Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company plans to purchase a piece of equipment that costs $208,000 and qualifies for five-year MACRS depreciation. The equipment has a useful life

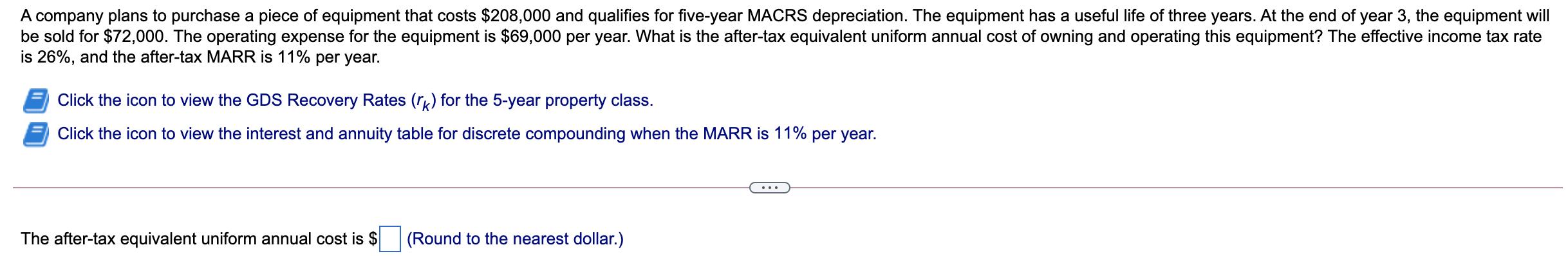

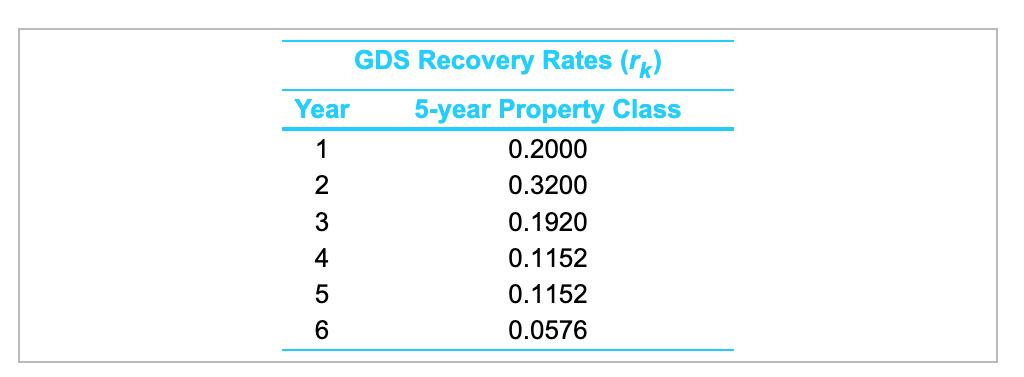

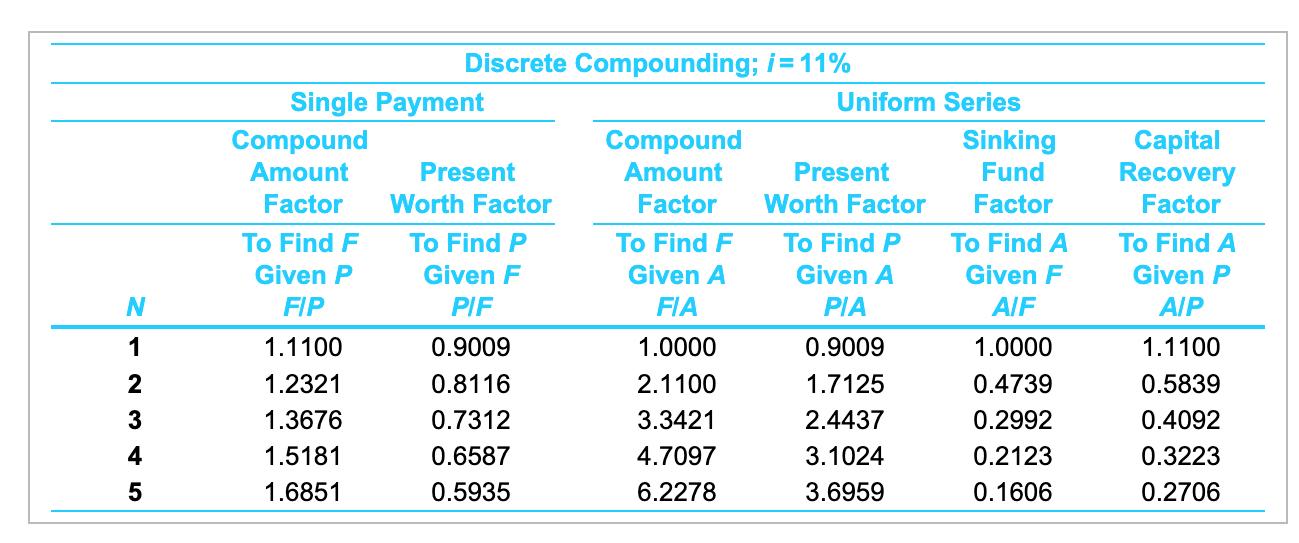

A company plans to purchase a piece of equipment that costs $208,000 and qualifies for five-year MACRS depreciation. The equipment has a useful life of three years. At the end of year 3, the equipment will be sold for $72,000. The operating expense for the equipment is $69,000 per year. What is the after-tax equivalent uniform annual cost of owning and operating this equipment? The effective income tax rate is 26%, and the after-tax MARR is 11% per year. Click the icon to view the GDS Recovery Rates (rk) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11% per year. The after-tax equivalent uniform annual cost is $ (Round to the nearest dollar.) GDS Recovery Rates (rk) Year 5-year Property Class 1 0.2000 0.3200 0.1920 0.1152 0.1152 0.0576 23456 N 1 2 3 4 5 Discrete Compounding; i = 11% Compound Amount Factor To Find F Given A FIA 1.0000 2.1100 3.3421 4.7097 6.2278 Single Payment Compound Amount Factor To Find F Given P FIP 1.1100 1.2321 1.3676 1.5181 1.6851 Present Worth Factor To Find P Given F PIF 0.9009 0.8116 0.7312 0.6587 0.5935 Uniform Series Present Worth Factor To Find P Given A PIA 0.9009 1.7125 2.4437 3.1024 3.6959 Sinking Fund Factor To Find A Given F AIF 1.0000 0.4739 0.2992 0.2123 0.1606 Capital Recovery Factor To Find A Given P A/P 1.1100 0.5839 0.4092 0.3223 0.2706

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started