Question

Company X currently has no debt, and the current market value of total assets is $200 million. The company intends to substitute debt for equity.

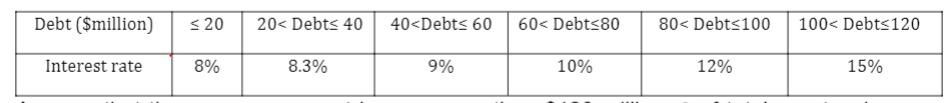

Company X currently has no debt, and the current market value of total assets is $200 million. The company intends to substitute debt for equity. The company can take the loan with the amount of debt and respective interest rate(the average interest rate on the whole amount of loan)as follows:

Assume that the company cannot borrow more than $120 million. of total assets when there is no debt (Beta unlevered) is 1.7. The current risk free rate is 4%. Market risk premium is 5%. Corporate tax rate is 20%. The company has no preferred shares. Beta of debt is zero. Regarding the companys proposed expansion plans, the chief executive has expressed his preference for any financing requirements to come from increasing debt rather than increasing equity in order to move towards minimizing the companys weighted average cost of capital. Required:

a) From the available information calculate the optimal capital structure of the company from the WACC approach?

b) Critically evaluate the preference of the chief executive for any financing requirements to come from increasing debt rather than increasing equity in order to move towards minimizing the companys weighted average cost of capital.

Debt ($million)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started