Answered step by step

Verified Expert Solution

Question

1 Approved Answer

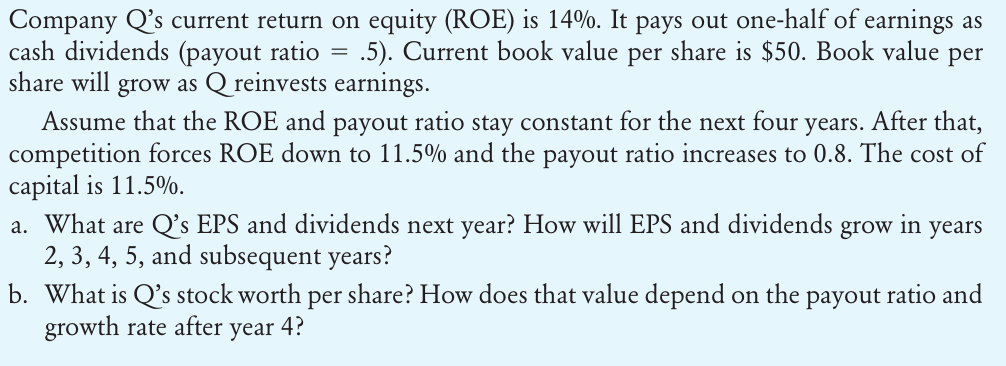

Company Q ' s current return on equity ( ROE ) is 1 4 % . It pays out one - half of earnings as

Company Qs current return on equity ROE is It pays out onehalf of earnings as

cash dividends payout ratio Current book value per share is $ Book value per

share will grow as Q reinvests earnings.

Assume that the ROE and payout ratio stay constant for the next four years. After that,

competition forces ROE down to and the payout ratio increases to The cost of

capital is

a What are Qs EPS and dividends next year? How will EPS and dividends grow in years

and subsequent years?

b What is Qs stock worth per share? How does that value depend on the payout ratio and

growth rate after year

DO NOT PROVIDE EXCEL SOLUTION. FOCUS ON SECOND PART PLEASE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started