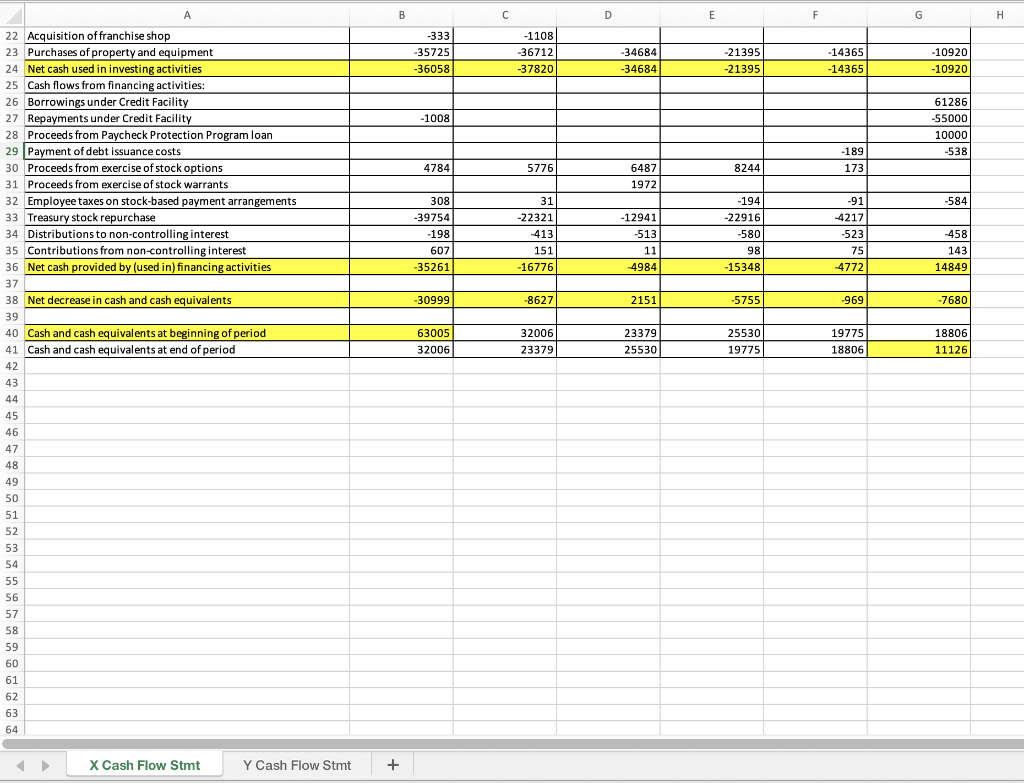

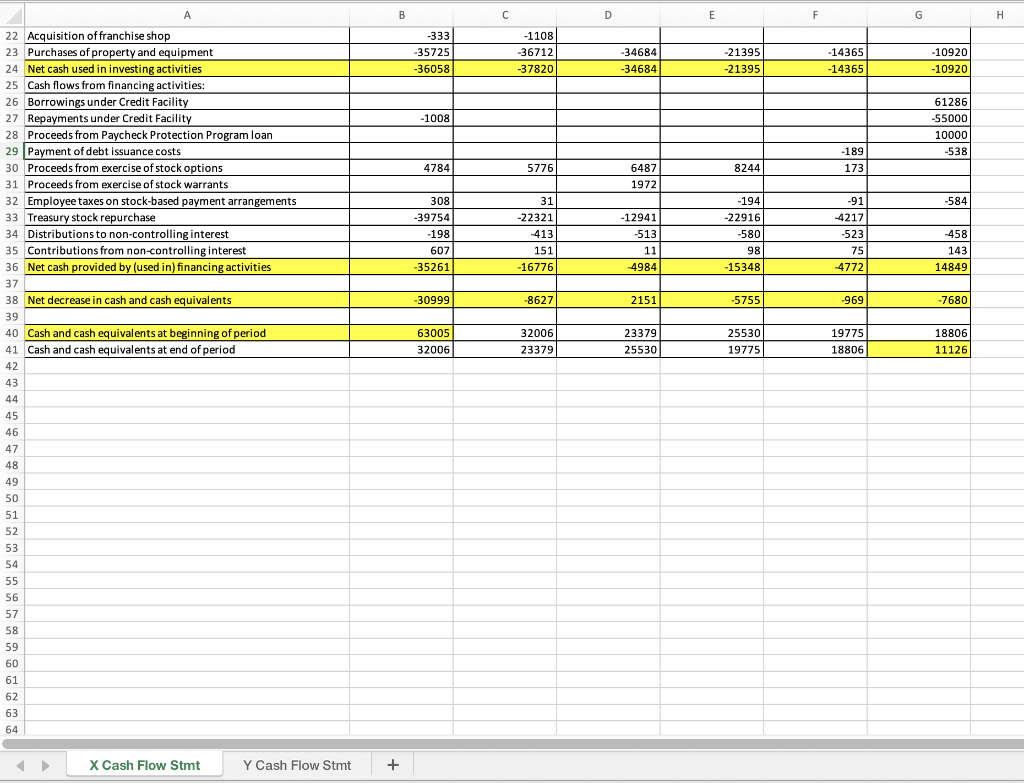

Company X: 1. The Cash Flows from Operating Activities are highlighted in this cash flow statement. What does the trend in these cash flows tell you about this firm? What seems to be the main thing causing this trend? 2. Look at the Cash Flows from Financing Activities for this firm. What does the trend in these cash flows tell you about this firm? Does this trend look healthy? Explain. 3. What types of things might a restaurant company be investing in? 4. Add the Cash Flow from Operating activities to the Cash flow from Investing Activities. The Cash Flow from Investing Activities is typically a negative, so when it is, you will be subtracting it from Operating cash flows. If the results is positive, they brought in more from operations than they spent on new investments. If it is negative, they spent more on investments than they brought in from operations. This number is called "Free Cash Flow". Record the Free Cash Flow for each year and then comment on whether the trend in that looks good or bad. 5. Look at the financing cash flow for 2020. Most restaurants had negative free cash flow for 2020 because of the pandemic. Look at the financing cash flows. What did this company do to finance their deficit in 2020? 6. What happened to their cash balance over time? Does this look good or bad? A B D E F G H -333 -35725 -36058 -1108 -36712 -37820 -34684 -34684 -21395 -21395 -14365 -14365 -10920 -10920 -1008 61286 -55000 10000 -538 -189 173 4784 5776 8244 6487 1972 -584 308 -39754 -198 607 -35261 31 -22321 -413 151 -16776 -12941 -513 11 4984 -194 -22916 -580 98 -15348 -91 -4217 -523 75 4772 -458 143 14849 -30999 -8627 2151 -5755 .969 -7680 19775 18806 63005 32006 32006 23379 23379 25530 25530 19775 18806 11126 22 Acquisition offranchise shop 23 Purchases of property and equipment 24 Net cash used in investing activities 25 Cash flows from financing activities: 26 Borrowings under Credit Facility 27 Repayments under Credit Facility samy 28 Proceeds from Paycheck Protection Program loan 29 Payment of debt issuance costs 30 Proceeds from exercise of stock options 31 Proceeds from exercise of stock warrants 32 Employee taxes on stock-based payment arrangements 33 Treasury stock repurchase 34 Distributions to non-controlling interest 35 Contributions from non-controlling interest 36 Net cash provided by (used in)financing activities 37 38 Net decrease in cash and cash equivalents 39 Cash and cash equivalents at beginning of period 41 Cash and cash equivalents at end of period 42 43 44 45 40 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 X Cash Flow Stmt Y Cash Flow Stmt + Company X: 1. The Cash Flows from Operating Activities are highlighted in this cash flow statement. What does the trend in these cash flows tell you about this firm? What seems to be the main thing causing this trend? 2. Look at the Cash Flows from Financing Activities for this firm. What does the trend in these cash flows tell you about this firm? Does this trend look healthy? Explain. 3. What types of things might a restaurant company be investing in? 4. Add the Cash Flow from Operating activities to the Cash flow from Investing Activities. The Cash Flow from Investing Activities is typically a negative, so when it is, you will be subtracting it from Operating cash flows. If the results is positive, they brought in more from operations than they spent on new investments. If it is negative, they spent more on investments than they brought in from operations. This number is called "Free Cash Flow". Record the Free Cash Flow for each year and then comment on whether the trend in that looks good or bad. 5. Look at the financing cash flow for 2020. Most restaurants had negative free cash flow for 2020 because of the pandemic. Look at the financing cash flows. What did this company do to finance their deficit in 2020? 6. What happened to their cash balance over time? Does this look good or bad? A B D E F G H -333 -35725 -36058 -1108 -36712 -37820 -34684 -34684 -21395 -21395 -14365 -14365 -10920 -10920 -1008 61286 -55000 10000 -538 -189 173 4784 5776 8244 6487 1972 -584 308 -39754 -198 607 -35261 31 -22321 -413 151 -16776 -12941 -513 11 4984 -194 -22916 -580 98 -15348 -91 -4217 -523 75 4772 -458 143 14849 -30999 -8627 2151 -5755 .969 -7680 19775 18806 63005 32006 32006 23379 23379 25530 25530 19775 18806 11126 22 Acquisition offranchise shop 23 Purchases of property and equipment 24 Net cash used in investing activities 25 Cash flows from financing activities: 26 Borrowings under Credit Facility 27 Repayments under Credit Facility samy 28 Proceeds from Paycheck Protection Program loan 29 Payment of debt issuance costs 30 Proceeds from exercise of stock options 31 Proceeds from exercise of stock warrants 32 Employee taxes on stock-based payment arrangements 33 Treasury stock repurchase 34 Distributions to non-controlling interest 35 Contributions from non-controlling interest 36 Net cash provided by (used in)financing activities 37 38 Net decrease in cash and cash equivalents 39 Cash and cash equivalents at beginning of period 41 Cash and cash equivalents at end of period 42 43 44 45 40 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 X Cash Flow Stmt Y Cash Flow Stmt +