Question

Company P owns 80% of Company S. On January 1, Company S has outstanding 6% bonds with a face value of $200,000 and an

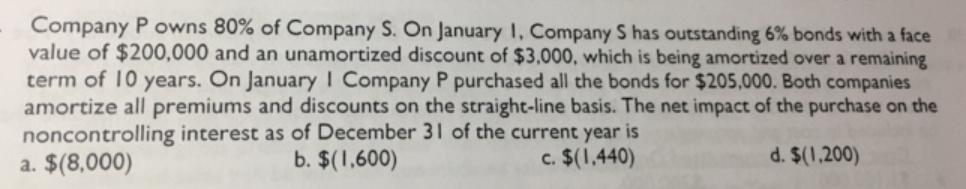

Company P owns 80% of Company S. On January 1, Company S has outstanding 6% bonds with a face value of $200,000 and an unamortized discount of $3,000, which is being amortized over a remaining term of 10 years. On January I Company P purchased all the bonds for $205,000. Both companies amortize all premiums and discounts on the straight-line basis. The net impact of the purchase on the noncontrolling interest as of December 31 of the current year is d. $(1,200) a. $(8,000) b. $(1,600) c. $(1,440)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Carrying value before purchase Face val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay

7th edition

132928930, 978-0132928939

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App