Company nestle pakistan LTD

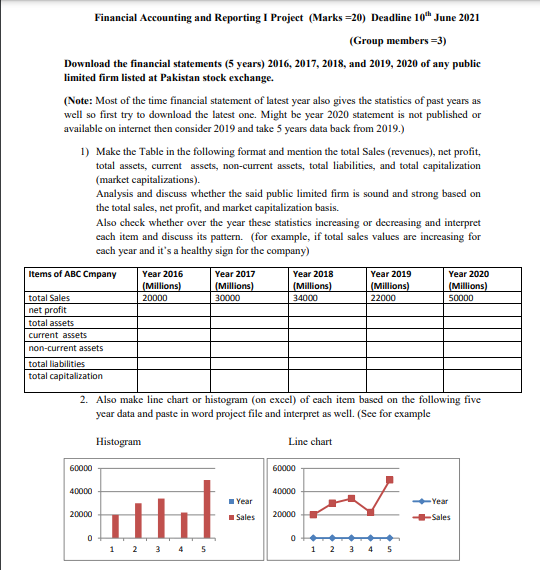

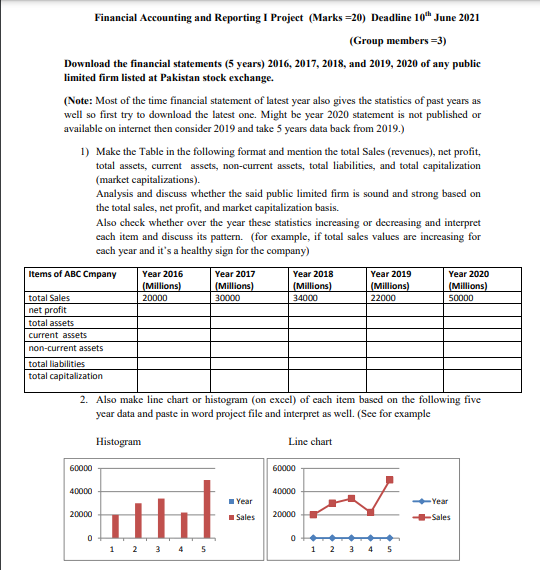

Financial Accounting and Reporting I Project (Marks =20) Deadline 10 June 2021 (Group members =3) Download the financial statements (5 years) 2016, 2017, 2018, and 2019, 2020 of any public limited firm listed at Pakistan stock exchange. (Note: Most of the time financial statement of latest year also gives the statistics of past years as well so first try to download the latest one. Might be year 2020 statement is not published or available on internet then consider 2019 and take 5 years data back from 2019.) 1) Make the Table in the following format and mention the total Sales (revenues), net profit, total assets, current assets, non-current assets, total liabilities, and total capitalization (market capitalizations). Analysis and discuss whether the said public limited firm is sound and strong based on the total sales, net profit, and market capitalization basis. Also check whether over the year these statistics increasing or decreasing and interpret cach item and discuss its pattern. (for example, if total sales values are increasing for cach year and it's a healthy sign for the company) Items of ABC Cmpany Year 2016 Year 2017 Year 2018 Year 2019 Year 2020 (Millions) (Millions) (Millions) (Millions) (Millions) total Sales 20000 30000 22000 net profit total assets current assets non-current assets total liabilities total capitalization 2. Also make line chart or histogram (on excel) of each item based on the following five year data and paste in word project file and interpret as well. (See for example 34000 50000 Histogram Line chart 60000 60000 40000 40000 Year 20000 tut Year -Sales Sales 20000 0 1 2 3 4 5 1 2 3 4 5 Financial Accounting and Reporting I Project (Marks =20) Deadline 10 June 2021 (Group members =3) Download the financial statements (5 years) 2016, 2017, 2018, and 2019, 2020 of any public limited firm listed at Pakistan stock exchange. (Note: Most of the time financial statement of latest year also gives the statistics of past years as well so first try to download the latest one. Might be year 2020 statement is not published or available on internet then consider 2019 and take 5 years data back from 2019.) 1) Make the Table in the following format and mention the total Sales (revenues), net profit, total assets, current assets, non-current assets, total liabilities, and total capitalization (market capitalizations). Analysis and discuss whether the said public limited firm is sound and strong based on the total sales, net profit, and market capitalization basis. Also check whether over the year these statistics increasing or decreasing and interpret cach item and discuss its pattern. (for example, if total sales values are increasing for cach year and it's a healthy sign for the company) Items of ABC Cmpany Year 2016 Year 2017 Year 2018 Year 2019 Year 2020 (Millions) (Millions) (Millions) (Millions) (Millions) total Sales 20000 30000 22000 net profit total assets current assets non-current assets total liabilities total capitalization 2. Also make line chart or histogram (on excel) of each item based on the following five year data and paste in word project file and interpret as well. (See for example 34000 50000 Histogram Line chart 60000 60000 40000 40000 Year 20000 tut Year -Sales Sales 20000 0 1 2 3 4 5 1 2 3 4 5