free Rate (rf) = 4% Hypothetical Value to the nearest place taken for academic purpose only Task 2 (5 Marks) Construct three types of portfolios of equal weights Assuming that each stock has equal weight in the portfolio, calculate Portfolio A any combination of any three companies, (1/3, 1/3, 1/3 - weights x returns) & (weights x standard deviation) Portfolio B any combination of any five companies, and (1/5, 1/5, 1/5, 1/5, 1/5 (weights x returns) & (weights x standard deviation) Portfolio C any combination of any 7 companies - (1/7, 1/7...1/7) average yearly returns, return variances and standard deviations, Comment and analyze based on the rankings which portfolio has the maximum returns and which portfolio is having the minimum standard deviation. Give the reasons (Economic reasons) (3 marks for calculations + 2 marks for analysis and comments)