Question

Company plans to increase production to 96 ths of items at the cost 243 USD per item and selling price of 305 USD. There are

Company plans to increase production to 96 ths of items at the cost 243 USD per item and selling price of 305 USD. There are two projects of technology use for 5 years:

1st assumes purchase of the license on the following conditions: lump payment is 960 this USD, purchase of hardware is 690 ths USD, costs for setting the production 185 ths USD. Product release starts on the second year of project implementation.

2nd one assumes costs for research and development in the amount of 500 this USD (1st year of the project), purchase of hardware - 380 ths USD (2nd year of the project), costs for setting the production 75 ths USD (2nd year of the project). Product release starts on the third year of project implementation, depreciation is accrued steadily in equal parts (term of depreciation is 4 years), income tax 18%, discount rate - 16 %.

Questions:

1. To define more beneficial alternative.

2. Give comments to calculations.

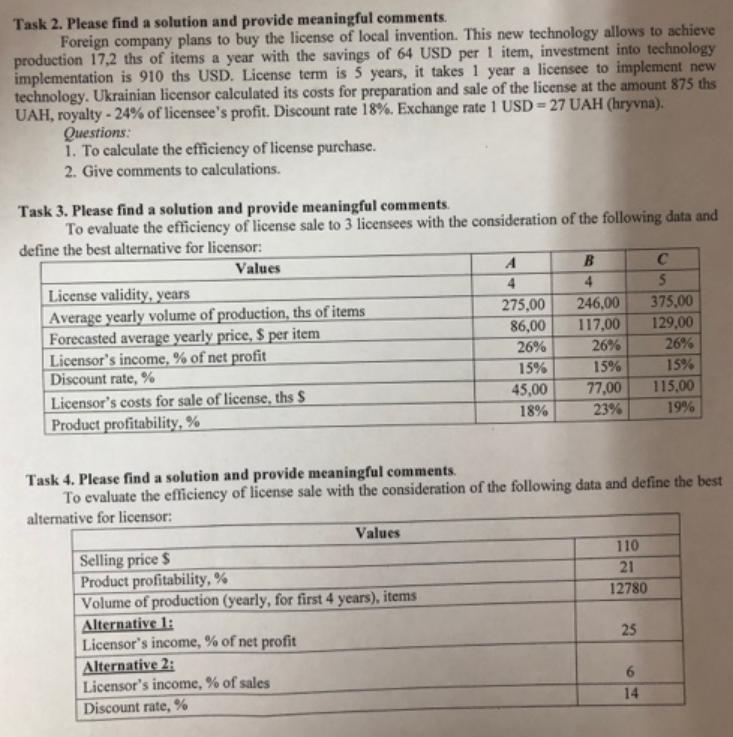

Task 2. Please find a solution and provide meaningful comments. Foreign company plans to buy the license of local invention. This new technology allows to achieve production 17,2 ths of items a year with the savings of 64 USD per 1 item, investment into technology implementation is 910 ths USD. License term is 5 years, it takes 1 year a licensee to implement new technology. Ukrainian licensor calculated its costs for preparation and sale of the license at the amount 875 the UAH, royalty -24% of licensee's profit. Discount rate 18%. Exchange rate 1 USD = 27 UAH (hryvna). Questions: 1. To calculate the efficiency of license purchase. 2. Give comments to calculations. Task 3. Please find a solution and provide meaningful comments. To evaluate the efficiency of license sale to 3 licensees with the consideration of the following data and define the best alternative for licensor: Values License validity, years Average yearly volume of production, ths of items Forecasted average yearly price, $ per item Licensor's income, % of net profit Discount rate, % Licensor's costs for sale of license, ths S Product profitability,% Selling price $ Product profitability,% Volume of production (yearly, for first 4 years), items Alternative 1: Licensor's income, % of net profit Values Alternative 2: Licensor's income, % of sales Discount rate, % A 4 275,00 86,00 26% 15% 45,00 18% B 4 246,00 117,00 26% 15% 77,00 23% Task 4. Please find a solution and provide meaningful comments. To evaluate the efficiency of license sale with the consideration of the following data and define the best alternative for licensor: 110 21 12780 25 C 5 6 14 375,00 129,00 26% 15% 115,00 19%

Step by Step Solution

3.59 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 To Define More Beneficial Alternative Calculation of Net Present Value NPV for both the projects First project Initial Investment 960 690 185 1835 thousand Income 305 24396 6912 thousand Di...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started