Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company S is a 100%-owned subsidiary of Company P. On January 1, Company S had $100.000 face value of 8% bonds outstanding. The bonds

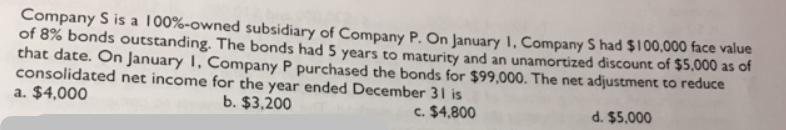

Company S is a 100%-owned subsidiary of Company P. On January 1, Company S had $100.000 face value of 8% bonds outstanding. The bonds had 5 years to maturity and an unamortized discount of $5,000 as of that date. On January 1, Company P purchased the bonds for $99,000. The net adjustment to reduce consolidated net income for the year ended December 31 is a. $4,000 b. $3,200 c. $4,800 d. $5,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The net adjustment to reduce consolidated net income for the year ended December 31 can be calculated based on the acquisition of the bonds by Company P Lets analyze the impact of this transaction on the consolidated net income 1 Initial Bond Details Face Value 100000 Discount 5000 Maturity 5 years Interest Rate 8 2 Purchase by Company P Company P purchased the bonds for 99000 This transaction has an impact on the consolidated financial statement The net adjustment will account for the change in the value of the purchased bonds and the bond discount This change will directly impact the consolidated net income for the year ended December 31 3 Calculation The purchase price 99000 is less than the face value of the bonds 100000 so there is an immediate gain on the acquisition The unamortized discount 5000 also needs to be considered in the adjustment The net adjustment to reduce consolidated net income will account for the change in value due to the acquisition and the unamortized discount To calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started